By Tyler Durden at ZeroHedge

April 15 comes and goes but the federal debt stays and grows. The secrets of its life force are the topics at hand— that and some guesswork about how the upsurge in financial leverage, private and public alike, may bear on the value of the dollar and on the course of monetary affairs. Skipping down to the bottom line, we judge that the government’s money is a short sale.

Diminishing returns is the essential problem of the debt: Past a certain level of encumbrance, a marginal dollar of borrowing loses its punch. There’s a moral dimension to the problem as well. There would be less debt if people were more angelic. Non-angels, the taxpayers underpay, the bureaucrats over-remit and everyone averts his gaze from the looming titanic cost of future medical entitlements. Topping it all is 21st-century monetary policy, which fosters the credit formation that leads to the debt dead end. The debt dead end may, in fact, be upon us now. A monetary dead end could follow.

As to sin, Americans surrender, in full and on time, 83% of what they owe, according to the IRS—or they did between the years 2001 and 2006, the latest period for which America’s most popular federal agency has sifted data. In 2006, the IRS reckons, American filers, both individuals and corporations, paid $450 billion less than they owed. They underreported $376 billion, underpaid $46 billion and kept mum about (“nonfiled”) $28 billion. Recoveries, through late payments or enforcement actions, reduced that gross deficiency to a net “tax gap” of $385 billion.

This was in 2006, when federal tax receipts footed to $2.31 trillion. Ten years later, the U.S. tax take is expected to reach $3.12 trillion. Proportionally, the 2006 gross tax gap would translate to $607.7 billion, and the net tax gap to $520 billion. To be on the conservative side, let us fix the 2016 net tax gap at $500 billion.

Then there’s squandermania. According to the Government Accountability Office, the federal monolith “misdirected” $124.7 billion in fiscal 2014, up from $105.8 billion in fiscal 2013. Medicare, Medicaid and earnedincome tax credits accounted for 75% of the misspent funds—i.e., of those wasted payments to which government bureaus confessed. “[F]or fiscal year 2014,” the GAO relates, “two federal agencies did not report improper payment estimates for four risk-susceptible programs and five programs with improper payment estimates greater than $1 billion were noncompliant with federal requirements for three consecutive years.” It seems fair to conclude that more than $125 will go missing in fiscal 2016.

Add the misdirected $125 billion to the unpaid $500 billion, and you arrive at a sum of money that far exceeds the projected fiscal 2016 deficit of $534 billion.

Which brings us to intergenerational self-deception. The fiscal outlook would remain troubled even if the taxpayers paid in full and the bureaucrats stopped wiring income-tax refunds to phishers from Nigeria. Not even a step-up in the current trudging pace of economic growth would put right the long-term fiscal imbalance. So-called non-discretionary spending, chiefly on Medicare, Medicaid and the Affordable Care Act, is the beating heart of the public debt. It puts even the welladvertised problems of Social Security in the shade.

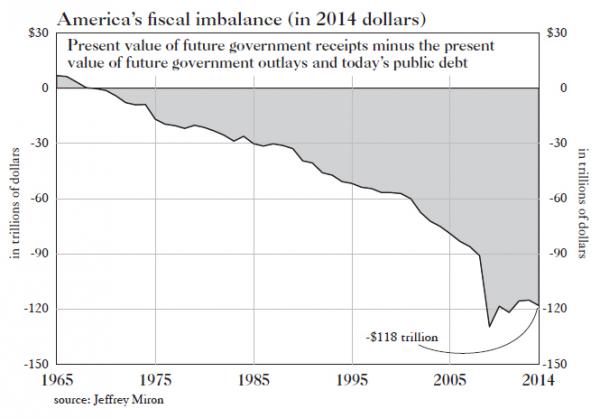

Fiscal balance is the 3D approach to public-finance accounting. It compares the net present value of what the government expects to spend versus the net present value of what the government expects to take in. It’s a measure of today’s debt plus the present value of the debt that will pile up if federal policies remain the same. To come up with an estimate of balance or—as is relevant today, imbalance—you make lots of assumptions about life in America over the next 75 years. Critical, especially, is the interest rate at which you discount future streams of outlay and intake. Jeffrey Miron has performed these fascinating calculations over the span from 1965 to 2014.

