So far Europe’s QE is having some trouble gaining pace. As of March 13, the ECB reports that €9.7 under the Public Sector Purchase Program has been carried out, or about half the rate that was anticipated. That may come as a shock to those not familiar with the ECB’s heightened action of the past eight months, but it is actually quite consistent with prior “programs.” Despite all the promises of radical intervention, the “markets” seem highly uninterested if not completely immune to the liquidity enticements.

The third covered bond buying program only captured €57 billion in liabilities, offering liquidity far less than anticipated. The asset-backed buying program, which was a central focus at one time and celebrated as such, is almost non-existent with just €3.7 billion net purchasing. This is so far below what was projected when it was finally described in September 2014:

The European Central Bank ushered in a new era by launching an aggressive bond-buying program Thursday, shifting pressure to Europe’s political leaders to restore prosperity in one of the global economy’s biggest trouble spots.

In other words, the idea of “aggressive bond-buying” was mere posturing and did not reflect actual appetite nor the ability of the central bank to deliver on “portfolio effects.”

“ECB policymakers are attempting to ward off deflation and jumpstart the eurozone economy,” says Alex Epstein, an analyst at Schaeffer’s Investment Research.

Asset-back securities are packages of loans issued by banks to investors. The goal of the ECB is to buy those securities from banks, leaving banks with a wad of cash that could be put to better use, such as issuing loans.

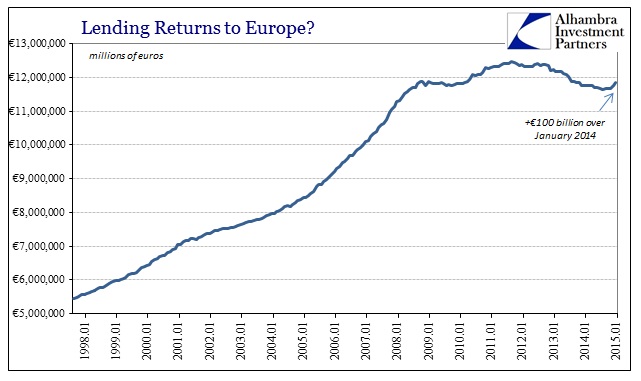

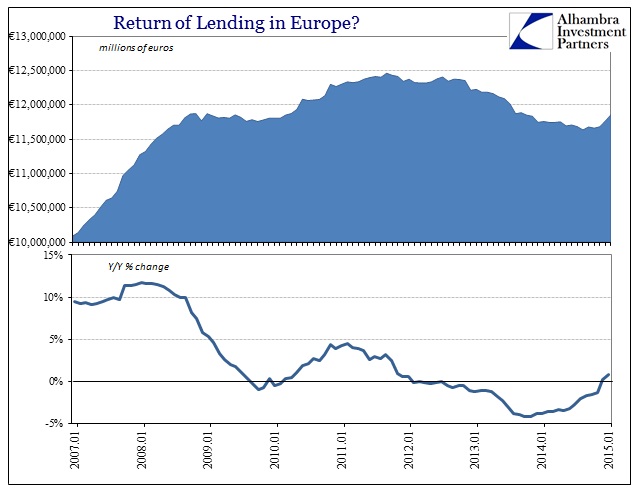

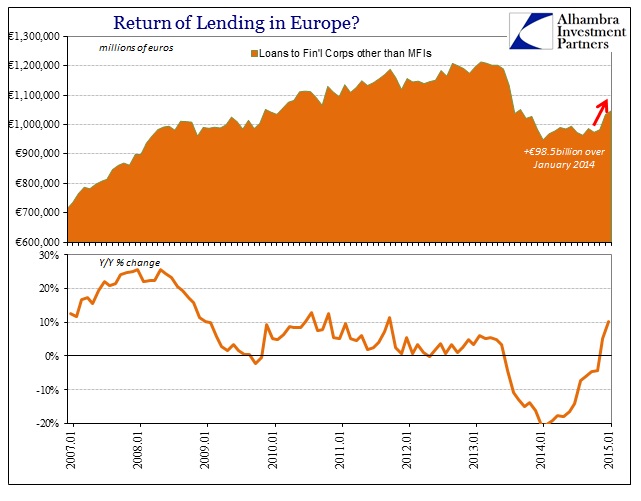

Despite the deficient take-ups on the programs, lending in Europe did increase modestly in December for the first time in almost two years. The (revised) 0.17% increase in year-over-year lending was followed by a nearly 1% increase in January. For the banking system as a whole, total loans (which include lending programs to Euro-area governments) in January were €100 billion more than January 2014.

