There hasn’t been much of Treasury Secretary Jack Lew around the mainstream newsfeed in a long time, maybe even going back to his confirmation. However, he caused a lit bit of wrinkle by proclaiming his love for a “strong dollar” while placing it within the context of perhaps ECB criticism.

“The strong dollar, as all my predecessors have joined me in saying, is a good thing. It’s good for America. If it’s the result of a strong economy, it’s good for the U.S., it’s good for the world,” he said during an interview at the World Economic Forum in Davos, Switzerland. “If there are policies that are unfair, if there are interventions that are designed to gain an unfair advantage, that’s a different story.”

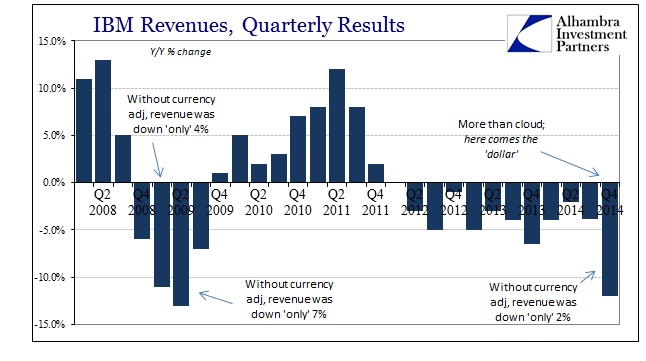

So he’s all for the “strong dollar” as a matter of actual economic progress (without wages) but not in the manner of a currency war or some other perceived financial transgression. The Japanese have been openly abetting a lower yen, but nothing much is made of that (likely because it has had the opposite effect on Japanese exports and imports). Might the timing of something like this (which will spread throughout this earnings season and those to come) explain the sudden interest in the currency:

To think that multi-national companies are not complaining to government officials at this very moment is to be fully naïve. I would not doubt, given where the Treasury Secretary is, if he hasn’t been waylaid repeatedly about “doing something” about that “strong dollar.” Unfortunately, he cannot come right out and say that corporatism despises it so the administration, like those before, would prefer it sinking like a rock. Like monetarism, the fiscal side prefers not currency stability but their own, specific brand of instability.

They talk about a “strong dollar” as something that might actually exist, but in this financially-dominated economic reality it doesn’t relate. This is why it is so easy for policymakers to say that while openly courting the opposite – better for IBM, so they believe, not to have to take such negative currency “pressure.” Secretary Lew might continue to talk about it in the same manner as his predecessors, but the dollar is not what it used to be and neither are the implications of its “strength.”