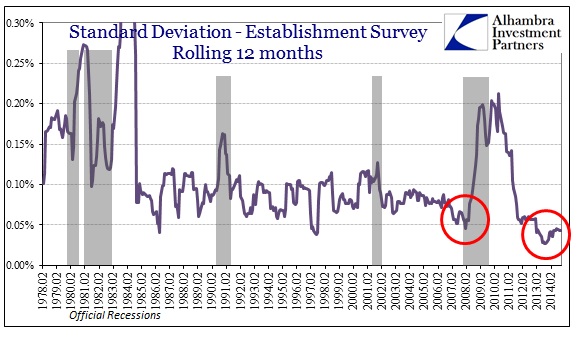

All the parameters we have come to expect from the payroll report were exhibited for October, including “good” numbers all around. Even the Household Survey jumped in October while the Labor Force grew slightly, so for one month volatility in the data was at least favorable. None of that, of course, erases the problems that have been equally durable and visible since October 2012, now more than two full years of trend building. For all the talk of this robust labor market, people still seem curiously reticent to enter it.  Even with a few hundred thousand joining the labor force in October, over those 25 months since the great divergence began only 771k have joined the labor force out of 4.7 million new potential labor members. Worse, the labor force has been essentially unchanged since the snow stopped this year, which is decidedly not what should have taken place if the economy has finally shifted toward that elusive recovery. As with all these labor statistics, there are the curious straight lines and divergences running through them. The Establishment Survey seems to have entered a permanent state of no volatility as if businesses in the US are on some kind of lackluster autopilot.

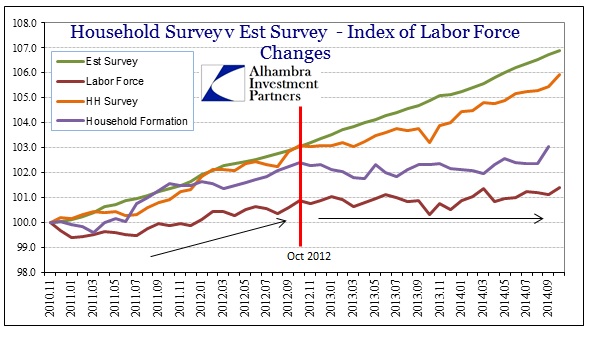

Even with a few hundred thousand joining the labor force in October, over those 25 months since the great divergence began only 771k have joined the labor force out of 4.7 million new potential labor members. Worse, the labor force has been essentially unchanged since the snow stopped this year, which is decidedly not what should have taken place if the economy has finally shifted toward that elusive recovery. As with all these labor statistics, there are the curious straight lines and divergences running through them. The Establishment Survey seems to have entered a permanent state of no volatility as if businesses in the US are on some kind of lackluster autopilot.  Next to the labor force, the number of households offers another potential data point in confirmation of one or the other position. Until a big jump in September, household formation, which should be moving upward in a robust payroll environment, has largely been likewise flat and thus stands out against whatever payroll gains.

Next to the labor force, the number of households offers another potential data point in confirmation of one or the other position. Until a big jump in September, household formation, which should be moving upward in a robust payroll environment, has largely been likewise flat and thus stands out against whatever payroll gains.  With nothing much changed in these factors and figures, it appears as if the 2012 slowdown is still in effect whatever of the Establishment Survey’s direct line to the up and right. Given the timing of all of this, there has been an extra layer of politics added to the narrative. On the one side is the established and dominant narrative of the economist class. To them, the payroll figure with the unemployment rate is established proof of recovery and the “right” direction.

With nothing much changed in these factors and figures, it appears as if the 2012 slowdown is still in effect whatever of the Establishment Survey’s direct line to the up and right. Given the timing of all of this, there has been an extra layer of politics added to the narrative. On the one side is the established and dominant narrative of the economist class. To them, the payroll figure with the unemployment rate is established proof of recovery and the “right” direction.  That just doesn’t match up with the election, pitting statistical figures (and only some of them) against a very real world outcome where even incumbent politicians noticed serious economic disenchantment. From the Washington Post:

That just doesn’t match up with the election, pitting statistical figures (and only some of them) against a very real world outcome where even incumbent politicians noticed serious economic disenchantment. From the Washington Post:

“The exit polls show that candidates like Mark Pryor, Kay Hagan, Bruce Braley and Mark Udall lost by anywhere from large to truly massive margins among non-college whites and older voters. That’s also true of the overall national electorate. You should treat these exit polls with a grain of salt, but the pollsters I spoke to agree that this gets at a fundamental problem Democrats face…. “’We have a huge problem: People do not think the recovery has affected them, and this is particularly true of blue collar white voters,’ [Democratic pollster Celinda] Lake said. ‘What is the Democratic economic platform for guaranteeing a chance at prosperity for everyone? Voters can’t articulate it. In the absence of that, you vote for change.’ “’Our number one imperative for 2016,’ Lake concluded, ‘is to articulate a clear economic vision to get this country going again.’”

