By John P. Hussman, Ph.D.

“Understand that securities are not net economic wealth. They are a claim of one party in the economy – by virtue of past saving – on the future output produced by others. Fundamentally, it’s the act of value-added production that ‘injects’ purchasing power into the economy (as well as the objects available to be purchased), because by that action the economy has goods and services that did not exist previously with the same value. True wealth is embodied in the capacity to produce (productive capital, stored resources, infrastructure, knowledge), and net income is created when that capacity is expressed in productive activity that adds value that didn’t exist before.

“New securities are created in the economy each time some amount of purchasing power is transferred to others, rather than consuming it. Once issued, all of these pieces of paper can vary in price later, so the saving that someone did in a prior period, embodied in the form of some paper security, may be worth more or less consumption in the current period than it was initially. That’s really the main effect QE has – to encourage yield-seeking speculation that drives up the prices of risky securities, but without having any material effect on the real economy or the underlying cash flows that those securities will deliver over time.

“If one carefully accounts for what is spent, what is saved, and what form those savings take (securities that transfer the savings to others, or tangible real investment of output that is not consumed), one obtains a set of ‘stock-flow consistent’ accounting identities that must be true at each point in time:

1) Total real saving in the economy must equal total real investment in the economy;

2) For every investor who calls some security an ‘asset’ there is an issuer that calls that same security a ‘liability’;

3) The net acquisition of all securities in the economy is always precisely zero, even though the gross issuance of securities can be many times the amount of underlying saving; and perhaps most importantly,

4) When one nets out all the assets and liabilities in the economy, the only thing that is left – the true basis of a society’s net worth – is the stock of real investment that it has accumulated as a result of prior saving, and its unused endowment of resources. Everything else cancels out because every security represents an asset of the holder and a liability of the issuer.”

Stock-Flow Accounting and the Coming $10 Trillion Loss in Paper Wealth

John P. Hussman, April 6, 2015

Following the British referendum to exit the European Union, the paper value of global assets briefly fell by about $3 trillion. This decline in the market capitalization immediately garnered headlines, suggesting that some destruction of “value” had occurred. No. The value of a security is embodied in the future stream of cash flows that will actually be delivered into the hands of investors over time. What occurred here was a paper loss. While the recent one was both shallow and temporary, get used to such headlines. In the U.S. alone I fully expect that $10 trillion of paper wealth will be erased from U.S. equity market capitalization over the completion of the current market cycle.

While any given holder can sell their securities here, somebody else has to buy those same securities. The fact that valuations are obscene doesn’t mean that the economy has createdmore wealth. It just means that existing holders of stocks and long-term bonds have a temporary opportunity to obtain a wealth transfer from some unfortunate buyer. Whoever ends up holding that bag will likely earn total returns close to zero on their investment over the coming 10-12 year horizon, with profound interim losses on the way to zero returns.

Investors who fail to understand the difference between paper wealth and value are likely to learn that distinction the same way they did during the 2000-2002 and 2007-2009 collapses, both which we correctly anticipated, with a constructive shift in-between. So not to throw stones in our own glass house, see the “Box” in The Next Big Short for a narrative of the challenges we encountered in the speculative half-cycle since 2009, as the Federal Reserve intentionally encouraged yield-seeking speculation long after previously reliable warning signs appeared. This has created what is now the third financial bubble in 16 years, the third most offensive valuation extreme next to 2000 and 1929, and the single most extreme point of valuation in history for the median stock.

Part of the discussion below repeats portions of recent commentaries. While we may or may not observe further short-run speculative extremes, I can’t think of a more important set of principles that a long-term, risk-conscious investor should understand at present.

The higher the price an investor pays for a given stream of future cash flows, the lower the long-term return the investor can expect to achieve over time. As the price of a security rises, what investors considered “expected future return” only a moment before is suddenly converted into “realized past return.” The higher the current price rises, the more expectedfuture returns are converted into realized past returns, and the less expected future return is left on the table. Because of this dynamic, the point where a security seems most enticing on the basis of realized past returns is also the point where the security is least promising on the basis of expected future returns. See Blowing Bubbles: QE and the Iron Laws for a straightforward demonstration of this idea.