The director of economic studies at the Cato Institute and the director of undergraduate studies in the Harvard University economics department, Miron has projected that, over the next 75 years, the government will take in $152.5 trillion and pay out $252.7 trillion —each discounted by an assumed 3.22% average real rate of interest. Add the gross federal debt outstanding in 2014, and—voila!—he has his figure: a fiscal imbalance on the order of $120 trillion. Compare and contrast today’s net debt of $13.9 trillion, GDP of $18.2 trillion, gross debt of $19.2 trillion and household net worth of $86.8 trillion. Compare and contrast, too, the estimated present value of 75 years’ worth of American GDP. Miron ventures that $120 trillion represents something more than 5% of that gargantuan concept.

There’s nothing so exotic about the idea of fiscal balance. In calculating the familiar-looking projection of debt relative to GDP, the Congressional Budget Office uses assumed rates of growth in spending and revenue, which it also discounts by an assumed rate of interest. It’s fiscal-balance calculus by another name, as Miron notes.

Nor is the fiscal-balance idea very new. Laurence J. Kotlikoff, now a chaired professor of economics at Boston University, has been writing about it at least since 1986, when he shocked the then deficit-obsessed American intelligentsia with the contention that the federal deficit is a semantic construct, not an economic one. This is so, said he, because the size of the deficit is a function of the labels which the government arbitrarily attaches to such everyday concepts as receipts and outlays. Thus, the receipts called “taxes” lower the deficit, whereas receipts called “borrowing” raise it. The dollars are the same; only the classification is different.

Be that as it may, Miron observes that the deficit and the debt tell nothing about the fiscal future. Each is backward-looking. “The debt,” he points out, “. . . takes no account of what current policy implies for future expenditures or revenue. Any surplus reduces the debt, and any deficit increases the debt, regardless of whether that deficit or surplus consists of high expenditure and high revenues or low expenditure and low revenues. Similarly, whether a given ratio of debt to output is problematic depends on an economy’s growth prospects.”

Step back in time to 2007, Miron beckons. In that year before the flood, European ratios of debt to GDP varied widely, even among the soon-to-be crisis-ridden PIIGS. Greece’s ratio stood at 112.8% and Italy’s at 110.6%, though Ireland’s weighed in at just 27.5%, Spain’s at 41.7% and Portugal’s at 78.1% (not very different from America’s 75.7%). “These examples do not mean that debt plays no role in fiscal imbalance,” Miron says, “but they illustrate that debt is only one component of the complete picture and therefore a noisy predictor of fiscal difficulties.”

So promises to pay, rather than previously incurred indebtedness, tell the tale. Social Security, a creation of the New Deal, did no irretrievable damage to the intergenerational balance sheet. It was the Great Society that turned the black ink red. Prior to 1965, the United States, while it had run up plenty of debts related to war or—in the 1930s—depression, never veered far from fiscal balance. Then came the Johnson administration with its guns and butter and Medicare and Medicaid. From a fiscal balance of $6.9 trillion in 1965, this country has arrived at the previously cited $120 trillion imbalance recorded in 2014. And there are “few signs of improvement,” Miron adds, “even if GDP growth accelerates or tax revenues increase relative to historic norms. Thus, the only viable way to restore fiscal balance is to scale back mandatory spending policies, particularly on large health-care programs such as Medicare, Medicaid and the Affordable Care Act.”

We asked Miron about the predictive value of these data. Could you tell that Greece was on the verge by examining its fiscal imbalance? And might not Japan be the tripwire to any future developed-country debt crisis, since Japan—surely—has the most adverse debt, demographic and entitlement spending profile? Miron replied that comparative statistics on fiscal imbalance among the various OECD countries don’t exist. And even if they did, it’s not clear that they would tell when a certain country would lose the confidence of its possibly inattentive creditors. The important thing to bear in mind, he winds up, is that the imbalances— not just in America or Japan or Greece but throughout the developed world—are “very big and very bad.”

