Some people are either born or nurtured into a time warp and never seem to escape. That’s Janet Yellen’s apparent problem with the “bathtub economics” of the 1960s neo-Keynesians.

As has now been apparent for decades, the Great Inflation of the 1970s was a live fire drill that proved Keynesian activism doesn’t work. That particular historic trauma showed that “full employment” and “potential GDP” were imaginary figments from scribblers in Ivy League economics departments—not something that is targetable by the fiscal and monetary authorities or even measureable in a free market economy.

Even more crucially, the double digit inflation, faltering growth and repetitive boom and bust macro-cycles of the 1970s and early 1980s proved in spades that interventionist manipulations designed to achieve so-called “full-employment” actually did the opposite—that is, they only amplified economic instability and underperformance as the decade wore on.

The irony is that the paternity of this real world proof came from the Yale economics department, which was inspired in the 1960s and 1970s by one of the most arrogant, wrong-headed Keynesians of modern times—–Dr. James Tobin. It was Tobin’s neo-Keynesian theories and activist role in the Kennedy-Johnson White House which gave rise to the Great Inflation and its destructive aftermath.

Still, Professor Tobin could perhaps be forgiven for the original science experiment in full employment economics he helped author from his perch at 1600 Pennsylvania Avenue. After all, economists were just then enamored by newly invented large-scale math models of the US economy and their equations always generated beneficent results.

But there is no debate about what happened next. The Heller-Tobin CEA proclaimed that the America of the early 1960s—an economy that Eisenhower had left in fine, growing, non-inflationary fettle—was suffering from too much “slack”. This included unnecessarily high levels of unemployment (@ 5.5% in 1962!) and a general failure to utilize capital and labor resources at their full-employment level and thereby achieve “potential GDP”.

The latter was held to be mathematically calculable and was reckoned by the JFK’s Keynesian doctors to be tens of billions greater than reported GDP. Accordingly, until the nation’s economic bathtub was filled full-up to the brim there was an urgent need for more fiscal and monetary stimulus.

When conservatives protested that deficits should be reserved for national emergencies and were potentially inflationary, Tobin and his acolytes impatiently huffed that traditionalists didn’t understand economic “slack” and its policy cures. As they had it, “slack” was an economic free lunch that could be harvested by means of “accommodative” policy until the last steelworker was called back to work and every auto plant mustered a third shift.

Soon the experiment was off to the races with large deficit financed tax cuts for individuals, a generous tax credit for business investment, giant increases in Federal spending for the war on poverty and soon thereafter the war on Vietnam. And all this was accompanied by a steady drum-beat from Tobin for “easier” monetary policy. This encompassed feckless monetary experiments like the original treasury market “twist” and endless pontification about how the growing surfeit of unwanted US dollars abroad was actually a gift to the rest of the world.

If the Europeans wanted to redeem their excess dollars, as they had the right to do under Bretton Woods, Tobin had a plan: Instead of gold, give them 10-year US debt that would never be paid back.

Needless to say, the whole thing ended in calamity. Johnson’s guns and butter economy got red hot; inflation soared; widespread shortages suddenly materialized; large industrial strikes proliferated; the US balance of payments plunged deep into the red; and then a full-blown dollar and gold crisis flared up in the winter of 1967-1968. All the while, insuperable pressure was put on the Fed to “accommodate” fiscal policy until the politicians could screw up enough courage to take away the fiscal punch bowl.

History makes clear that then and there the Fed was housebroken. When Johnson closed the gold pool on his way out the White House door and Nixon performed the coup de grace by defaulting on America’s obligation to redeem dollars for gold at Camp David in August 1971, the US dollar left the traditional world of monetary standards. Thereupon it embarked upon the brave new world of the PhD standard that reigns among all central banks today.

But here’s the historic crime of the piece. The serviceable and experience-proven regime of a gold-based monetary standard was destroyed by the PhD’s the very first time they got their hands fully on the levers of national economic policy. In the argot of Breaking Bad, the blame for the immense economic disorder of 1966-1983 was on them.

Accordingly, here is where professor Tobin gets his nomination to the Eternal Woodshed. Rather than going back to Yale chastened by the disaster he had wrought, he spent the next decades teaching a whole generation of students about the virtues of bathtub economics and that levitating “aggregate demand” was the essential key to keeping the US economy humming tightly along the arc of its full-employment potential.

Stated differently, not withstanding his own abject failure as a policy-maker,Tobin remained an evangelist for the proposition that a tiny clique of economists can deliver macro-economic results that are far superior to outcomes on the free market resulting from the interactions of millions of producers, consumers, savers, investors, entrepreneurs and speculators.

