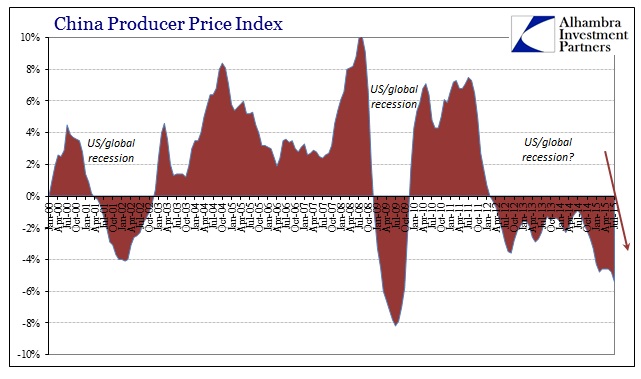

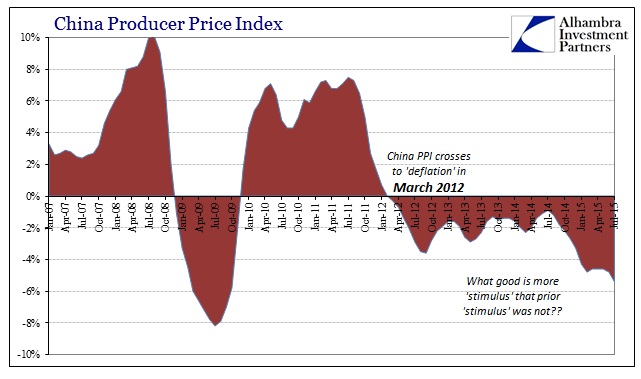

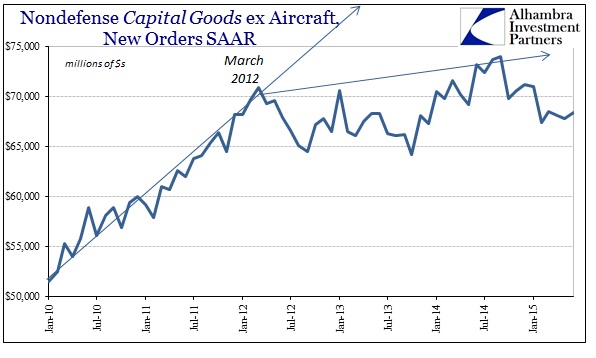

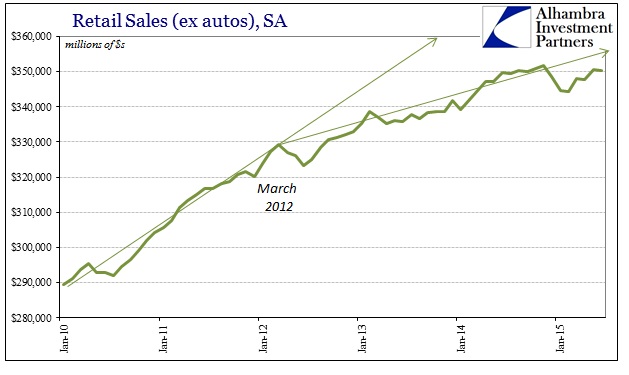

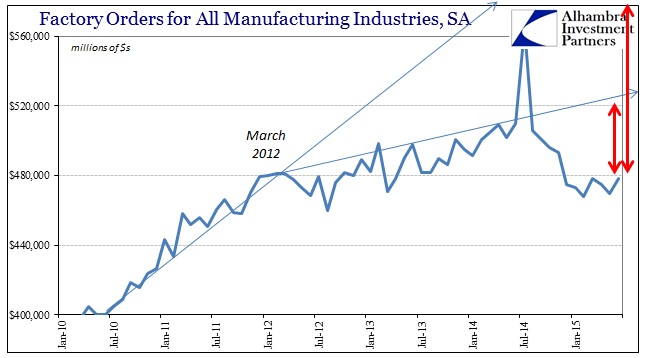

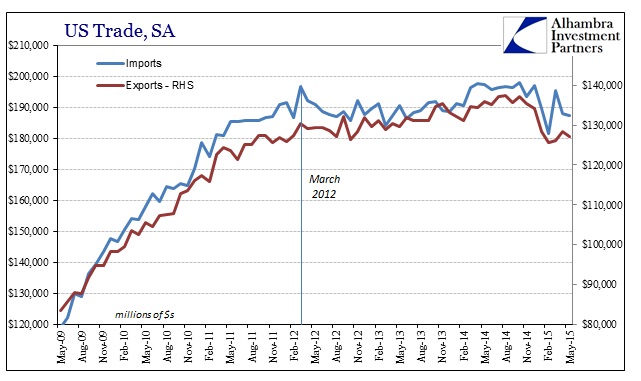

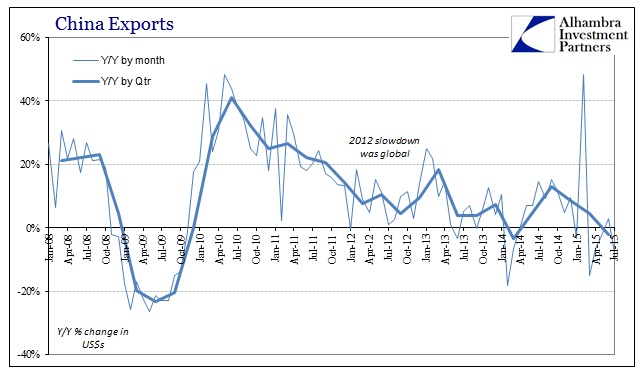

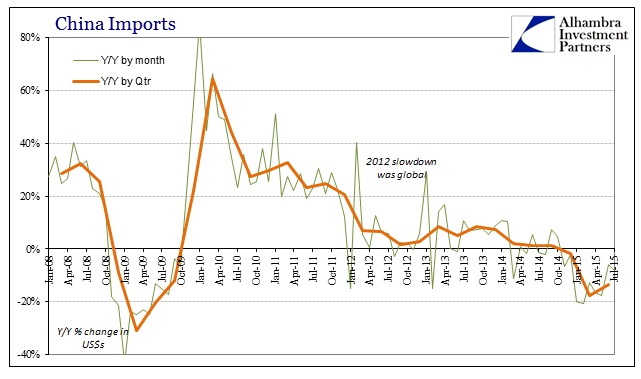

In another of the innumerable cosmic coincidences that so abound these days, producer prices in China have been in “deflation” since March 2012. Not only is that 41 consecutive months of falling prices (insofar as this index captures that effect), that month is ubiquitous as a trend demarcation in so many other places. It’s as if the Chinese economy and its production, particularly the marginal orientation for external production, were directly linked with the US economy’s very real shirking demand. China’s producer prices have had the good effort of displaying quite consistently US recession.

The fact that China’s PPI times to March 2012 would seem to offer the same interpretation with only semantics and numerical definitions to offer a counterargument. Maybe what we have seen since early 2012 does not meet the dominant recession definition, but does that really matter? By all these accounts, something unsavory has occurred during this time and by all these measures is unsurprisingly getting worse with the “dollar.”

The causative agent is clearly the continual eurodollar decay which spread out in renewed deficiency with the mid-2011 euro/”dollar” crisis. Given that backdrop, the persistent calls for more “stimulus” on the part of the PBOC to combat this structural decay is just plain wrong, if understandable from the continued standpoint of orthodoxy’s unwillingness to move beyond the 1950’s. In other words, as the PBOC itself has realized, what good can internal monetary “stimulus” program foster under these governing dynamics?

The only “benefit” is more of the same asset bubbles, which the PBOC in its reform agenda has recognized for what they are – wasteful, harmful, and a disaster waiting to happen. Economists make no distinction in either terms of asset bubbles or actual finance which is wholly apart from their generic, stylized models that take none of this into account.

China is under growing pressure to further stimulate its economy after disappointing data over the weekend showed another heavy fall in factory-gate prices and a surprise slump in exports.

Producer prices in July hit their lowest point since late 2009, during the aftermath of the global financial crisis, and have been sliding continuously for more than three years.

The mainstream press, like economists’ flirtations, is arguing that the yuan is the answer when it is in fact a full part of the problem. I mean by that the conventional “solution” is that China should go for devaluation in order to jumpstart their exports when they really can’t because the yuan, by design, is tied into the “dollar” and thus further entangled in those internal bubble dynamics. The PBOC has its hands obviously tied by its currency even though we don’t yet know how or through which conduit that is taking place (we just reasonably surmise that they are at work here because the yuan’s behavior has been, in a word, unnatural).

