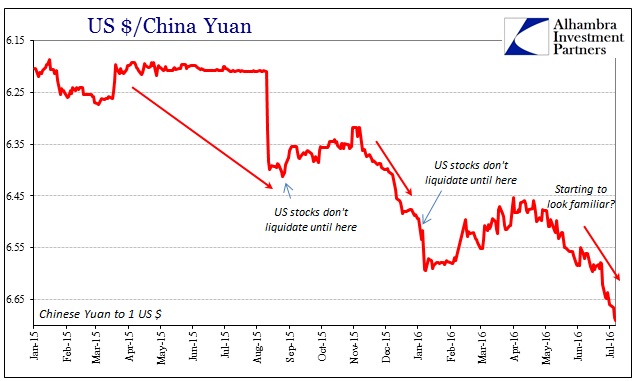

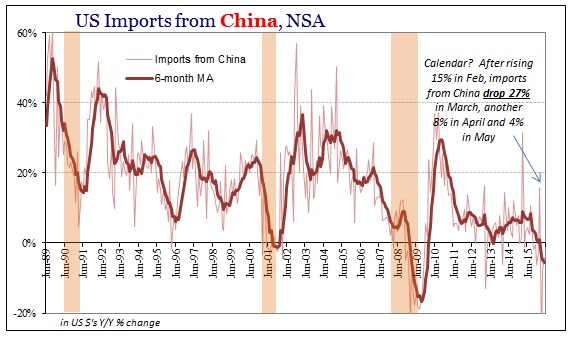

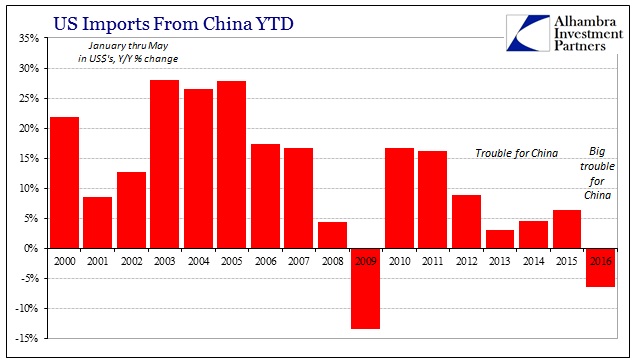

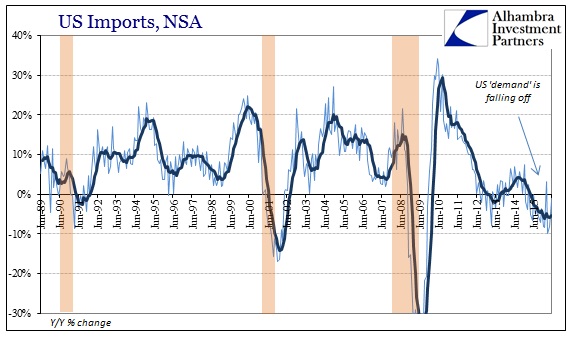

You’ll have to forgive the Chinese if they view “global turmoil” as something far more than an esoteric financial concept to be debated by irrelevant monetary committees. US imports from China fell 4.3% year-over-year in May 2016, the third consecutive contraction and seventh out of the last eight months. With February’s 16% gain more a calendar/holiday illusion, especially since it was more than wiped out by February’s -27%, US “demand” for Chinese goods has steadily declined since last autumn. Thus, when the FOMC voted in December to raise the federal funds target band, they were in reality increasing rates in a market where nobody is to declare a recovery that nobody believes in – the Chinese first of among the non-believers.

It wasn’t just China, however, as imports fell from every major trading partner. Imports from Japan dropped by another 8% in May after declining 14% in April and nearly 6% in March. Inbound European trade was down 1.1% for the month and 1.7% YTD. In the five months of 2016 so far, imports from China are 6.4% less than the first five months of 2015. These are all alarming statistics in the context of the global economy, but again nowhere more so than its central pivot in China where +20% from the US is supposed to be the baseline that keeps it all going.