As I said of this same analysis elsewhere,

That is more than a little confusing given the nature of stock prices in the US. From those and mainstream economic commentary, there should be no need to “get this country going again” because they say it has been going for the better part of five years, if especially the past two.

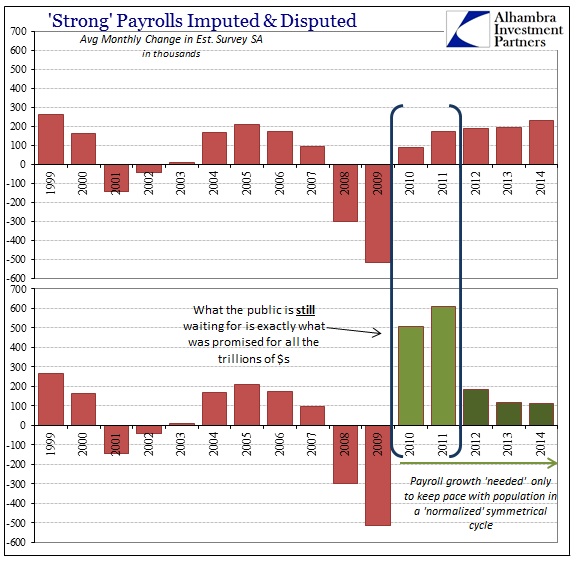

I’ll actually go one step further than the White House’s tweet above and show that, according to the Establishment Survey, this year, so far, has been the “best” year for jobs since 1999.  Now of course these numbers are not normalized to the size of the population, so 229k monthly average is really not all that different than 2005’s 209k, but that doesn’t diminish what economists are trying to say. According to this one figure, alone, jobs are plentiful at a rate not seen since past “boom” periods. Whether or not that “analysis” is intentionally misleading is another matter, even setting aside any questions about the statistic’s validity in the first place (of which there are grave doubts via lack of any corroboration, especially outside of regression-based adjustments, which now includes the latest election). While the track highlighted above might be even satisfactory in a “normal” course, the job losses in 2008 and 2009 are not accounted by the narrative. In other words, even if the economy is actually growing right now it is not nearly “enough.” The lack of recovery is apparent when you normalize to a hypothetical pattern more consistent with an employment rate according to symmetry and past experience. A real recovery would have looked more like this, which is what people have expected all along:

