In an effort to prove that the Federal Reserve and ECB are not that far apart in at least philosophical terms, the European Central Bank released minutes from its historic QE meeting in January. Whereas the Fed has been using circular logic to “justify” at least bluffing toward rate hikes, the ECB apparently has done the same to “justify” QE. To wit:

Therefore, purchases of sovereign bonds should remain a contingency instrument of monetary policy, to be used only as a last resort in the event of an extremely adverse scenario, such as a downward deflationary spiral. However, thus far there was no evidence of a serious risk of deflation, which clearly argued against mobilising the instrument of sovereign bond purchases at the current meeting.

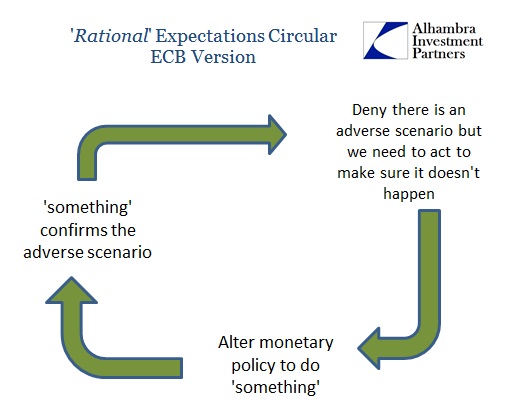

The ECB is doing QE as a last resort, but there is no evidence of a serious risk of that last resort? Simple logic would dictate that the very fact of doing QE would be recognition of at least a high, not nil, potential of what they offer as not just an “adverse scenario”, but an “extremely adverse scenario.”

As with the Fed, this shows the limitations which central banks have imposed upon themselves due to rational expectations. In other words, if they admit there is a problem they believe it will create the problem, or at least prevent a solution (because, “rationally”, this theory really prioritizes economic agents as taking their cues from central bank policy and only central bank policy; they really believe there is no crisis until policy confirms there is a crisis). In other words, don’t worry too much about an ultra-horrible outcome as they are just being prudent in positioning in the only manner that can address just such an ultra-horrible outcome.

Monetary policy is always then only preventative rather than rehabilitative, which is a tremendous problem especially for people that believe so strongly in monetary policy. If you actually take this to an extreme, altering monetary policy in just such a prophylactic manner thus ensures the outcome anyway. The Fed is under the same self-imposed pressure, by which they “have” to threaten ZIRP as doing so “confirms” that the economy is so terrific. That goes against everything they stand for as the economy, as they just admitted yesterday, might not be so terrific; meaning that they want badly to be more “accommodative” but can’t otherwise it will confirm that there is no recovery.

And round and round this goes, the inevitable end of monetary neutrality. The only concept that so insulates monetary policy in this way is the very same means that will keep it trapped in these cages of circular “reason” and “rationality.”

Janet Yellen spoke about this very topic last year close to her installment as Chairman.

…it is important for the central bank to make clear how it will adjust its policy stance in response to unforeseen economic developments in a manner that reduces or blunts potentially harmful consequences. If the public understands and expects policymakers to behave in this systematically stabilizing manner, it will tend to respond less to such developments.

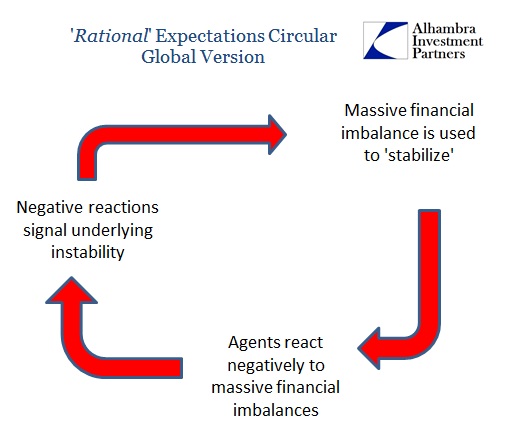

What she is saying, and where monetary policy is at globally in 2015, is that breaking the cycle is the job of “markets” to no longer worry about much of anything since central bank policies will always and everywhere be not just effective but fully effective. It’s not utopian, it is positively dystopian totalitarianism. Nobody is ever allowed to worry about anything because worries lead to the cause of all the worries – and central banks are here to make sure that you never trade on those worries or you will get punished financially. The bubbles will continue until morale improves.

The great weakness in all of this, as it relates to monetary neutrality and beyond, is monetary policy as a “systemically stabilizing” force. Redistribution is axiomatically the opposite of that, so it is difficult to take such an unquestioned maxim of orthodox behavior simply at face value. Monetary policy is stabilizing because of the massive imbalances that it creates?

And so we are back at another point of circularity, a feedback loop that remains in force as long as neutrality does, which ends up encompassing the whole of the global economy.

Yellen’s “solution” to this cycle is the middle part on the bottom rather than the upper right. Everyone needs to simply stop worrying about financialism in any form or to any degree. It is Dr. Strangelove only in monetarism updated for the wholesale “dollar” system that nobody, even Dr. Yellen, understands or appreciates (she certainly has given no indication that she moved beyond the “global savings glut” view).

Dr. Strangemoney or: How I Learned to Stop Worrying And Love the Bubble