Despite now two doses of QE taper and much more confirmation that the FOMC will be committed to that course, gold prices have not collapsed. Conventional wisdom has been uniform in believing QE as inflationary, and thus a positive for gold prices (despite the trajectory since 2011). Removal of QE should have been, if this thinking is correct, a negative factor for gold via that inflation channel. Yet, pretty much since the first taper was announced in December, gold prices have been on a steady climb. The reason for that, and I think there is little doubt now, is gold as a “tail risk” hedge or insurance.

The relationship between QE and inflation was always tenuous, particularly given the actual (as opposed to imagined) role of reserves (and excess at that) in the modern, shadow/investment banking system. Instead, I believe it was the projection of FOMC resolve in QE that allowed the entire financial system to fall into the trap of expectations – that the Fed would not countenance major systemic risks, thus removing considerations of “tail risk.” Less tail risk = lower demand for tail risk hedging.

That gold would reclaim a steady bid after such visible removal of FOMC-driven “surety” is a direct consequence of removing not just the pace of “reserve” expansion but the recalibration of market risk without that visible assurance.

On the other side of the economics of gold lies the monetary system as it actually exists – the one in which collateral is much more moneylike than “money” or currency. The operational fact of QE has been the reduction in available collateral to the marketplace for secured short and overnight lending (interbank). As episodes of collateral shortages broke into the open, gold filled the breach with a resulting slam in terms of gold prices. The indication of such collateral demand was forward rates (GOFO).

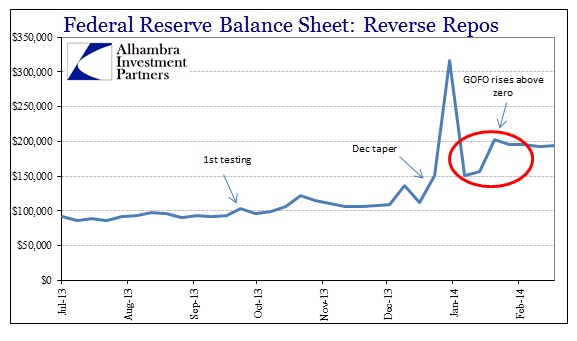

As with what I mentioned above of the apparent return of the golden bid, the collateral system has also been affected by changes in systemic operations post-taper. While the Open Market Desk is removing less collateral from the system in its POMO activity, that has not alleviated all collateral conditioning. In fact, as I highlighted last week, bond issuance, particularly MBS and t-bills, is declining even more rapidly. Mortgage issuance, ironically enough, is being decimated by taper threats from this past summer. T-bill issuance has collapsed under the illusion of fiscal responsibility.

Yet for all these ongoing imbalances, gold has remained in that steady upward march. I think in addition to the restart in demand for tail risk, on the other side there has been added an alternate pathway for collateral to flow, thus making the appeal of gold less appetizing at the margins.

On September 20, 2013, the Fed announced, via its Open Market Desk, that it would conduct daily reverse repo “tests.” The first, beginning September 23, was designed to gauge effectiveness of expanded policy coverage to, in a historic first, nonbank participants (the cash side of repo). The reasons for the reverse repo program really boil down to enforcing a lower limit, or floor, on short-term interest rates that have not conformed due to the US financial system’s quirks regarding banks vs. nonbanks (a fuller discussion of this here).

The other primary facet of the reverse repo program is the potential for nonbanks and banks alike to use it to obtain collateral sitting idle in the SOMA “silo.” In this kind of “reverse repo” (from the Fed’s perspective), banks and institutions are parking cash with the Fed, collateralized by the Fed’s holdings of UST. In other words, it represents another avenue to get collateral into the repo system.

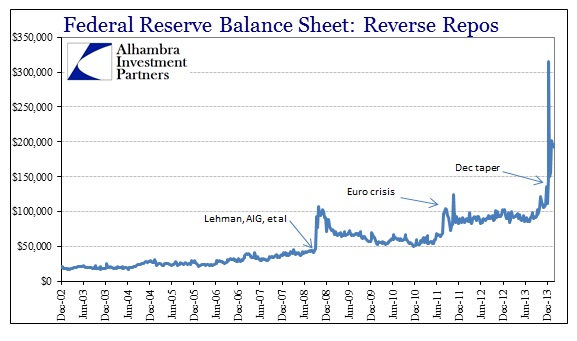

The first reverse repo test regime was limited to a maximum of $500mm per bidder, and was scheduled to expire on January 29, 2014. In the interim, the bidder ceiling was raised, and on January 29, the per bidder max was further increased to $5 billion and the overall “test” program was extended by another year, now set to expire on January 30, 2015. As you can see from the chart below, the “test” has been quite popular.

Reverse repos are not new to the Fed’s monetary toolkit. The most (in)famous usage occurred the week Lehman failed, as the FOMC directed the Open Market Desk to “drain” $50 billion in “excess liquidity” from the system. That was an attempt to get the federal funds rate back up to its target, as it tended below target in the growing fragmentation between London (eurodollars) and NYC (federal funds). As we know now from the 2008 FOMC transcripts, there were intraday discrepancies that made such a movement somewhat suspect – the Fed may have been trying to rectify the target imbalance, but only to make the geographic divide that much greater.

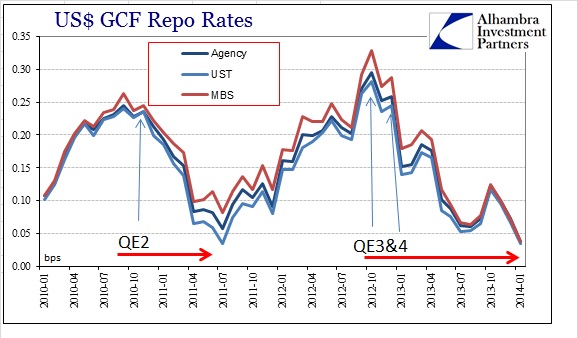

In the current set of circumstances, given the origination demise in MBS and t-bills, it would make sense that the reverse repo “test” would take the place of gold as a marginal source of collateral. That theory is bolstered further as repo rates have sunk closer to zero, making the Fed’s program a realistic, and even cost-efficient, alternative (and performing as desired by policy intentions).

If collateral strains have been transferred back to the Fed’s SOMA by the daily reverse repo auctions, it would offer a more complete picture as to gold’s recent behavior. Put that together with the “expiration” of QE as a full-blown tail risk suppressant, and it is very compelling in my mind.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com