Even if the PBOC could radically devalue, that isn’t truly an answer, either. One need only look at Japan’s growing QQE “hole” in order to see how such naked and aggressive currency bypasses aren’t “stimulus.”

The PBOC started “cutting rates” three quarters of a year ago and they have had practically no effect – which was precisely the point under the reform umbrella. China’s authorities are trying to actively manage, as best they can, this decline so that it at least does not take on a crash trajectory (so unhelpful are equities recently in that related regard). The Chinese have picked their poison, and since they can’t really do much to create a global recovery they have to labor instead against the downside of having followed the mainstream, orthodox prescriptions going back to 2009 (when the PBOC did what the monetary textbook said; receiving only alarming bubbles rather than temporary imbalances to bridge until full and expected recovery).

The mainline agenda has taken on such backwards proportions that it is no longer, as it once used to be convention, grounded much in consistent reality or fundamental philosophy. Up is now always down:

Wall Street surged Monday following a multi-billion-dollar deal by Warren Buffett’s Berkshire Hathaway that raised optimism over mergers and acquisitions, and weak Chinese data that boosted hopes for fresh stimulus in the world’s No. 2 economy…

Global stock markets also got a lift from hopes that Beijing might take new measures to stimulate the Chinese economy after a report that producer prices in July hit their lowest point since late 2009 and exports tumbled 8.3 percent in the same month.

Stock prices apparently rise on nothing but continued failure (on both counts in that first paragraph – more harmful financial engineering in M&A plus more “stimulus” that clearly doesn’t stimulate). Central banks have been “stimulating” regularly all over the world for years now, to no positive effect, and now the global economy is synchronized in contraction (emphasized by the “dollar” and its effects through commodities) so they should do more? There seems to be an intuitive leap that just doesn’t belong, as if efficacy and expectation are divorced wholly from results.

The downturn in China is “our” downturn. All the recent happy talk, due to unsuitable extrapolation and nothing more, has melted away yet again. In short, the same trend dating back almost four years now is quite expectedly unaltered by whatever any central bank does or does not do. That dynamic was exploded into place by the events of August 2007, which clearly remain the overarching economic guideline. A global economy built upon eurodollar saturation cannot, marginally, continue to expand without it. There is a great difference between that artificial, financial economy and a real one, and the growing absence of eurodollar banks is proving that point to greater and global emphasis this year. “Stimulus” is just noise against all that, at best; at worst it actively contributes to the instability of the decline.