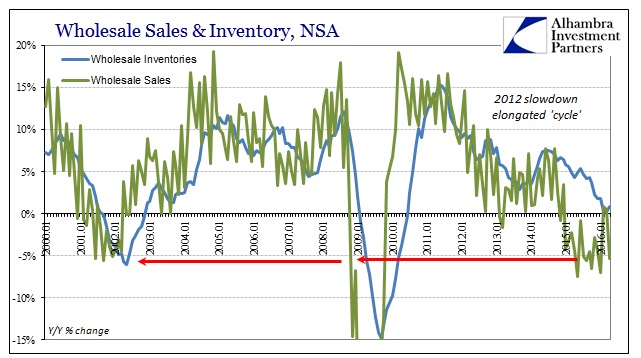

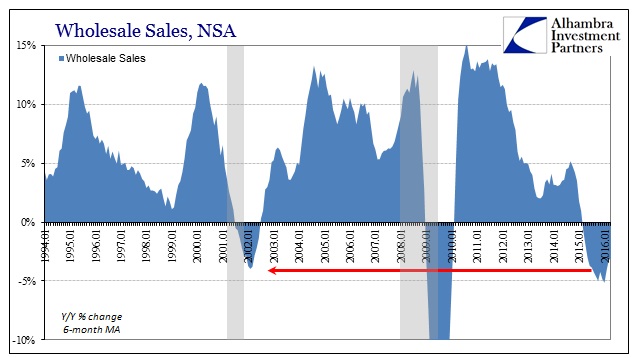

Wholesales sales are right back on track again after two months of being affected by the calendar. After rising 0.8% in February and 0.6% in March, sales declined by 5.3% Y/Y in April. For the first four months of the year combined, wholesale sales were down nearly 3% compared to the first four months of last year. Since sales in 2015 were lower than 2014, that leaves cumulative sales year-to-date in 2016 6.2% below the same period in 2014 – the year when there was so much fuss and bother over the winter of the Polar Vortex. It never was the snow, though I doubt we will see any retractions and corrections.

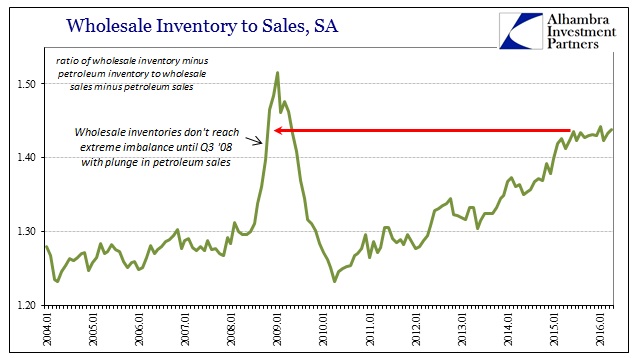

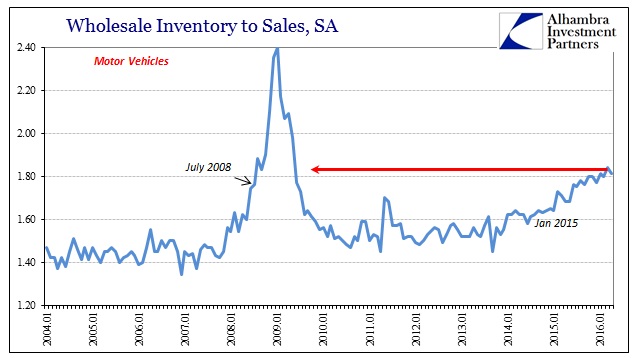

Wholesale inventories were up very modestly, rising less than 1% Y/Y for the third straight month. Petroleum inventories were up also only slightly, meaning that the inventory-to-sales ratio on the wholesale level not including oil rose again to the second highest point of this “recovery” (behind only January).

