It seems Charles Dickens had a flair for 21st century economics all the way back in the 19th century. Writing in his book Little Dorrit (thanks to W Krauss for the reminder) he observed that credit systems tended to be, “…a person who can’t pay, gets another person who can’t pay, to guarantee that he can pay.” The first person is clear as is the second, as the modern top-down economy “demands” this arrangement of central bank “nontraditional” measures. There are a number of ways in which we see Dickens in shadow finance, including the ECB’s collateral rules from 2010 on. Ability to pay used to define the Bagehot tradition of “good” collateral, no longer as “guarantees” and backroom “rules” are the order of the day.

It can also be said of the QE regime in the US which is finding itself precariously unimpressive. To use once more today Ben Bernanke’s quote shortly upon the launch of the third version, it was supposed to be jobs and all that:

Many savers are also homeowners; indeed, a family’s home may be its most important financial asset. Many savers are working, or would like to be. Some savers own businesses, and–through pension funds and 401(k) accounts–they often own stocks and other assets. The crisis and recession have led to very low interest rates, it is true, but these events have also destroyed jobs, hamstrung economic growth, and led to sharp declines in the values of many homes and businesses. What can be done to address all of these concerns simultaneously? The best and most comprehensive solution is to find ways to a stronger economy. Only a strong economy can create higher asset values and sustainably good returns for savers. And only a strong economy will allow people who need jobs to find them. Without a job, it is difficult to save for retirement or to buy a home or to pay for an education, irrespective of the current level of interest rates.

The way for the Fed to support a return to a strong economy is by maintaining monetary accommodation, which requires low interest rates for a time.

As QE is no more, there should be full-blown and inarguable economic growth tied to its having been undertaken. The Establishment Survey would have that interpretation if it weren’t so much a self-fulfilling prophecy (trend-cycle analysis may tend to do that), leaving a lot more doubts being expressed especially in credit and funding markets. While common perception somehow sees the stock market as a sizable enough gauge of such things, stocks are often self-captured in rationalizations as well as tiny in comparison to credit and global funding. Stocks may continue to be totally bullish on at least the US, but the entire “dollar” world has been running for six months (at least) toward the bunker.

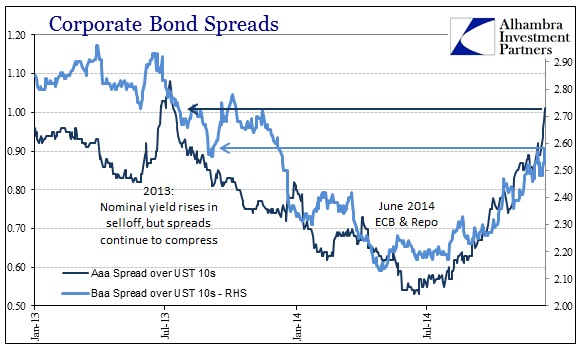

In addition to all the bearishness in the UST curve and the price of oil, the funding markets as I have described are perhaps even more important in this context. Riskiness is being withdrawn, a direct consequence of balance sheet restrictions growing “tighter” even after October 15. While the FOMC will conspicuously ignore decompressing spreads, it will grow much harder to do so as spread blowouts extend not just in lower quality but all the way to the highest quality.

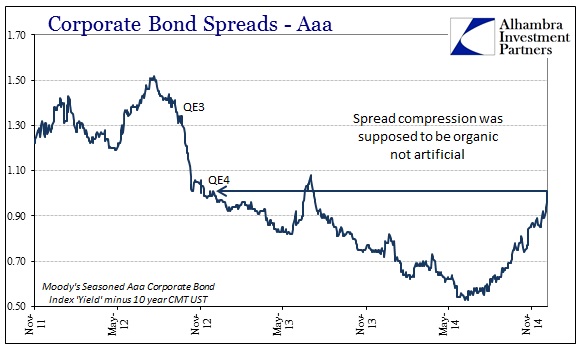

In a lot of ways, the spread movements in Aaa and high quality corporates is more remarkable than lower investment grade and junk. You expect the latter to lose value under such conditions but high quality corporate bonds are often viewed a close substitute to comparable UST. The spread of Aaa over the 10s is now back to where it was just upon QE4’s launch (and at the tail end of the clear euphoria over QE3’s announcement).

