The Ricardian theory of free trade has dominated economics philosophy for good reason. It has a sound basis in common sense and offers a theoretical guide to understand the nature of exchange from a systemic standpoint. It does not, however, cover all such basis for all such manner of trade. Comparative advantage is somewhat straightforward where nations exchange goods, but what happens when the advantage is not goods but finance?

This question applies especially to the world under the eurodollar standard because credit-based currency follows far different rules of the game. Until 2007, that didn’t seem to matter because “dollars” flowed freely and made the world look as if it had found enduring prosperity through free trade. This other side of the eurodollar divide, however, increasingly reveals that goods for “dollars” trade was never free, nor did it benefit anyone outside of the money sector (so long as eurodollar banks would be made whole by TBTF).

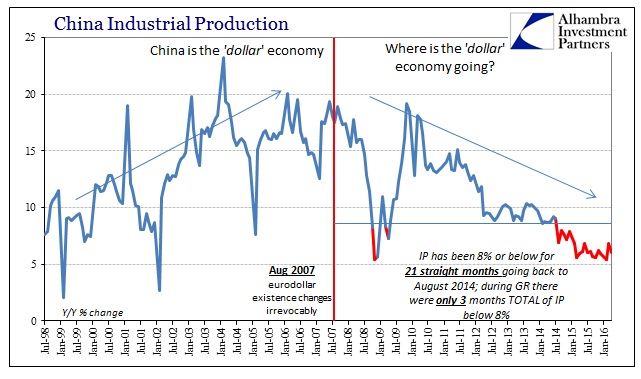

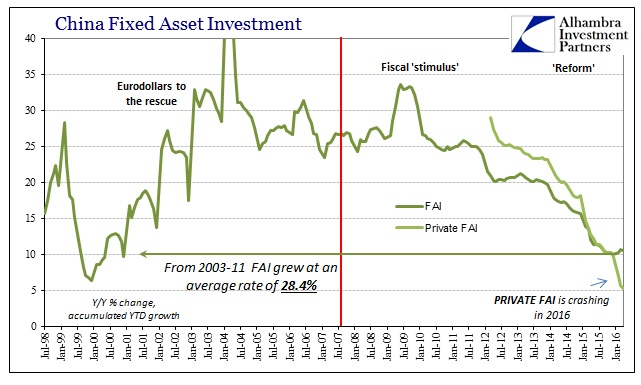

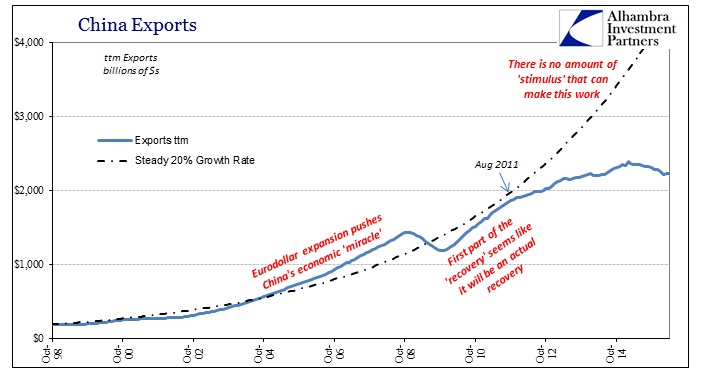

These longer-term shifts are much harder to appreciate when everything is supposed to be condensed into at most a single business cycle. China is a perfect example of that not just from the perspective of the prosperity illusion, but in how their own redistributive connection to the “dollar short” transforms others. For its own part, its economic “miracle” only continues to unwind as the growth of the 2000’s comes apart and leaves the country with only debt, not created wealth. Because of this internal/external imbalance of the credit-based eurodollar (and the PBOC’s first policies to get out of the Great Recession), the Chinese have plied the rest of the world in search of them – or better.

Africa has been a particularly friendly target for goods-for-finance trade. Chinese firms, especially state-owned companies, have lent billions to African nations (and their businesses) largely to obtain oil rights. This is, again, not free trade as China is not opening its domestic “demand” to anything more than one commodity even though for its part the country obtains growing trade ties for its own manufacturing. The comparative advantage is not productive but financial.

