There was considerable attention given to Janet Yellen’s appeal toward “optimal control” language in prior speeches and toward her confirmation. The idea is such that the newly committed 2% inflation target does not need to be a “rule.” Under optimal control, the FOMC may tolerate an inflation rate above that target if it allowed unemployment to decline at a quicker pace. In other words, optimal control is a modeled concept whereby the FOMC can assume the best parts of the dual mandate, with a focus so far only on that narrow set of potential circumstances far afield of what we see now.

At his press conference in March 2013, then-Chairman Bernanke tried to address some minor criticism about the pace of recovery, particularly as it related to optimal control concepts.

But for right now, we find that the thresholds that we have put into that rate guidance seemed to be sufficient to approximate the—what’s called the Optimal Control Path of Interest Rates that it seems to give a path of unemployment inflation that’s about as good we can get with the monetary policy tools that we have. It doesn’t mean we’re satisfied. It just means that we don’t have enough fire power to get the economy back to full employment more quickly.

In a speech delivered in June 2012, Janet Yellen predisposed of some of the same issues.

Figure 6 illustrates the magnitude of the disappointment by comparing Blue Chip forecasts for real GDP growth made two years ago with ones made earlier this year. As shown by the dashed blue line, private forecasters in early 2010 anticipated that real GDP would expand at an average annual rate of just over 3 percent from 2010 through 2014. However, actual growth in 2011 and early 2012 has turned out to be much weaker than expected, and, as indicated by the dotted red line, private forecasters now anticipate only a modest acceleration in real activity over the next few years.

In response to the evolving outlook, the FOMC has progressively added policy accommodation using both of its unconventional tools. For example, since the federal funds rate target was brought down to a range of 0 to 1/4 percent in December 2008, the FOMC has gradually adjusted its forward guidance about the anticipated future path of the federal funds rate. In each meeting statement from March 2009 through June 2011, the Committee indicated its expectation that economic conditions “are likely to warrant exceptionally low levels of the federal funds rate for an extended period.” At the August 2011 meeting, the Committee decided to provide more specific information about the likely time horizon by substituting the phrase “at least through mid-2013″ for the phrase “for an extended period”; at the January 2012 meeting, this horizon was extended to “at least through late 2014.”9 Has this guidance worked? Figure 7 illustrates how dramatically forecasters’ expectations of future short-term interest rates have changed. As the dashed blue line indicates, the Blue Chip consensus forecast made in early 2010 anticipated that the Treasury-bill rate would now stand at close to 3-1/2 percent; today, in contrast, private forecasters expect short-term interest rates to remain very low in 2014.

In other words (pardon the lengthy quotation), the Fed continues to get it wrong. Even by early 2011 the Fed was expecting the first rate hike to come in mid-2013. And in her last sentence of the first paragraph above, the “modest acceleration” has failed to materialize at any point in either 2012 or 2013. They keep getting their forecasts completely wrong.

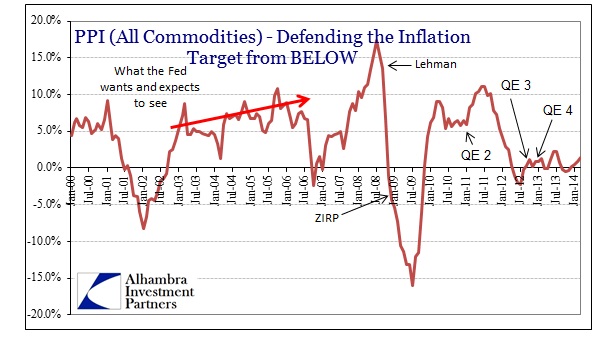

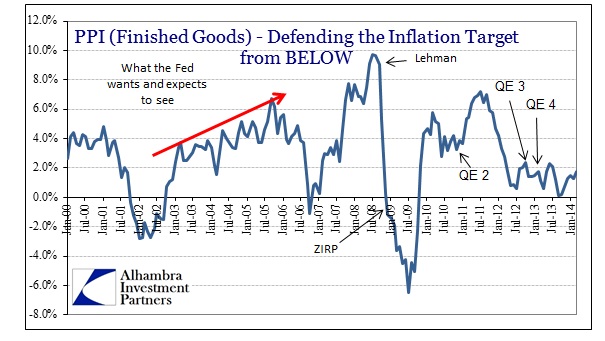

Bernanke asserted that was due to “as good as we can get with the monetary tools we have.” The latest inflation figures also track closely to this idea that the Fed is ultimately powerless. Bernanke had long been a proponent of inflation targeting, finally getting his wish in January 2012. One prime rationale is that 2% inflation realizes enough cushion for the FOMC to maintain a margin for future “stimulus.” Bernanke himself addressed that exact inquiry in the same March 2013 press conference (as part of the same line of questioning).