To some that may make perfect sense, as QE clearly compressed spreads in a risk-taking, “portfolio effect”; QE’s end would thus lead to an unwind of the very same. But it wasn’t supposed to be that way as QE, as mentioned above, was supposed to lead to an organic expansion. In terms of credit, that should mean lower spreads that remain lower.

Again, this interminable (which is why the FOMC feigns ignorance here) march of risk retrenchment is an after-effect of “dollar” problems recurring somewhat like 2013’s global credit event. However, the mechanism may be the same but the results are far different as illiquidity is surprisingly (to some) much degraded now than even last year (suggesting nothing but heightened bearish positions). Further, the trend has not been stopped by the repo market settling of collateral on October 15; indeed much has been worse and growing as clearly leveraged positions are having constant difficulties with funding where it was only a minor disturbance (by comparison) in 2013.

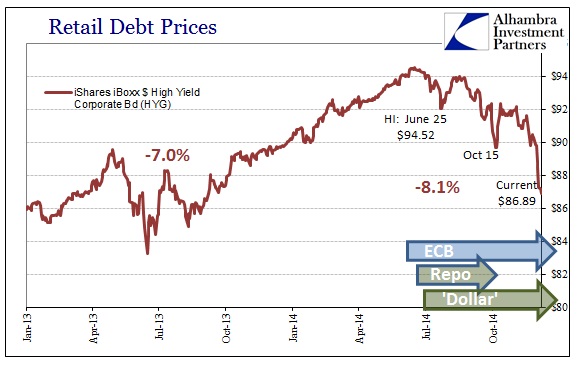

The S&P/LSTA Leveraged Loan Index, for example, is now down 4%, more than twice the drop during the 2013 event. Further, the decline in market value of this high-risk segment has lasted far longer indicating a much different interpretation. This is not an adjustment period, as in mid-2013, but rather a full-blown repositioning which has yet to find its final act.

In fact, prices here are now back to where they were before the last versions of QE were launched. But that isn’t fully descriptive, as the flattening of prices post QE3 suggests – it wasn’t prices that were “boosted” under the newest QE but rather volumes which exploded back to 2008-type levels.

That would mean that the current negative pricing environment is a much bigger problem that extends to a larger “pie” than in 2013. And as I have mentioned in the past, the pricing presented by the index here is based on the most liquid 100 names in this credit universe, meaning that prices further out in the unobserved portions of this “market” are likely experiencing a much higher beta.

In short, 2014 has far surpassed 2013 as a negative reflection on pretty much everything; policy to economy.

If the economy were as the FOMC says it is, and what Bernanke was shooting for all the way back in October 2012, then there should be the opposite trend in credit right now. I think that is the most damaging assessment in the funding markets and therefore leverage expansion and availability. Belief in QE was high and so credit and leverage were funding and expanded based on the economy that was promised rather than the economy that was delivered. The growing realization of QE’s failures (low interest rates do not equal jobs, in Bernanke’s speech formulation) is unwinding credit all over the spectrum. Balance sheet expansion is as much about economic stability as it is monetary policy.

The Fed has been tapering since last December, and the Yellen-FOMC has been foretelling an end to ZIRP since March of this year. Yet, it wasn’t until June that all of this “dollar” and leverage “tightening” began. It started when the ECB went negative and has yet to end.

The UST curve flattening and the crash in crude oil are both significant warnings in their own right, combined make for a very compelling bearish case. However, I maintain that this dollar disruption is far more meaningful and profound, and likely is fueling perceptions further on – such as when high yield US$ debt trades in close correlation to the Brazilian real. That the funding markets are still so much under pressure after a six-month period of sustained retrenchment is very concerning. The FOMC will not admit as much, so they act curiously as if it hasn’t happened.