With new figures on Japan’s GDP released, it is becoming increasingly clear the disparity between what is supposed to happen and what has actually taken place. The main operative theory by which everything has been supported takes “aggregate demand” literally; in that all demand is essentially a perfect substitute for itself. In other words, monetary theory posits that demand of any type is the same as demand that might take place organically, thus “creating” demand through any means is preferable to allowing markets their creative destruction.

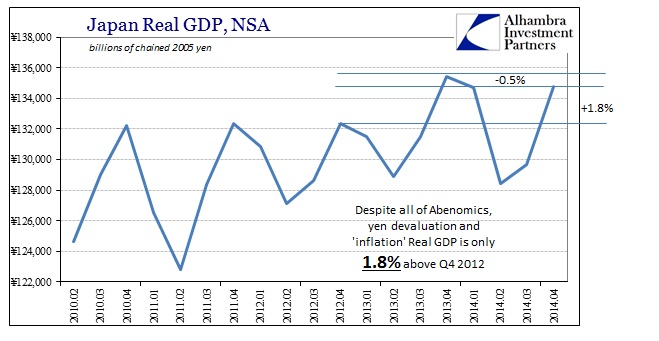

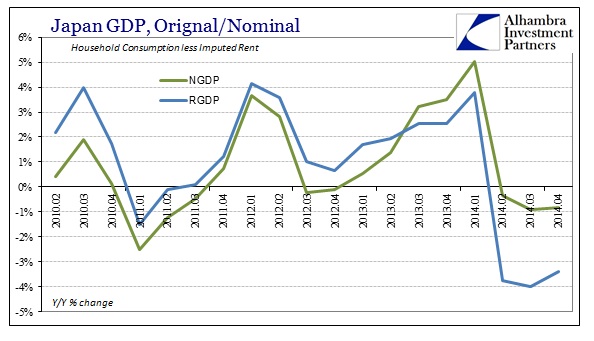

That redistribution emphasizes the transactional nature of statistics like GDP. As long as a transaction takes place, orthodox theory counts it as a success. The accumulation of transactions is thus believed a full and comprehensive economy. Yet for all the redistribution, by repression no less, Japan is just as far from “recovery” as when the process began.

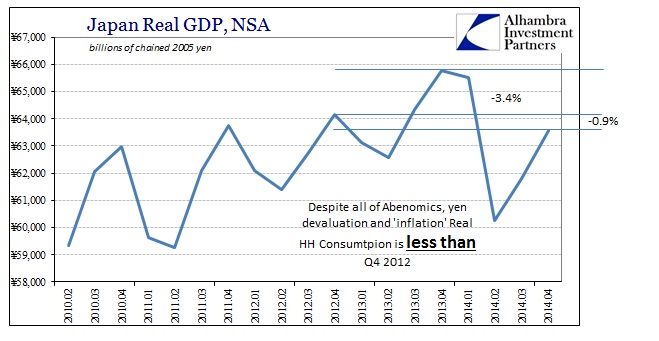

However, in terms of actual households, the Japanese economy has run backwards by comparison.

The difference between them is redistribution benefiting some parts of the economy at the obvious and direct expense of Japanese households. Again, mainstream monetary theory intends for that, only for that to be a temporary backward step erased under the “strong economy” (Bernanke’s favored phrasing of this picking “winners”) that they expect will follow. For Japan it has been almost two full years, so the idea of households being “temporary” “losers” is harder to swallow.

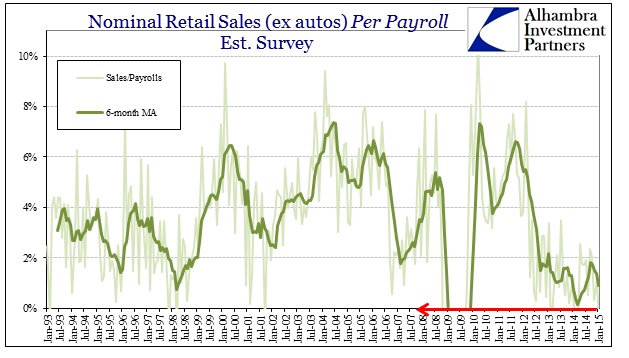

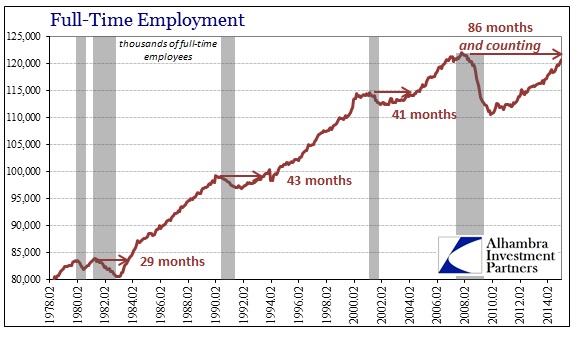

Unfortunately, this same disparity shows up everywhere else monetarism has been so practiced. That includes the “cleanest dirty shirt”, the United States, where central planning of this kind has left even economists bewildered by a seeming dichotomy of so many jobs that lead to depression-levels of spending (as this has gone on for almost three years now).