This is why good valuation measures, such as the ratio of market capitalization to corporate gross value-added, are inversely related to actual subsequent market returns across history. Bubbles do not create wealth. They simply raise the current price of a security, lower the future expected long-term return, and, at best, leave long-term cash flows unchanged.

I say “at best” because there’s no evidence that yield-seeking speculation, encouraged by central banks, has any positive effect on long-term cash flows at all. Indeed, I don’t think there’s any real doubt that the crisis and disruption following the collapse of prior yield-seeking bubbles is precisely what has crippled the accumulation of productive capital at every level (real investment, work experience, infrastructure) in the real economy. Given that the accumulated stock of productive capital is the basis for the net worth of our nation (as detailed above), it follows that yield-seeking speculation, intentionally encouraged by the Federal Reserve, is perhaps the single most destructive force in the U.S. economy, and in the lives of the American people.

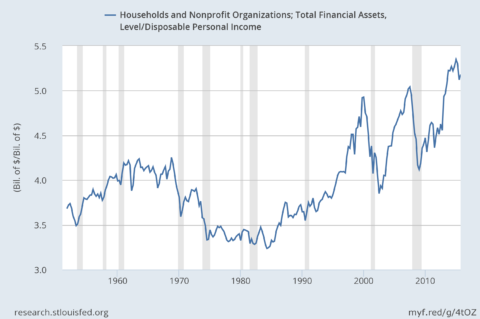

If one looks at the chart below, it may appear that American households are “wealthier” than they have ever been, in the sense that financial assets held by households have never been higher as a fraction of disposable income (the Federal Reserve Z.1 flow of funds data include non-profit organizations in this figure, but the effect is comparatively small). As I observed in May, one might imagine that a high value of financial assets relative to disposable income is actually a good thing, and that it reflects greater saving by households. Unfortunately, since 2000, saving as a fraction of household income has plunged to half the savings rate observed in the previous half-century. No, the elevated level of financial assets reflects extreme valuations, not an increase in the rate of financial investment.

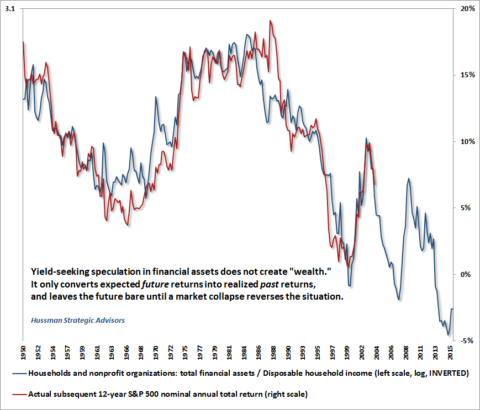

Unfortunately, the chart above only depicts paper wealth, and not surprisingly, it turns out that the best moments for paper wealth are actually the worst moments for future investment returns. The chart below shows the same data as above, but places financial assets / disposable income on an inverted log scale (blue line, left). Actual subsequent 12-year S&P 500 nominal total returns are plotted in red (right scale). Though alternative measures vary slightly, the implication of roughly zero, or even negative, expected total returns on the S&P 500 over the coming 12-year period is broadly consistent with other reliable valuation measures that are most closely correlated with actual subsequent market returns (see Choose Your Weapon).

Understand that what appears to be a substantial amount of paper “wealth” embodied in securities here is actually a reflection of massive overvaluation, relative to the stock of productive investment and the cash flows (from value-added production) that will actually be delivered into the hands of security holders over time. These rich valuations imply poor long-term investment returns, but in the end, these securities will deliver a stream of cash flows that is no different than the stream of cash flows that investors would receive at lower valuations. Again, paper wealth may change as valuations fluctuate, but the value of any security is embodied in those future cash flows.

The return/risk profiles of investment securities are not constant

Investors tend to believe that the return/risk characteristics of a particular investment class are given, associating bonds with “safety” and equities with “growth, though with greater volatility.” But a central feature of bubbles, always overlooked by investors until the collapse, is that an extended period of speculation dramatically changes the return/risk characteristics of whatever market is involved. Throughout the housing bubble, for example, mortgage debt was considered safe, gains were attributed to “fundamentals,” and a generalized decline in the national housing market was seen as inconceivable. In the words of Ben Bernanke as the housing bubble was in full swing:

“Unquestionably, housing prices are up quite a bit; I think it’s important to note that fundamentals are also very strong. We’ve got a growing economy, jobs, incomes. We’ve got very low mortgage rates. We’ve got demographics supporting housing growth. We’ve got restricted supply in some places. So it’s certainly understandable that prices would go up some. I don’t know whether prices are exactly where they should be, but I think it’s fair to say that much of what’s happened is supported by the strength of the economy.”

