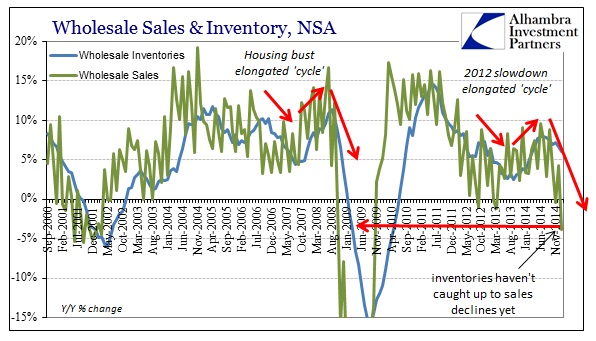

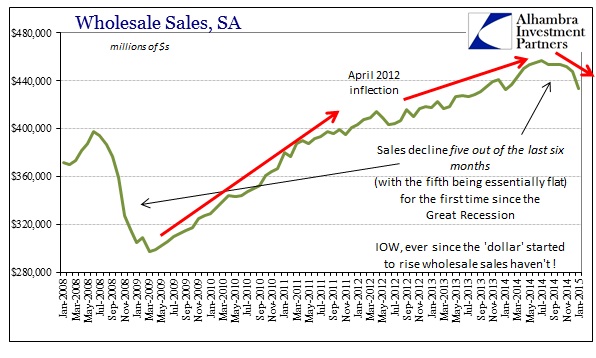

The estimates for wholesale sales and inventory complete the devastation of January’s economic landscape. Overall sales fell by the largest amount, nearly 4%, since the bottom of the Great Recession. Inventories, however, continue to build despite the slowing sales, leaving the inventory-to-sales ratio far above either the most recent “cycle” peak or even the last one.

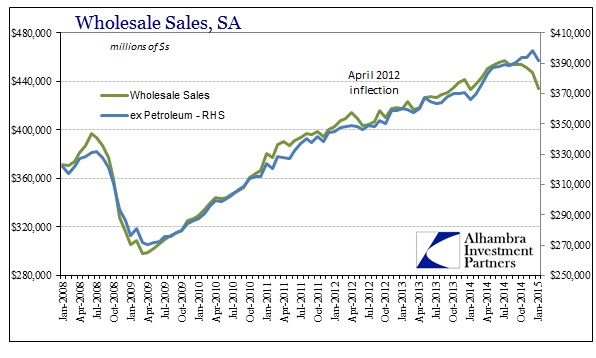

The greatest part of this trend continues to be crude oil and petroleum products in general, having altered the trajectory of the supposed “recovery” by quite a bit. Some are using that fact to obscure the trend otherwise in wholesale activity apart from oil. That is an inconsistent view in the first place as nobody was discounting oil sales when they were robust, and thus “helping” the overall sales environment.

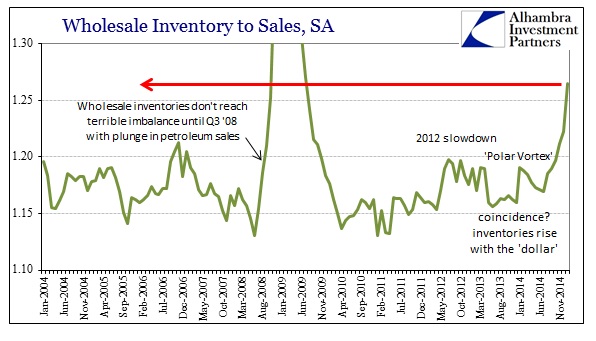

In the cycle preceding the Great Recession, wholesale inventory/sales ratios didn’t gain huge and recessionary imbalances until around August 2008, with a large proportion of that recession signal owing to collapsing crude sales (and crude prices). That is another facet both the current period has in common with the Great Recession, as oil sales are themselves an economic indicator (including price).

Even if we control for the impact of crude prices, not much really changes except the speed to which the most recent alarm has attained. Ex petroleum and petroleum products, wholesale sales have slacked in the past seven months and non-petroleum inventories have not. The net result is a non-petroleum inventory-to-sales ratio that is likewise above any prior “cycle” peak, and well-above the 2007 comparable.

This is all similar to observations inside the CPI, where crude oil prices gain the bulk of attention and commentary, thus muddying interpretations about prices in general (as opposed to “inflation”). In other words, the CPI is negative for the first time since 2009 largely but not exclusively due to crude prices, meaning that the rest of the price structure is similarly weak if not exceptionally so. The same can be said of wholesale sales and inventories, which is still contrary to all orthodox claims about the economic revival at the end of 2014.

The relation of such low CPI gains (or declines) is as much imbalance of inventory as anything else. Thus the relatively large inventory build at the outset of 2015 more than suggests reinforcing not just the negative view of economic fundamentals in the CPI (low pricing increases that cannot, but should, offset crude oil if economic fundamentals were decidedly and unambiguously positive) but even oil prices themselves. After all, crude is a major economic input that is inseparable from the overall economy no matter how many iterations of exclusion are presented. The reality of the wholesale level of the supply chain in that respect matches the reality of what is driving crude to collapse in the first place – distinct lack of “demand.”