First, the China Manufacturing “Flash” PMI had “markets” exhaling relief since an increase from 50.2 to 50.5 meant, Manufacturing Rebound Relieves Growth Concerns. A week later, however, that PMI increase disappeared as the final PMI for September came in at an even 50.2 instead – which altered the commentary from “rising” manufacturing to “thankfully” steady manufacturing. So both rising and steady growth in Chinese industry are cause for optimism in conventional thinking.

The problem with the China PMI is that with all PMI’s, namely they offer no context into which we can derive use or meaning. Steady growth in September from August 2014 in terms of manufacturing or industrial production is a severe deficiency, particularly given that China’s IP in August was the worst since the darkest days of the Great (and global) Recession.

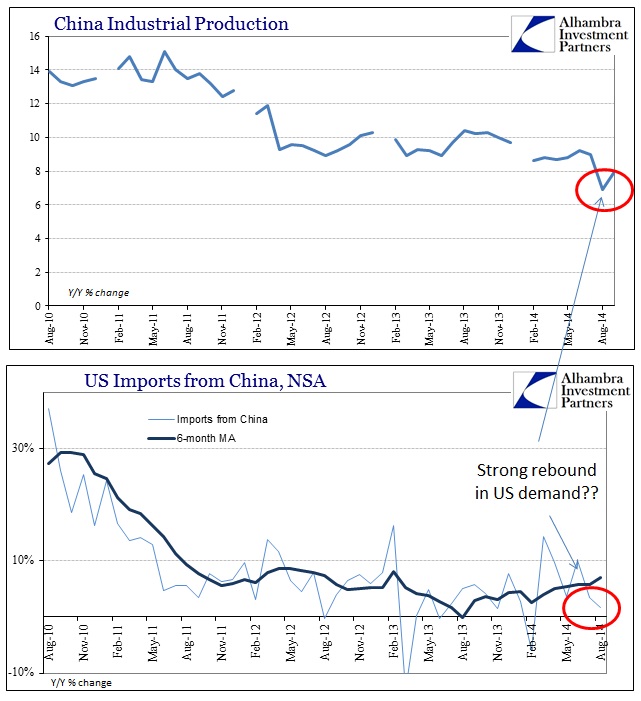

Sure enough, China’s IP in September was indeed “better” than August, meaning only the second worst showing since 2008. In terms of the Chinese economy, there really isn’t much marginal difference between August’s atrocious 6.9% and September’s slightly less atrocious 8.0%; meaning the PMI was actually pretty close to reality, if devoid of pertinent context.

The second problem as it relates to observations about China is that such pessimism directs too often as nothing but an internal problem. And that is true, but only to a certain extent as Chinese authorities are surely coming to grips with their own version of secular stagnation. They encouraged the PBOC to allow (or directly enforce) an immense bubble that they belatedly recognize now as more than dangerous in proportion and stage. In ad hoc response, the PBOC is handcuffed by its new paradigm of “targeting” monetarism rather than encouraging the “flood” approach.

But that is not the sole source of disconnect, as the bubble represents simply past attempts to buy time via monetary “fill.” Like elsewhere around the globe, the PBOC went full bubble in what amounts to its own version of “extend and pretend”, awaiting the global recovery to fix these imbalances. That recovery is beyond late at this point, and that is the primary factor revealing that internal bubble as too weighty to allow further progression.

However, the true scale of the imbalance is actually worse than that since the global recovery is not just late, it is actually moving in the “wrong” direction once more. Hence Chinese industry operating toward 2008-09 levels rather than something approaching 2005, or at least 2010.

If you look at Chinese IP alongside US imports from China the relationship is entirely clear and evident. Where Chinese GDP falls below that 7.5% “floor” authorities publicly set, as it did with only 7.3% growth in Q3, that is a reflection not just of Chinese problems but US problems as well. “They” keep saying that the US is the cleanest dirty shirt, but they are, again, all dirty in this open system.

US policymakers continue to suggest the US economy is gaining, but the rest of the world begs to differ; strenuously. A growth level in China that is more aligned with the Great Recession than an inarguable recovery is an indictment against the US, European and Japanese responses to that global depression. All those central banks are still at it (even in the US, QE may be ending now but ZIRP remains) but from Brazil onward up the global supply chain there is more than enough obvious deficit to refute any proclaimed success. Worse, again, the immediate direction is down – where is all the “aggregate demand” that monetarism promised to supply? That impacts not just economically, but with major financial implications.