The timing of this change in lending might seem to offer at least some evidence as to the effects of ECB monetarism, except that what I described above is contradictory to that idea. That might then suggest that perhaps the EU economy itself was already on the mend by the time the ECB acted, and thus banks did not need any additional boost. However, the actual data does not lend itself (pun intended) to that interpretation either, as, more likely, there were just anticipations of ECB’s QE acting ahead.

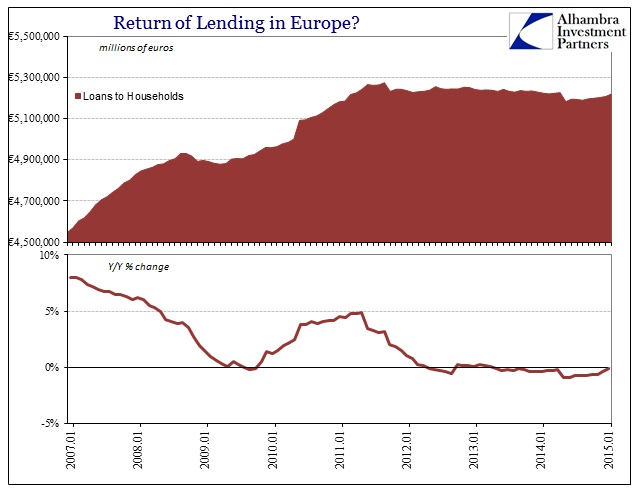

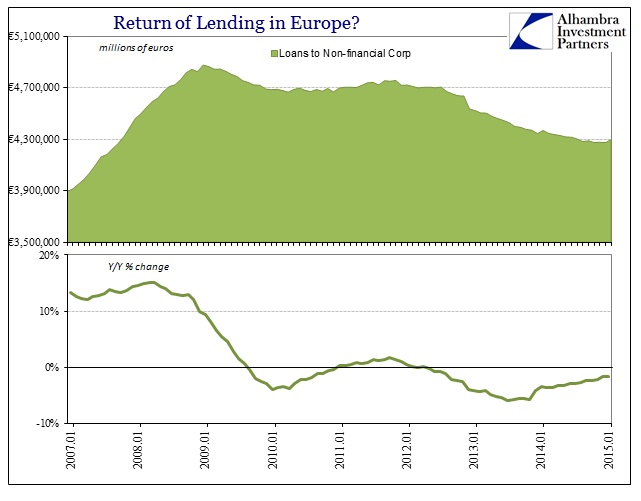

If you separate lending in Europe by segment there really isn’t lending of the type that is being desperately sought. In the ECB’s categorization, the intent is to see a large and sustained increase in credit-based real economic activity which means loans to households and businesses (non-financial corporations). Not surprisingly, given the actual condition of banking in Europe, lending in both of those categories remains stuck below zero, which means banks are still cutting back lending in the real economy. That would certainly corroborate the pitiful participation in either ABSPP or CBPP3.

Since lending has not picked up to either households or businesses, that can only mean an increase in loan activity with or within the financial sector. In fact, that is where almost all the €100 billion gain came from, as banks, for some reason, have decided to send this “portfolio effect” out to “financial corporations other than MFIs.”

This category includes securitization conduits, so it could very well be renewed surge in lending via that channel but there is no confirmation as to what these “other financial corporations” are actually doing. The traditional conduits, which do report to the ECB, are still shrinking or at least maintaining a consistent level of assets. There is little information on where this increase in lending is actually going, though we can infer from the type of businesses arranged here that this is likely recalibrating and repositioning credit functions (financial corporations other than MFIs tend to be non-bank intermediaries, including interbank conduits). That itself creates the striking possibility that banks are using off-balance sheet arrangements to resort activities to best “take advantage” of the ECB’s QE.

In other words, so far the changes in European banking have been purely and totally financial without any spillover into the actual economy (yet). Maybe that is a prerequisite step for repairing Europe economically, especially since Europe is far more dependent on banking than the US and its bond markets, but I highly doubt it. The nature of “portfolio effects” no matter how repressive central banks become, and the ECB is highly so, is far more uncertain than orthodox theory allows. Given the nature of Europe right now, it might be easier to try to scalp ECB price intrusions than to lend into a decimated real economy featuring an overwhelming degree of uncertainty, not to mention a default overhang that has never been alleviated (or allowed natural correction, as that would mean widespread insolvency).

The only actual, visible reaction to the ECB’s intentions since last June has been contained within asset prices almost exclusively. That is a constant of this type of monetarism, which only further suggests any lending increase so far in Europe is more of the same.