As is well-known, one of Tobin’s first students to be conferred a PhD after he repaired from his Washington follies to Yale was Janet Yellen. That was 1971. If Keynesian economics in a national bathtub that was not at all a closed system was nonsense even then, it surely is nothing less than a laughingstock in the blooming, buzzing, churning global economy of today—-a place where the source of the marginal supply of labor and capital cannot even be pronounced in Washington, let alone be measured, calibrated and factored into a policy equation.

Yet here is Janet Yellen at a Congressional hearing yesterday faithfully lip-synching professor Tobin. She has not even learned any new jargon in 43 years!

“In light of the considerable degree of slack that remains in labor markets and the continuation of inflation below the (Fed’s) 2 percent objective, a high degree of monetary accommodation remains warranted,” Ms. Yellen said.

This was all by way of justifying the lunatic proposition on which the Fed is now operating: Namely, that for the 68th consecutive month it kept the money market rate at zero—a condition that has never previously occurred in all of human history. Well, outside of post-bubble Japan anyway, and its evident how well that’s working.

But under the Keynesian macro-models— zero interest rates are really nothing more than a magical “slack” fighter. The assumption is that the US economy—even as it prepares to enter it sixth year of “recovery”—remains deficient in that mysterious ether called “aggregate demand”. Therefore more of same needs to be conjured by the ultimate in low interest rates—which is to say, 5 bps on the federal funds.

Well, let’s see. Non-financial business has taken its debt from $11.0 trillion on the eve of the financial crisis 76 months ago to $13.6 trillion today, but this immense borrowing binge all went into financial engineering in the form of stock buybacks, LBOs and M&A deals. Actual “aggregate demand” for real plant and equipment outlays is still $70 billion or 5% below it 2007 peak. So how can another month of ZIRP accomplish what the first 67 months evidently haven’t?

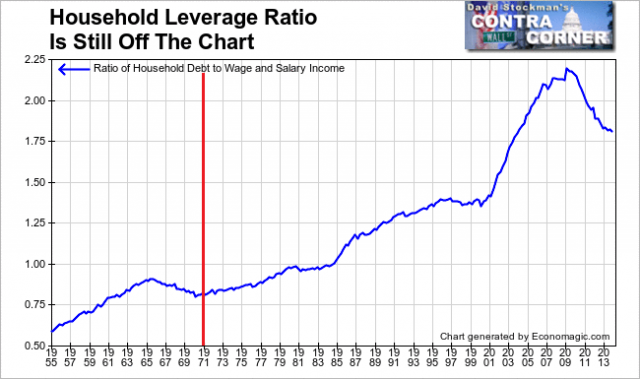

And then there is the consumer, who shopped during the entire 40 years of Dr. Yellen sleepwalk, but has now finally and unequivocally dropped. Household leverage soared after the Tobin/Nixon/Milton Friedman depredations of the 1960s-70s, but it has now rolled-over. Stated differently, for 40 years the Fed tilted at the specter of “slack” by periodically slashing interest rates, but that only caused households to ratchet-up their leverage ratios—spending more today by hocking their future.

Accordingly, the Fed was not creating an ether called “aggregate demand” at all. It was simply causing consumer spending to be inflated by the layering of excess credit growth on top of available income. But with the leverage ratio now having just begun its long descent back toward solid ground, the Fed can conjure no ether of demand, but keeps banging the interest rate lever just the same.

The pathos of the Fed’s misbegotten ZIRP is even further evident in the chart below. Just how is it that zero interest rates generate any of that aggregate demand ether when nearly 100% of the gain in borrowing over the last year has gone to student debt serfs and sub-prime auto borrowers who will be underwater on their loans before the first payment is due?

At the same time, mortgage credit is not expanding, and appropriately so since its still stands at a 2-3X it historically ratio to wage and salary income. The only exception is a small pocket of jumbo loans to affluent homebuyers and a recent surge in floating rate home equity lines to upper income households. But do the latter really need ZIRP to fund another junket to the Caribbean? The fact is, the household credit channel is broken and done. Still, Yellen lip-syncs Tobin’s tired old slack song.

Then there is the public sector. But my heavens—do politicians need to be told for yet another year that they can push the treasury’s mountain of outstanding debt closer and closer to the front end of the curve where it will cost nothing? In fact, the Bernanke-Yellen Fed has become the great enabler of deficit finance by making the carry cost of the Federal debt so pitifully and artificially cheap that politicians have no choice except to go along for the ride. The Fed has effectively seized control of fiscal policy through the backdoor of ZIRP and QE.