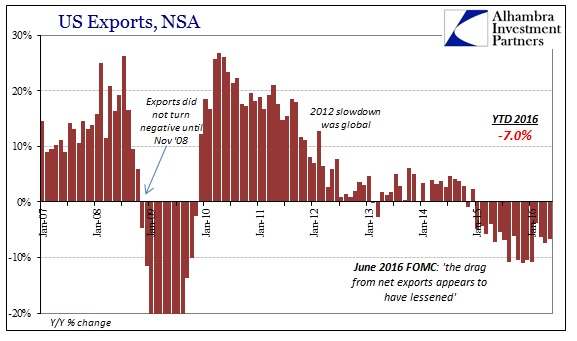

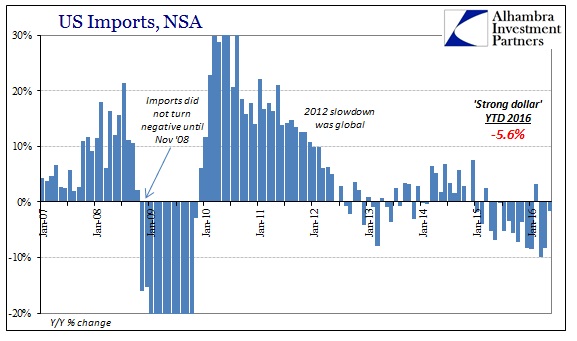

The June 2016 FOMC policy statement referenced a smaller drag from “net exports” as if that were a comforting feature of the current economy. It may be technically true (and it may not), but the implications, as I pointed out at the time, are nowhere near the semantic construction of the statement. January 2016 was the fourth consecutive month of greater than 10% declines in US exports, bringing the 6-month average to just shy of -10%. Since then, exports have still contracted but at a slightly better rate. The 6-month average as of May 2016 is -7.6%.

Imports, on the other hand, have been more erratic. With February’s 29th day, US imports rose 3.2% for the first positive number since March 2015. But the very next month, March, imports fell by almost 10% which was, by far, the worst monthly contraction of this “cycle.” The 6-month average for imports was -5.6% in December and is 5.5% in May. In other words, exports have improved slightly while still contracting while imports decline overall at about the same; or, what the FOMC implied in its policy statement may have been technically true but utterly meaningless especially about what that implies of the US economy itself and US demand.

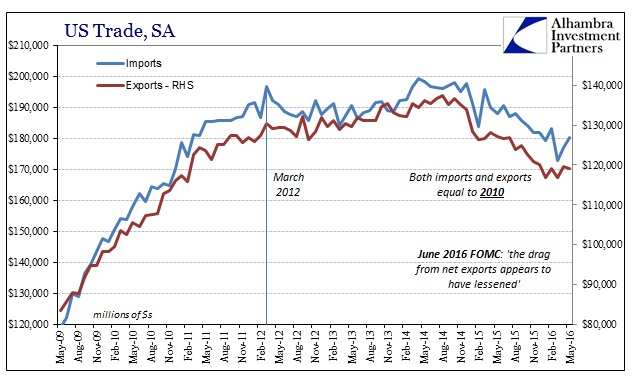

Seasonally-adjusted, the trade deficit actually increased to -$61 billion in the current month, up from -$57 billion in April and -$55 billion in March. While both imports and exports decline year-over-year in unadjusted terms, the seasonally-adjusted series shows more monthly variability due to nothing more than mathematically-figured seasonality. Imports have been rising the past two months faster than exports, suggesting for GDP the opposite as the FOMC statement – though still not any more meaningful despite the technicalities.

What is important is that exports are 13% less than the seasonally-adjusted peak reached all the way back in August 2014. Despite monthly ups and downs, overall across the subsequent 22 months US exports continue to be generally lower without any end to the contraction as yet indicated. Imports in May 2016 (SA) were almost 8% less than the October 2014 peak. This is not a dollar problem in changing the relative terms of trade, rather it is a “dollar” problem for the entire global economy as it undergoes a monetary-driven paradigm shift .

So the seasonally-adjusted numbers are up for imports, only slightly lower in exports, and down everywhere year-over-year unadjusted. In short, nothing has changed as this is clearly still the same post-2011 economy in its “rising dollar” phase or format. It is a condition that prices (especially funding markets) are once again keeping to.