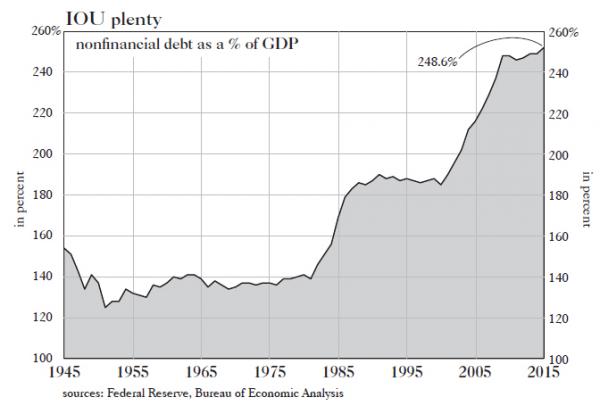

Of course, government debt is only one flavor of nonfinancial encumbrance. The debt of households, businesses and state and local governments complete the medley of America’s nonfinancial liabilities. The total grew in 2015 by $1.9 trillion, which the nominal GDP grew by $549 billion. In other words, we Americans borrowed $3.46 to generate a dollar of GDP growth.

We have not always had to work the national balance sheet so hard. The marginal efficiency of debt has fallen as the growth in borrowing has accelerated. Thus, at year end, the ratio of nonfinancial debt to GDP reached a record high 248.6%, up from 245.4% in 2014 and from the previous record of 245.5% set in 2009. In the long sweep of things, these are highly elevated numbers.

In the not-quite half century between 1952 and 2000, $1.70 of nonfinancial borrowing sufficed to generate a dollar of GDP growth. Since 2000, $3.30 of such borrowing was the horsepower behind the same amount of growth. Which suggests, conclude Van Hoisington and Lacy Hunt in their first-quarter report to the clients of Hoisington Investment Management Co., “that the type and efficiency of the new debt is increasingly nonproductive.”

What constitutes a “nonproductive” debt? Borrowing to maintain a fig leaf of actuarial solvency would seem to fill the bill. Steven Malanga, who writes for the Manhattan Institute, reports that state and municipal pension funds boosted their indebtedness to at least $1 trillion from $233 billion between 2003 and 2013. Yet, Malanga observes, “All but a handful of state systems have higher unfunded liabilities today than in 2003.”

Neither does recent business borrowing obviously answer the definition of productive. To quote the Hoisington letter:“Last year business debt, excluding off-balance-sheet liabilities, rose $793 billion, while total gross private domestic investment (which includes fixed and inventory investment) rose only $93 billion. Thus, by inference, this debt increase went into share buybacks, dividend increases and other financial endeavors, [although] corporate cash flow declined by $224 billion. When business debt is allocated to financial operations, it does not generate an income stream to meet interest and repayment requirements. Such a usage of debt does not support economic growth, employment, higherpaying jobs or productivity growth.”

The readers of Grant’s would think less of a company that generated its growth by bloating its balance sheet. The composite American enterprise would seem to answer that unwanted description. Debt of all kinds—financial and foreign as well as nonfinancial— leapt by $1.97 trillion last year, or by $1.4 trillion more than the growth in nominal GDP; the ratio of total debt (excluding off-balance-sheet liabilities) to GDP squirted to 370%.

The United States is far from the most overextended nation on earth. Last year, Japan showed a ratio of total debt (again, excluding off-balancesheet items) to GDP of 615%; China and the eurozone, ratios of 350% and 457%. Hoisington and Hunt, who dug up the data, posit that overleverage spells subpar growth. In support of this proposition (a familiar one in the academic literature), they observe thataggregate nominal GDP growth for the four debtors rose by just 3.6% in 2015. It was the weakest showing since 1999 except for the red-letter year of 2009.

The now orthodox reaction to substandard growth is hyperactive monetary policy. Yet the more the central bankers attempt, the less they seem to accomplish. ZIRP and QE may raise asset prices and P/E ratios, but growth remains anemic. What’s wrong?