Despite Bernanke’s assurances, speculation in mortgage debt had already changed the return/risk characteristics of the housing market, fueled by yield-seeking speculation in response to a Federal Reserve that dropped short-term interest rates to just 1% after the tech bubble collapsed. A market that had historically been safe and nearly immune from widespread loss ended up provoking the deepest economic crisis since the Great Depression. Likewise, speculation in equities, junk debt and even investment grade debt has dramatically changed the return/risk profile of these asset classes in recent years, to the point where they bear no resemblance to what passive investors might expect based on historical norms. When one stops to realize that the amount of global debt yielding negativeinterest rates now exceeds $12 trillion, it should be clear how extreme central bank distortions have become. To imagine that equity valuations have not already fully responded to this situation after years of yield-seeking competition is, quite frankly, ignorant both of reliable valuation measures and of financial history.

Over the completion of the current market cycle, we expect the S&P 500 to retreat by 40-55%; a decline that would be merely run-of-the-mill in the sense that it would bring the most historically reliable measures of valuation back into a range that has been visited or breached during the completion of every single market cycle in history (including cycles prior to the 1960’s when interest rates were often quite low). With the yield on the 10-year Treasury bond currently just 1.45%, investors already know that they will earn next to nothing on their investment over the coming decade, the only question being whether to hold out for a few percent in gains that might be available in a recessionary environment that drives yields below 1%. Across the corporate bond market, and not only in junk debt, the combination of steep increases in corporate debt, justified by temporarily high profit margins that make these debt burdens seem reasonable, is likely to unravel into a much deeper default problem than investors seem to anticipate. While default rates remain quite low for now, and “investment grade” debt rarely defaults in one fell-swoop, I expect a cascade of downgrades in the coming years as “transition probabilities” from high-grade to lower-grade rankings soar beyond their historical norms.

Head of the snake

The evidence, if one cares to examine it, is that Fed-induced yield-seeking speculation is not the cure but the cause of economic malaise. Much of America has still not recovered from the violent consequences of the last yield-seeking bubble the Fed engineered. Now the Fed has engineered another, and has drawn nearly every pendulum to an extreme.

For me, probably the saddest part of this whole spectacle was watching an earnest, well-meaning congressman asking Janet Yellen, during her Humphrey-Hawkins testimony two weeks ago, why the Fed was not doing “more” on behalf of unemployed people of color. The problem here is that the underlying assumption is false. If one actually examines data across history, there is no reliable or economically meaningful relationship between activist monetary policy and subsequent changes in output or employment. This congressman was essentially begging the Fed to deliver poison to his community.

I distinguish “activist monetary policy” from “rules-based monetary policy”; the fluctuations in interest rates and the monetary base that can be predicted from past values of non-monetary variables alone, such as GDP, inflation, and unemployment. Statistically, it’s difficult to determine whether that “predictable” component of monetary policy is economically useful or not, since by definition, it’s perfectly correlated with non-monetary data and “spans the same space.” What we can say, however, is that deviations from those predictable monetary responses – “activist” policy interventions – have no reliable or economically significant impact on the subsequent performance of the economy, other than to create yield-seeking bubbles that exert violent long-term injury when they collapse.

Virtually nobody cares to look at the utterly weak and insignificant correlation between monetary policy and desired outcomes, apparently preferring a dogmatic insistence on some little graph or model they learned in Economics 101. While Janet Yellen showed enough conceit to give the Fed credit for millions of new jobs since 2009, the path of the economy since the crisis has been nearly identical to what one would have anticipated in the absence of all of this monetary insanity (a result that one can demonstrate using vector autoregression). The crisis itself was not “fixed” by monetary policy, but ended the same week that the Financial Accounting Standards Board announced it would waive the requirement for financial institutions to mark their assets to market value, allowing them “significant judgment” in how they valued those assets, and eliminating the specter of widespread insolvency with the stroke of a pen.

