Just when you thought it couldn’t get worse….

A week ago, we pointed out how China’s dropping exports and plunging imports – the “inevitable fallout from China’s unsustainable and poorly executed credit splurge,” according to Thomson Reuters – had collided with long-term bets by the shipping industry that has been counting on majestic endless growth.

The industry has been adding capacity in quantum leaps, where “the scramble to order so-called ultra-large container vessels had turned into a stampede,” as the Journal of Commerce put it. So we said, Pummeled by Lousy Global Demand and Rampant Overcapacity, China Containerized Freight Index Collapses to Worst Level Ever.

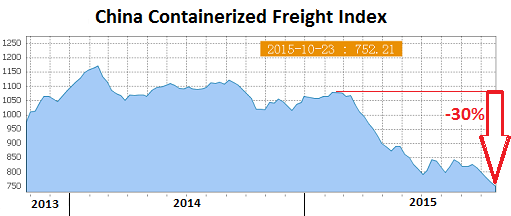

And now, the China Containerized Freight Index (CCFI) has dropped to an even worse level.

Unlike a lot of official data emerging from China, the index, which is operated by the Shanghai Shipping Exchange and sponsored by the Chinese Ministry of Communications, is raw, unvarnished, not seasonally adjusted, or otherwise beautified. It’s volatile and a reflection of reality, as measured by how much it costs, based on contractual and spot market rates, to ship containers from China to 14 major destinations around the world.

These rates are a function of oversupply of shipping capacity and of lackluster demand for shipping containers to distant corners of the world. They’ve been in trouble since February. “Trouble” is a euphemism. They relentlessly plunged.

By early July, the index dropped below 800 for the first time in its history, which started in 1998 when the index was set at 1,000. It soon recovered to about 850. And just when bouts of hope were rising that the worst was over, it plunged again and hit even lower levels.

The latest weekly reading dropped another 1.7% from the prior week to 752.21, the worst level ever. The CCFI is now 30% below where it had been in February this year and 25% below where it had been 17 years ago at its inception.

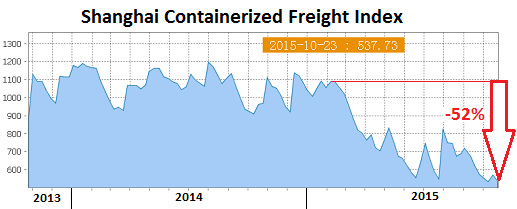

The Shanghai Containerized Freight Index (SCFI), also operated by the Shanghai Shipping Exchange, tracks spot rates (not contractual rates) of shipping containers from Shanghai to 15 major destinations around the world. It’s even more volatile than the CCFI. But being based on spot rates, it’s a good indicator where the CCFI is headed.

For last week, the SCFI plunged 5.4% to a new record low of 537.73, down 46% from where it had been at its inception in 2009 when it was set at 1,000 – and down 52% from February:

Not that any of this matters for stocks. What matters are central banks. And they have once again spoken. They’re frazzled by these signs of “unexpected” deterioration. Even China’s official GDP growth rate, at 6.9%, inflated as it may be, is now down to the worst level since the Financial Crisis.

So Friday morning, while perhaps still smarting from the Shanghai stock index’s plunge of 3.1% on Wednesday, the People’s Bank of China stepped in and announced that it would lower its benchmark interest rates by a quarter point, the sixth cut since November, and banks’ reserve-requirement ratios by half a point, all to flood the economy with even more money.

Whatever rounds of speculation this might trigger, it won’t stimulate global demand for Chinese goods and won’t help exports one iota. However, it goosed stocks worldwide on Friday. And that’s what matters.

Already on Thursday, it had been the European Central Bank that had done its magic in a magnificent spectacle of insinuation of its own. Read… Draghi Speaks, Euro Falls Off Chart, Stocks Soar Despite Layoffs, Shrinking Revenues, and Evil “Strong Dollar” that just Got a Heck of Lot Stronger