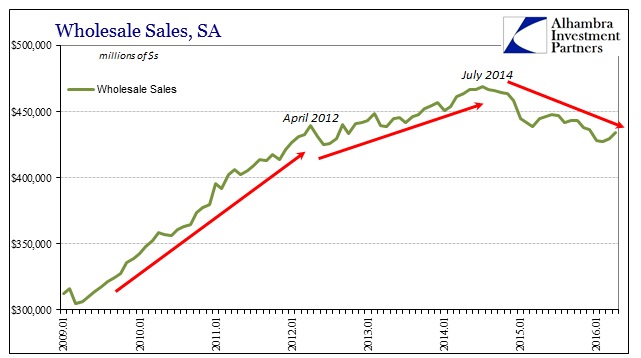

Seasonally-adjusted, wholesale sales were up 1% month-over-month in April, the second straight monthly gain. Despite that monthly variation, wholesale sales were more than 7% below the prior peak in the middle of 2014. That marks the 21st month of general and uneven decline, almost double the calendar length of the dot-com recession and of greater magnitude. The contraction in wholesale sales during the Great Recession lasted only nine months.

The level of seasonally-adjusted wholesale sales in April 2016 was only slightly more than March 2012 at the start of the slowdown.

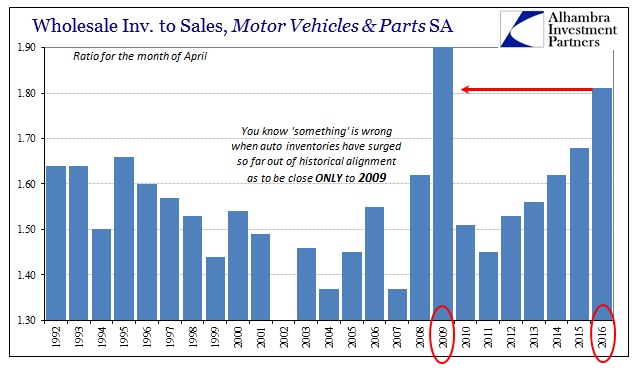

The inventory imbalance in the auto and motor vehicle segment improved in this update, but that wasn’t a significant change. The inventory-to-sales ratio in March was revised higher to 1.84, seasonally-adjusted, while the first estimate for April was 1.81. Compared to the 1.68 calculation for April 2015, however, that still indicates massive imbalance as overall motor vehicle sales slowed considerably as the “dollar” created “global turmoil.” We can only expect further impact on production at that level (or anything above 1.70).

There is a good chance that further revisions will alter the picture (recessionary) of the wholesale level of the supply chain at some point, but until then the data suggests exactly the same slow decline that has been at work for almost two years now. Economists and the media were unwise to dismiss the Polar Vortex economy of early 2014 as a weather anomaly since it is clear now, just as it was then, that the instability exhibited at that time was actually of great significance for the economy rather than precipitation and temperature. With time and now nearly two years of contraction, it is painfully obvious what that episode was – the economic warning set between the first financial upset in 2013 and the “rising dollar” that began in summer 2014.

The problem is as noted yesterday, that the mainstream media and economists (redundant) only offer a binary economic model. The economy to them is only in recession or expanding; and if it is not clearly recession then in orthodox terms it can only be expansion. The Polar Vortex under those terms would not be anything but an aberration because it wasn’t recession, and so economists were unprepared for the persistent weakness that never was “unexpected.” I wrote in April 2014:

An economy that is actually accelerating will show it conclusively across numerous and disparate economic accounts and estimates. And it will be fully insulated from snow and winter. A real recovery will not be bothered or interrupted because of a Polar Vortex, though it does offer very convenient cover to what is an obvious and durable downslope.

The unevenness of the decline is the primary issue with visibility and clarity of interpretation. Because it hasn’t been all at once, the orthodox convention forces everything into the expansion category at the expense of appreciating that warning for what it was. With only more contraction leading to more questions now, including the state of the labor market, suddenly 2016 is the first winter in many without so much meteorology despite the supersized El Nino.