The bottom line is this: speculation does not create wealth. The true wealth of a nation is in its accumulated stock of productive capital, stored resources, infrastructure and knowledge. This wealth contributes to the nation’s income and welfare when it is used to create value-added output – goods and services did not exist before, that have a greater value than the inputs used to produce them. It shouldn’t be surprising, then, that the ratio of market capitalization to corporate gross value-added is the single most reliable valuation indicator we identify, with a 93% correlation with actual subsequent 10-12 year total returns in the S&P 500 (see The New Era is an Old Story).

From an investment standpoint, the value of any security is inherent in the long-term stream of cash flows it will deliver to investors over time. Artificially jacking up financial securities through reckless monetary policy doesn’t change the cash flows that those securities will deliver over time; it only converts future expected return into past realized return, leaving nothing but risk on the table for years to come. Central bank intervention is not a benefit to long-term economic prosperity. It is the head of the snake.

We expect $10 trillion of “paper wealth” to be wiped from the U.S. equity market over the completion of this cycle, because it is not “wealth” at all. Again, since every security that is issued has to be held by someone until it is retired, the main consequence of Fed-induced speculation is the opportunity for wealth transfer – the chance for existing holders to sell their overvalued securities to some poor bagholder who will reap the whirlwind over the completion of the market cycle. We wish this on nobody, but it’s unavoidable that someone must assume that role. Those bagholders would best be those who understand our concerns and either accept the risks or choose to deny them.

As I’ve regularly emphasized, an improvement in our measures of market internals to the kind of uniformity that prevailed prior to about mid-2014 would indicate a shift back to risk-seeking among investors, in contrast to the current trend of increasing risk-aversion. When investors are in a speculative mood, they tend to be indiscriminate about it, so uniformity of market internals across a broad range of individual stocks, industries, sectors, and security types provides a useful signal of that disposition. Fresh speculation would do nothing to improve the dismal outlook for stocks over the completion of this cycle, or over the coming 10-12 year period, but could extend this topping phase enough to preclude a hard-negative market outlook until internals deteriorated again. At present, the combination of obscene valuations on historically reliable measures, coupled with broadly unfavorable market action and internals on our measures, holds us to a defensive outlook for now.

If we learned one lesson during the half-cycle since 2009, it was that the Fed’s recklessly experimental policy of quantitative easing was able to encourage yield-seeking speculation long after the emergence of warning signs that were reliably followed by market plunges in previous market cycles, so one had to wait for market internals to deteriorate explicitlybefore adopting a hard-negative market outlook. We need no further lessons on that subject.

Meanwhile, keep in mind that central bank easing only reliably encourages speculation when investors are already inclined to seek risk. As we’ve demonstrated in both U.S. and Japanesedata, central bank easing fails to support stocks (beyond an immediate knee-jerk rally) once market action has deteriorated and investors are inclined toward risk aversion. In a risk-averse environment, safe liquidity is a desirable asset, not an inferior one, so creating more of it doesn’t ignite yield-seeking. The Japanese stock market has suffered two separate losses in excess of 60% since 2000 despite short-term interest rates that were regularly pegged at zero, and never above 1%, during the entire period.

On Friday, interest rates went negative on the entire stock of Swiss government bonds. German government yields are now negative beyond a 15-year maturity. From current valuations, the prospect of positive 10-12 year investment returns on U.S. stocks has also died. Still, the relationship between equity valuations and bond yields is far weaker than investors seem to recognize (the “Fed Model” is an artifact of the 1980-1997 disinflation), and low interest rates have never durably removed equity market volatility, downside risk, or the tendency for compressed equity risk premiums to be restored over the completion of the market cycle. So maintain a patient, disciplined confidence that this market cycle will be completed, valuations will change, and fresh opportunities will emerge. We’ll respond to new evidence as it arrives.

The foregoing comments represent the general investment analysis and economic views of the Advisor, and are provided solely for the purpose of information, instruction and discourse. Please see periodic remarks on the Fund Notes and Commentary page for discussion relating specifically to the Hussman Funds and the investment positions of the Funds.

Source: Head of the Snake – The Poisonous Gap Between Paper Wealth and Real Wealth