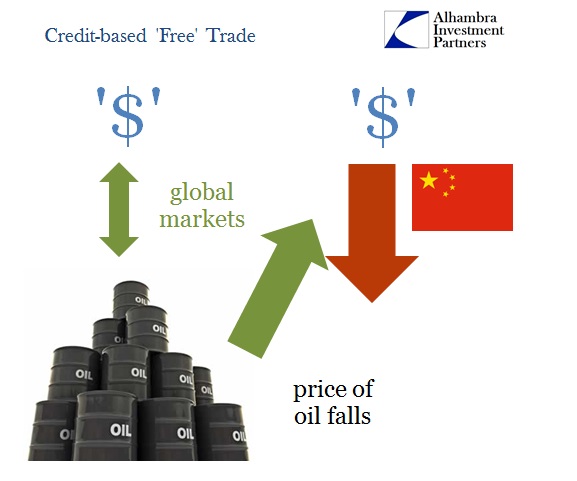

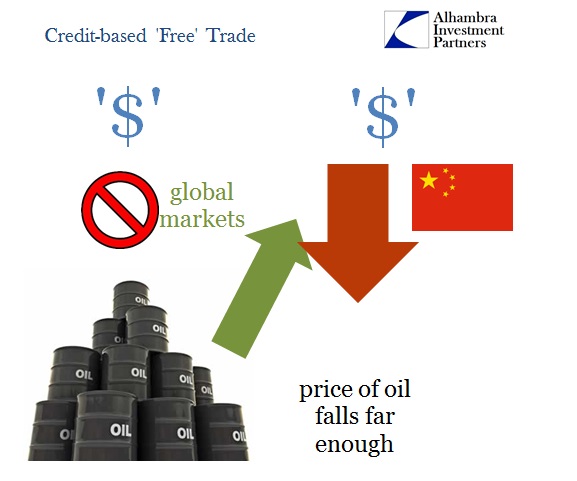

African oil producers typically source “dollars” selling oil, allowing them to participate in global markets via the eurodollar in order import products (including food) that they don’t produce themselves. In the past few years, however, the “windfall” of higher oil prices has led to an increase in supplemental credit-based “dollars” from China as everyone assumed the good times would only last. In exchange for allowing more Chinese imports, the oil producer only obtains another source of international funds. Worse, this alternate source comes in the form of a noose.

In effect, these nations have pledged their oil resources as collateral for those borrowed “dollars.” If the price of oil falls, more production has to be steered toward repayment of past currency lines, which has the doubly devastating effect of reducing the amount of oil available for open sale to further obtain “dollars” (at already reduced prices). It is a direct currency strangulation that if taken too far can lead to total “dollar” exorcise.

The Chinese are repaid in oil for their comparative financial advantage leaving the “host” nation drastically impoverished and facing both grave recession at the same time as monetary strangulation. There was already boiling shortages all across Africa last year, starting in Africa’s largest oil producer Angola:

When a halving of oil prices left a gaping hole in Angola’s finances this year, it became clear sub-Saharan Africa’s third largest economy needed help fast – and President Jose Eduardo dos Santos knew exactly where to turn.

But the multi-billion dollar loans he signed with China last month have angered Angolans who say they have been left behind as politicians and China share the spoils and Africa’s second-largest oil producer becomes ever more reliant on Beijing.

China has lent Angola around $20 billion since a 27-year civil war ended in 2002, according to Reuters estimates.

Repayments are often paid with oil or funds go directly to Chinese construction firms that have built roads, hospitals, houses and railways across the southern African country.

This means, however, dollars don’t end up entering the real economy, increasing costs for ordinary Angolans.

In response, the Central Bank of Angola has no choice but raise interest rates to contain the deafening “dollar” shortage in the real economy that pushes down the exchange value of the kwanza and leads to spiraling consumer prices. With drought hitting southern Africa, supermarkets have to ration food because there are no “dollars” with which to import it and nobody willing to take kwanza with it facing only further devaluation. The situation has deteriorated such that almost all oil output will be heading to China, leaving none left for Angola to source any international currency (RMB doesn’t count).

Angola, Africa’s largest oil producer has borrowed as much as $25 billion from China since 2010, including about $5 billion last December, forcing its state oil firm to channel almost its entire oil output toward debt repayments this year.

This year Angola, Nigeria, Iraq, Venezuela and Kurdistan are due to repay a total of between $30 billion and $50 billion with oil, according to Reuters calculations based on publicly disclosed information and details given by participants in ongoing restructuring talks.

On its end, China had been obtaining not just oil but collateral for “dollars” all along. As I wrote last month when Nigeria coincidentally hammered out an RMB swap in Beijing, the focus wasn’t free trade or even trade, it was very likely financial.

There is also another angle to consider, one which does not even require any infrastructure commitments or expenses to move oil to China from Nigeria. The Chinese could, if pressed, purchase Nigerian oil on their own RMB terms and then immediately sell it in global markets where it already likely exists. In return for those sales, the Chinese would receive dollars, effectively converting RMB to dollars via what was really Nigerian collateral (in theory, the Chinese could just use the oil as dollar collateral, too, after having purchased it via RMB).

Nigeria, for its end, would get yuan but the country still needs more dollars and now they may have just shut off one avenue of flexibility with regard to their own dollar short (which is more of the mercantile, traditional variety).

The Chinese get not just “dollar” collateral which can be mobilized quite easily, they also reduce their own short “dollar” footprint by bringing in oil that they now don’t have to buy on global markets. They have, in fact, turned a virtual currency into a real commodity by pawning it off on those more desperate for it. In other words, they conjured “dollars” that they themselves don’t really have so that they could position trade factors financially in their favor. Under a gold standard, they would have lent Nigeria (or Angola) gold and been repaid in gold assuming that they had done it all; that is the difference, under a gold standard the Chinese could not so easily just summon “money” with which to lend Nigeria or Angola in the first place. From that perspective, the eurodollar is like a highly contagious virus with a long incubation period. Everybody just creates “dollar” IOU’s and spreads them everywhere, leaving behind the contamination of now being “short.”

Under credit-based eurodollars, the Chinese lend Africa virtual numbers and get back all their oil. It is a much different result than one run by physical money and currency because there is really no value in the financial trade components (you may not be able to eat gold, but you can’t even define a eurodollar other than to know you really need it). That seems to be the biggest change, not just in financial factors becoming dominant but how that manifests into these sorts of processes. It is, in the purest sense, as if the Chinese have figured out how to exercise convertibility in a phantom currency without any such inherent aspect because they know all-too-well what “dollar” runs mean. It gives new and far more appropriate meaning to the term “petrodollar.”

It is nothing like free trade even though it appears the Chinese are “winning” in their dealings with Africa because they are themselves being strangled by industrial capacity built to service a “dollar” economy that no longer exists. In Ricardian free trade, everyone wins and benefits. In credit-based money, nobody does though it usually takes the long run to see it. Somebody let Mr. Keynes know.