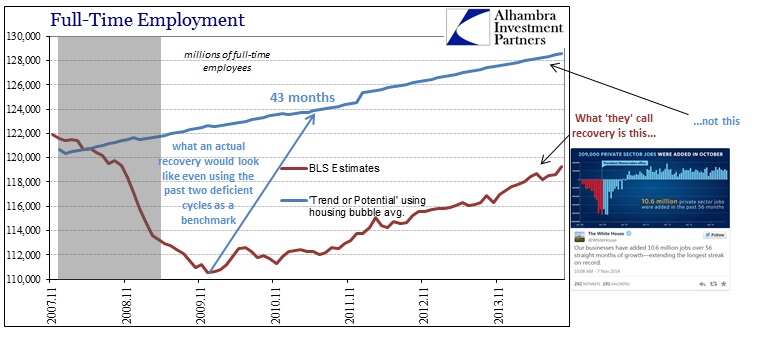

Now of course these numbers are not normalized to the size of the population, so 229k monthly average is really not all that different than 2005’s 209k, but that doesn’t diminish what economists are trying to say. According to this one figure, alone, jobs are plentiful at a rate not seen since past “boom” periods. Whether or not that “analysis” is intentionally misleading is another matter, even setting aside any questions about the statistic’s validity in the first place (of which there are grave doubts via lack of any corroboration, especially outside of regression-based adjustments, which now includes the latest election). While the track highlighted above might be even satisfactory in a “normal” course, the job losses in 2008 and 2009 are not accounted by the narrative. In other words, even if the economy is actually growing right now it is not nearly “enough.” The lack of recovery is apparent when you normalize to a hypothetical pattern more consistent with an employment rate according to symmetry and past experience. A real recovery would have looked more like this, which is what people have expected all along:  The take up out of the Great Recession should have seen a few years of job growth averaging 500k to 600k. Every year since then has been two-thirds short of that, dragging on now for five years. For “some” reason there is no account for the size of the decline in mainstream commentary, but that is the exact dissatisfaction that is ever-present on “Main Street.” This is the disconnect I highlighted yesterday as full-time employment is still 2.5 million short of the 2007 cycle peak, some 83 months and counting:

The take up out of the Great Recession should have seen a few years of job growth averaging 500k to 600k. Every year since then has been two-thirds short of that, dragging on now for five years. For “some” reason there is no account for the size of the decline in mainstream commentary, but that is the exact dissatisfaction that is ever-present on “Main Street.” This is the disconnect I highlighted yesterday as full-time employment is still 2.5 million short of the 2007 cycle peak, some 83 months and counting:  That deficiency only adds to questions about statistical validity in even the lower but positive track of employment. When you add in the viewpoint of wages and income, which is all that really matters, after all, the idea of even the lower track pointing upward isn’t so compelling.

That deficiency only adds to questions about statistical validity in even the lower but positive track of employment. When you add in the viewpoint of wages and income, which is all that really matters, after all, the idea of even the lower track pointing upward isn’t so compelling.  Again, I think most people are well-acquainted with this intuitively if not fully apprised of all the figures and charts. The question is why economists are not – is the recovery narrative all that persuasive and enthralling? Given the stakes, an end to the orthodox hold on the status quo, that is more likely an explanation than anything else; hope and faith that even positive numbers are meaningful in the real world even though they have yet to be so. Economists still try to point out all the “slack” as at least a partial explanation, as Ben Bernanke tried to do yesterday in Denver, but that still comes up far short. If the economy were growing as well as they claim, and “slack” were the reason for the lack of apparent income, then the Establishment Survey would indeed have seen that 500k or 600k year or two. If businesses were at all optimistic about future prospects for revenue and fundamentally-driven profits, they would certainly take advantage of all this “cheap” labor sitting around “idle.” If things are truly good and your largest input is at a historically cheap cost, you use it in overdrive – that is what took place in every single recovery period prior to 2000, indeed that is what a recovery actually is! Symmetry in all prior cycles was due to that very fact of economic reality in relation to recession. All of this leads me to suggest a few potential interpretations: either the economy is actually growing but is doing so almost exclusively via artificial factors, and thus moving far too slowly, or it isn’t really growing at all and the mainstream statistics are just not suited for such circumstances. In the end, for most people it doesn’t really matter parsing the difference between those two as they amount almost to the same thing; though in many ways the former is actually worse since more artificial growth is an impediment to future expansion.

Again, I think most people are well-acquainted with this intuitively if not fully apprised of all the figures and charts. The question is why economists are not – is the recovery narrative all that persuasive and enthralling? Given the stakes, an end to the orthodox hold on the status quo, that is more likely an explanation than anything else; hope and faith that even positive numbers are meaningful in the real world even though they have yet to be so. Economists still try to point out all the “slack” as at least a partial explanation, as Ben Bernanke tried to do yesterday in Denver, but that still comes up far short. If the economy were growing as well as they claim, and “slack” were the reason for the lack of apparent income, then the Establishment Survey would indeed have seen that 500k or 600k year or two. If businesses were at all optimistic about future prospects for revenue and fundamentally-driven profits, they would certainly take advantage of all this “cheap” labor sitting around “idle.” If things are truly good and your largest input is at a historically cheap cost, you use it in overdrive – that is what took place in every single recovery period prior to 2000, indeed that is what a recovery actually is! Symmetry in all prior cycles was due to that very fact of economic reality in relation to recession. All of this leads me to suggest a few potential interpretations: either the economy is actually growing but is doing so almost exclusively via artificial factors, and thus moving far too slowly, or it isn’t really growing at all and the mainstream statistics are just not suited for such circumstances. In the end, for most people it doesn’t really matter parsing the difference between those two as they amount almost to the same thing; though in many ways the former is actually worse since more artificial growth is an impediment to future expansion.