So historically, the argument for having inflation greater than zero—we define price stability as 2 percent inflation as do most central banks around the world. And one might ask, “Well, price stability should be zero inflation. Why do you choose 2 percent instead of zero?” And the answer to the question you’re raising which is that if you have zero inflation, you’re very close to the deflation zone and nominal interest rates will be so low that it would be very difficult to respond fully to recessions.

That raises the issue about current conditions as it relates to this orthodox arrangement, particularly “optimal control” theory. The idea is that the Fed must be able to “do something” at the onset of recession (because recessions are apparently the incarnation of pure evil and as such hold no beneficial resource re-allocation processes) so low inflation and low interest rates remove nearly every tool in the kit.

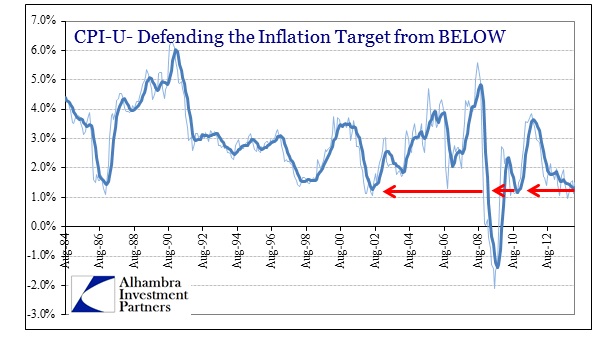

Current inflation readings for March have come out slightly higher than recent months, but that only moves them a little closer to the 2% target. Inflation, by these official definitions, remains nowhere near such a comfort level.

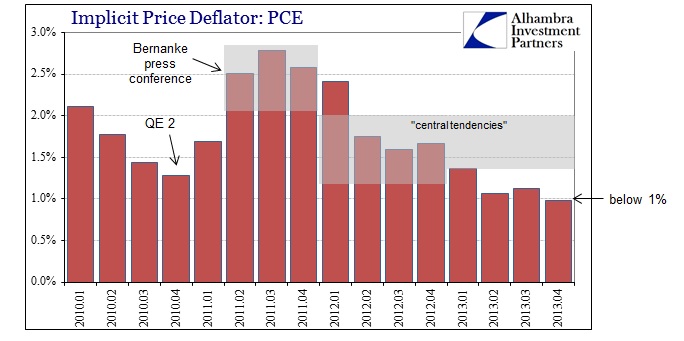

Though we won’t have an update for March on the Fed’s preferred inflation measure, the PCE deflator, until the end of this month, the last reading was actually under 1% and far below expectations.

If you put all these various pieces together it might suggest another rationale for taper. By now the FOMC members are at least aware of their consistent over-optimism about economic growth, and it has to at least remain a factor in considerations for policy. Given what Bernanke admitted about the desire to be at the inflation target, you have to believe that at some point policymakers might actually grow concerned about a forming recession in the face of QE already and persistently at such high levels.

In other words, what would they do, or at least think they might, if a recession became a greater likelihood while still going at full QE pace? It would be as Bernanke described, no room for additional “accommodation” in policy; a worst case. If a recession began to appear and they had not tapered, what would they be left with? If that is correct, taper is unrelated to the economy as it is now, but rather focused on restoring room to “do something.”

I still think it likely that the primary focus of taper is the mortgage market and the absolute decimation in issuance. That includes not just taper but the adjustment of POMO operations toward the 10-year maturity. However, even given that, I have to wonder if this set of circumstances has not been discussed at length. Again, they know their over-optimism is, at this point, systemic (that doesn’t mean they don’t still believe or hope on some level growth will return as predicted, only that they have to be more than aware of the last seven years) added to the obvious deceleration in the economy (which has been acknowledged on several occasions).

Might they not taper now so that they have at least the option of restoring QE should conditions grow worse? I think there is also the added “bonus” of rational expectations theory here, at least in this oversimplified orthodox world, where they can proclaim, against all observation, that the economy is doing well enough on its own to countenance taper in the hope that such a course convinces enough people to act according to that policy stance.

In the “optimal control” paradigm, a central bank already at high capacity of “stimulus” is unable to address further and worsening changes in economic direction – they have nothing left. Optimal control in such a case would demand exactly this course of action. In terms of psychology, restarting QE would probably have much more impact (in their minds, if nothing else) than simply increasing the levels of what would clearly be ineffectual bond buying.

Given what we know of rational expectations theory and the over-emphasis on psychology and “stimulus” potential, it certainly would be consistent. I don’t know if that is actually the case now with taper or not, but I find it plausible enough to present it.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com