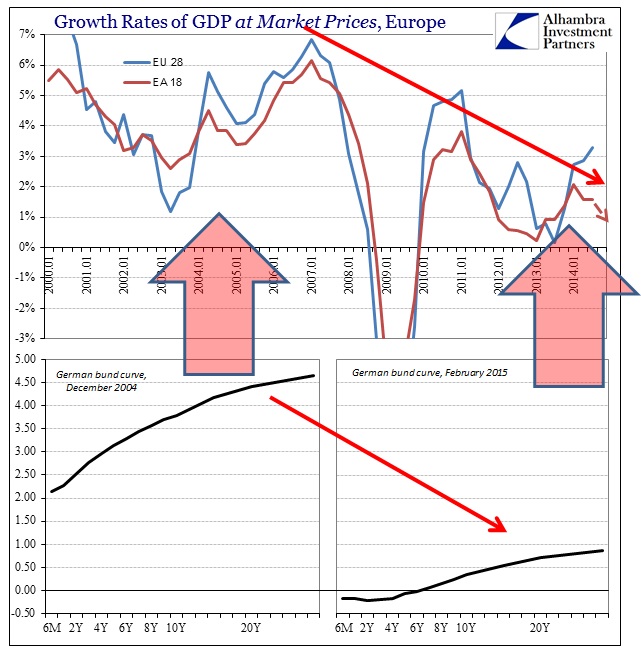

From a larger perspective, even GDP has been severely strained in direct correlation where monetary intrusion has been most severe. In other words, the more central banks do the less the real economy seems to gain. To Europe now:

Central bankers and orthodox economists will argue inverse causation; monetary measures are most severe because the economy is at its weakest. The problem with that view is that none of it ever seems to work – to this point not one central bank can say that it has established a full track of recovery despite massive, massive “stimulus.” Even the Federal Reserve, if actually pressed into reality, would have to concede at least a very large defeat against expectations:

In order to preserve the theory while at least recognizing this ugly reality, orthodox economics has conjured the idea of secular stagnation to “explain” why monetarism hasn’t led to full (or even partial) effect. They really intend that there is something wrong with you and me, the economy, rather than the monetary prescriptions that have been so heavily and repeatedly applied. Given that this disparity runs to every locale where central banks have been conspicuously in action only tempers the idea of secular stagnation, as the commonality cannot be distinctly economic where it can surely be tersely monetary.

The idea of secular stagnation may be somewhat acceptable in isolation (even then doubtful), but a global secular stagnation is just plain and outright silly. Not only would Occam’s Razor suggest the far more fundamental intrusion, the fact that redistribution is itself a negative factor might lead to an intuitive expectation whereby the preponderance of negative factors leads to only negative consequences. The fact that GDP can advance where households at best stagnates illustrates this point – that the long-decried “inequality” traces back to central banks using redistribution to pick “winners” and “losers.”

This socialization of economic function leads to the same dysfunction of inefficiency that inhabits every facet so-socialized. Economic and monetary ritual expects that “aggregate demand” is real, but empirical reality shows it is just a fantasy. Unfortunately, the consequences are very real where “recovery” is still, seven and a half years later, being debated. You cannot create an economy out of a preponderance of negative factors, but that is all that is being done in the name of “recovery.” With so much time passed and so little progress to show, “they” are now deciding which negative factor to recycle next, as if redoing past mistakes will somehow lead where nothing has so far.

Inside the capsule of monetarism as it exists now, the idea of redistribution makes sense because scarcity is the dominant regime. Reworking orientation to wealth leads to the conclusion that redistribution is insanity with official imprimatur – you cannot create wealth by official sanction of theft, to one designated “winner” from one designated “loser.” The transaction is paramount under redistribution, whereas in a real economy the transaction itself is incidental.

The attitudes about “money” in the current age largely parallel those thoughts. Samuelson’s contribution was to suggest and institutionalize, perhaps not intentionally and certainly not without aid from many others, that wealth was incidental and that businesses operate solely on the basis of transactions. That was the entire idea of “aggregate demand” in that everything is interchangeable, so why not encapsulate it into actionable theory and prescription. The unfortunate part, and the lesson that won’t stay “learned”, is that business is susceptible to the ideas of monetarism and Phillips Curves in unpredictable ways, largely because businesses that do actually operate on true wealth are simply perplexed at all the continued instability (or hiring lobbyists to best take advantage at everyone else’s cumulative expense). In the capitalist system, profits are the ultimate arbitration of activity, so disruption there is playing with fire.

Somebody is indeed “winning” somewhere, but it is not households in Japan, Europe or the United States. Modern economics is just not economics by any rational measure. Repeated injury to that definition only highlights the inaccuracy and maybe even misconduct of the attempts so far – how long can continued and obvious impoverishment be sustained before it becomes a more serious matter beyond just blindness to empiricism?