The price of Oil did today what it has been doing for a while: it waits for a trigger and plunges. As I’m writing this, West Texas Intermediate is down 4.4%, trading at $44.99 a barrel, less than a measly buck away from this oil bust’s January low. It’s down over 20% from the peak of the most recent sucker rally.

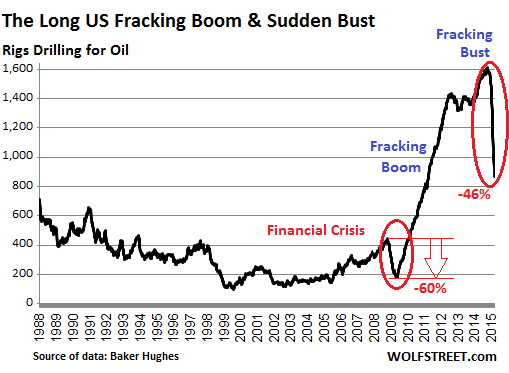

US oil drillers have been responding by slashing capital expenditures, including drilling, in a deceptively brutal manner. In the latest week, drillers idled 56 rigs that were classified as drilling for oil, according to Baker Hughes. Only 866 rigs were still active, down 46.2% from October, when they’d peaked at 1,609. In the 22 weeks since, drillers have taken out 743 rigs, the most dizzying cliff dive in the data series, and probably in history:

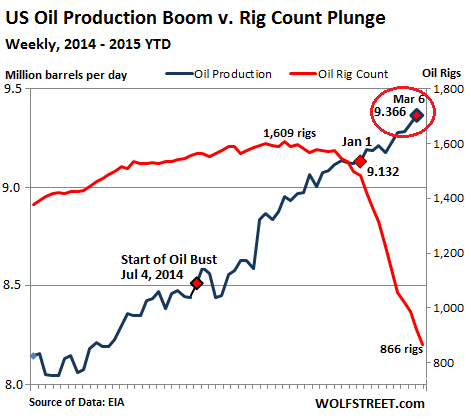

You’d think this sort of plunge in drilling activity would curtail production. Eventually it might. But for now, the industry has focused on efficiencies, improved drilling technologies, and the most productive plays. Drillers are trying to raise production but with less money so that they can meet their debt payments. Thousands of wells have been drilled recently but haven’t been completed and aren’t yet producing. This is the “fracklog,” a phenomenon that has been dogging natural gas for years.

So US oil production hit another record of 9.366 million barrels per day for the week ended March 6, according to the Energy Information Administration’s latest estimate. This chart shows how the rig count (red) has plunged while production (black) continues to soar:

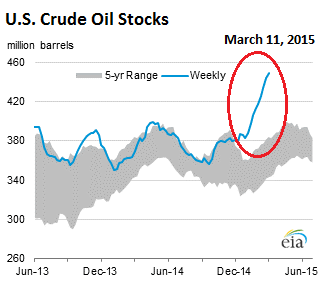

But demand is not living up to the level of production and imports. As an inevitable result, US crude oil inventories are piling up. Excluding the Strategic Petroleum Reserve, crude oil stocks, according to the EIA, rose by 4.5 million barrels in the latest reporting week, to a record 448.9 million barrels. A more modest rise than in prior weeks, but the ninth week in a row of increases. Crude oil stocks are now 78.9 million barrels, or 21.3%, higher than at this time last year. Note the beautiful spike:

So when is US storage capacity going to be full? That event would cause all sorts of havoc in the oil markets, including a terrible plunge in price. With no place to put their oil, some production companies would have to turn off the tap and leave the oil in the ground. That would bring production down in a hurry, but it would add to the pent-up supply, the “fracklog,” thus dragging out the bust even further.

How likely is this scenario?

Last week, the EIA released estimates that crude oil stocks nationwide, as of on February 20, were at 60% of “working storage capacity,” up from 48% last year at that time. In critical Cushing, Oklahoma, which accounts for 14% of the national total and is the delivery point for WTI futures contracts, storage facilities were 67% full.

Given a storage capacity of 521 million barrels, if weekly increases amount to an average of 5 million barrels going forward, it would take about 3 months to fill the remaining capacity. Cushing would be full sooner, which would pose its own set of problems.

But we’re not biting our nails just yet. The largest US refinery strike in 30 years that impacted 12 refineries and a fifth of US refining capacity appears to be settled. A tentative agreement has been reached between the United Steelworkers union and oil companies. Once these refineries are fully operational again, more crude will head their way. The driving season will start soon. SUVs and pickups and even fuel misers have a prodigious appetite collectively and can burn through a lot of gasoline in a hurry. And imports could be throttled back further.

So there is a very good chance that storage capacity will disappear as a death trap for the price of oil this year. But US oil production is likely to continue to rise, leaving the industry to face an even bigger oil glut and even more price mayhem next year. Yet production won’t start declining until the money runs out.

Some smaller oil and gas companies are already running out of money. For them, “restructuring” and “bankruptcy” are suddenly the operative terms. Read… “Default Monday”: Oil & Gas Companies Face Their Creditors