The obvious point is that there is no rational economic justification whatsoever for 68 months of ZIRP. It is completely owing to an atavistic attachment to bathtub economics. It represents the triumph of pseudo-science over reason and history. It embodies a model based on aggregates, arithmetic and algorithms rather than the sound economics of prices, choices and markets.

And that gets us to Yellen’s insensible and terrifying case of bubble blindness. Actually, she belongs to the camp of the bubble mute as well, insisting on the phrase “asset value misalignment”. But the essence of Yellen’s startling obliviousness to the bubbles all around her goes all the way back to Tobin’s easy money teachings.

In short, when it comes to interest rates, Tobin did not teach economics; he lectured about monetary plumbing. Under bathtub economics, the Federal funds rate is a dumb plumbing control—-the pavlovian lever you pull when you want more aggregate demand. But here’s a news flash. Its actually the smartest thing in the financial firmament—that is, its the price of hot money.

Indeed, its the most important single price in all of capitalism because it regulates the protean and combustible force of speculation—that is, the deeply embedded human instinct to chase something for nothing if given half the chance. Accordingly, the very last lever the Fed should toy with is the price of money; and the very last economic precinct it should try to “stimulate” is the money markets of Wall Street. That’s where the demons and furies of short-run, lightening fast financial speculation lurk, work and mount their momentum trading campaigns—ripping, dipping and re-ripping as they go.

Stated differently, the Federal funds rate is the price of trading risk—the regulator that drives the carry trades. It is the mechanism by which credit is expanded in the Wall Street gambling channel through the process of re-hypothecation. When the funds rate is ultra low for ultra long it massively expands the carry trades. That is, any financial asset with a yield or short-run appreciation potential gets leveraged one way or another through repo, options or structured trades—- because re-hypothecation produces a large profit spread from a tiny sliver of equity.

Needless to say, the massive carry trades minted in the Fed’s Wall Street gambling channel are a deep and dangerous deformation of capitalism. In money markets that are not pegged by the central banking branch of the state, outbreaks of fevered speculation drive short-term market rates skyward in order to induce more true savings from the market or choke off demand for funds. The money market rate is therefore the economic cop which keeps the casino in check.

Accordingly, the carry trade profit spread can go from positive to negative quickly and drastically, meaning that there are always two-way markets in the underlying financial assets. There is no shooting fish in a barrel full of free money. There are no hedge fund hotels where carry-traders can drive in-the-money strike prices higher and higher because premiums are dirt cheap.

Needless to say, the Fed’s 30-year encampment in the heart of the money markets has destroyed them; it has turned price discovery into the primitive, computerized act of red-green-and-orange-lining the Fed’s latest meeting statement to see which word, tense or adjective has changed.

At the end of the day, the Fed has been implanted in the money markets for so long that it does not even recognize it own handiwork. The speculative disorders and financial bubbles which are the inherent results of its interest rate pegging are seen as exogenous forces which emanate from almost any place on the planet except the Eccles Building. And even if some ultimate responsibility is acknowledged as to errors inside the great house of monetary central planning it’s always put off to failures on its regulatory and supervisory desks, and always after the fact.

So the bonehead bureaucrats like James Bullard who have come to populate the Fed like to blather on with gibberish such as the proposition that bubbles are “obvious” but none are ever identified until after they burst. In this spirit, Yellen yesterday took the monetary central planner’s 5th amendment:

“broad metrics don’t suggest we are in obviously bubble territory.”

These are the words of a Tobin acolyte— a trained monetary plumber. The reference to “broad metrics” is self-evidently the forward PE ratio on the S&P 500. But the leading edge of the market does not lie in the blue chips—it builds in the outer rings of speculation such as the Russell 2000, the junk credit universe and the global EM sector.

Yellen has no clue about markets, carry trades and the dynamics of the treacherous Wall Street gambling channel where she keeps banging the fed funds lever. She is merely reading from a list of bromides provided by the Fed staff.

But it’s a fact that margin debt is at an all-time high—both in dollars and as a percent of GDP where it currently tops out at 2.73% compared to 2.66% in March 2000. Might not this have something to do with the Russell 2000 having recently traded at 100X reported earnings; or the fact that it had risen from 350 in early 2009 to 1200—that is, by 250%—in the context of the most tepid recovery in the recorded history of the Main Street economy where most of these small caps function.