By Tyler Durden at Zerohedge

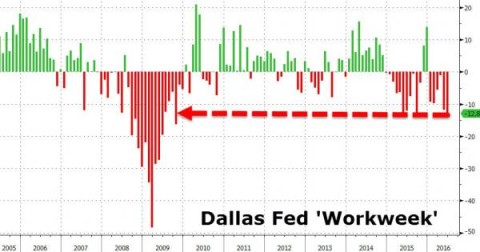

The Dallas Fed Business Outlook has now been in contraction for 18 straight months. The underlying components are mixed but the average workweek has collapsed back to its lowest since Nov 2009. As one respondent noted, “This is a recession… Fed policy has us locked into a lethargic and tenuous position… We cannot have millions of people out of the workforce and be healthy economically – they are a burden not a benefit.“

The biggest drop in Dallas Fed workweek since 2009!

The remarks from various Dallas Fed Survey respondents sums up the reality best…

“The oil industry is suffering due to the crude price plunge worse now than in the 1980s. For the ninth month U.S. industrial production declined year over year. This is a recession. There is a continued significant negative impact due to the downturn in the energy industry as a result of weak commodity prices. Recent slight improvement in commodity prices is having no positive impact on business conditions, although it may be slowing the pace of deceleration in business activity.”

“The economy is nervous, shaky and uncertain. Fed policy has us locked into a lethargic and tenuous position. It appears the Fed doesn’t know how to get off the horse it created. The Fed talks interest rate increases but looks for every reason not to do it. Until the Fed backs out of trying to manage the economy, we will be stuck on the cusp of slow growth and a recession. Add the difficulty in getting commercial and retail financing and rising employee costs (health care, minimum wage threats and the ridiculous overtime executive order), and hiring for many of us will be minimal. We cannot have millions of people out of the workforce and be healthy economically – they are a burden not a benefit.”

Source: “This Is A Recession” – Dallas Fed Workweek Hits 7-Year Low