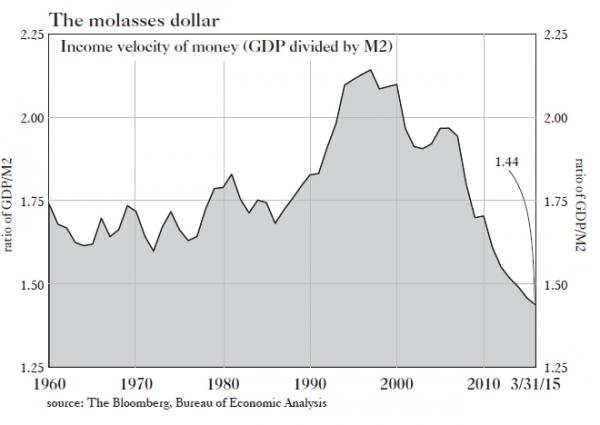

Debt is wrong, we and Hoisington and Hunt agree. With the greatest of ease do the central bankers whistle new digital money into existence. What they have not so far achieved is the knack of making this scrip move briskly from hand to hand. Among the big four debtors, the rate of monetary turnover, or velocity—“V” to the adepts— has been falling since 1998.

“Functionally, many factors influence V, but the productivity of debt is the key,” Hoisington and Hunt propose. “Money and debt are created simultaneously. If the debt produces a sustaining income stream to repay principal and interest, then velocity will rise because GDP will eventually increase by more than the initial borrowing. If the debt is a mixture of unproductive or counterproductive debt, then V will fall.

Financing consumption does not generate new funds to meet servicing obligations. Thus, falling money growth and velocity are both symptomsof extreme over-indebtedness and nonproductive debt.”

Which is why, perhaps, radical monetary policy seems to beget still more radical monetary policy. Insofar as QE and ultra-low interest rates foster credit formation, they likewise chill growth and depress the velocity of turnover in money. What then? Why, policies still newer, zippier, zanier.

Ben S. Bernanke, the former Fed chairman turned capital-introduction professional for Pimco, keeps his hand in the policy-making game with periodic blog posts. He’s out with a new one about “helicopter money,” the phrase connoting the idea that, in a deflationary crisis, the government could drop currency from the skies to promote rising prices and brisker spending. Attempting to put the American mind at ease, Bernanke assures his readers that, while there will be no need for such a gambit in “the foreseeable future,” the Fed could easily implement a “money-financed fiscal program” in the hour of need.

No helicopters would be necessary, of course, Bernanke continues. Let the Fed simply top off the Treasury’s checking account—filling it with new digital scrip. The funds would not constitute debt; they would be more like agift. Or the Fed might accept the Treasury’s IOU, which it would hold “indefinitely,” as Bernanke puts it, rebating any interest received—a kind of zero coupon perpetual security. The Treasury would then spread the wealth by making vital public investments, filling potholes and whatnot. The key, notes Bernanke, is that such outlays would be “money-financed, not debt-financed.” The “appealing aspect of an MFFP,” says he, “is that it should influence the economy through a number of channels, making it extremely likely to be effective—even if existing government debt is already high and/or interest rates are zero or negative [the italics are his].”

Thus, the thought processes of Janet Yellen’s predecessor. Reading him, we are struck, as ever, by his clinical detachment. Does the deployment of helicopter money not entail some meaningful risk of the loss of confidence in a currency that is, after all, undefined, uncollateralized and infinitely replicable at exactly zero cost? Might trust be shattered by the visible act of infusing the government with invisible monetary pixels and by the subsequent exchange of those images for real goods and services? The former Fed chairman seems not to consider the question— certainly, he doesn’t address it.

To us, it is the great question. Pondering it, as we say, we are bearish on the money of overextended governments. We are bullish on the alternatives enumerated in the Periodic table. It would be nice to know when the rest of the world will come around to the gold-friendly view that central bankers have lost their marbles. We have no such timetable. The road to confetti is long and winding.