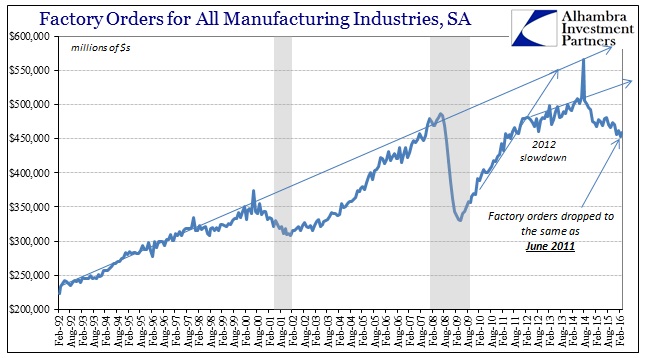

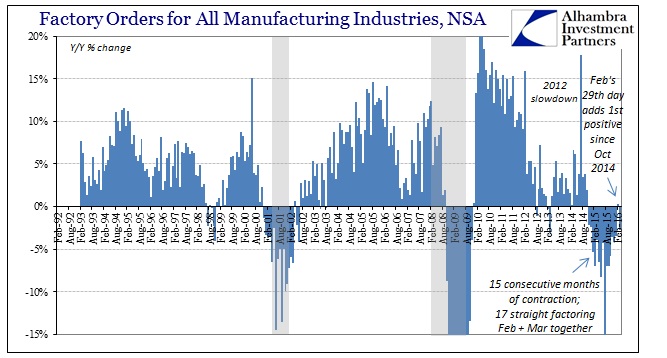

Factory orders declined again in March 2016, which was entirely expected on calendar effects alone. As leap year fades into historical memory, economic accounts are returning to their now normal slow, steady contraction. Year-over-year, factory orders were down 2.8% from March 2015, but it was the second consecutive March to receive a negative number. Factory orders (not seasonally adjusted) in March 2014 were $525.9 billion, but only $491.1 billion in March 2016. For the two years in between, orders shrank nearly 7% where the most important piece of that result is actually the two years rather than the 7%.

For the first quarter as a whole, encompassing February and its extra day, new orders declined 2%, which was better than the pace of contraction left at the end of last year. It suggests the same as the relevant interpretation of the PMI’s, namely that “better” is only a relative qualification (one step forward after two or three steps back). On a seasonally-adjusted basis, factory orders rose in March, but as usual remain in the same slow-churning downward trend.

What is remarkable is the consistency of that trend, and I mean that in two ways. The first is the length of time it has been the dominant feature. As noted above, factory orders have dropped for 17 months straight (combining Feb & Mar). The contraction part of the Great Recession lasted for just 14 in total, while the entirety of the dot-com version was 16 months. The difference is that those were completed cycles for the comparable spans; after the factory shrinking reached the 16 month mark in early 2002, it was only recovery from there. Now, even though the full extent of the current contraction is already of similar proportions, 17 months appears to be only the first part or beginning. The implications of that are enormous.

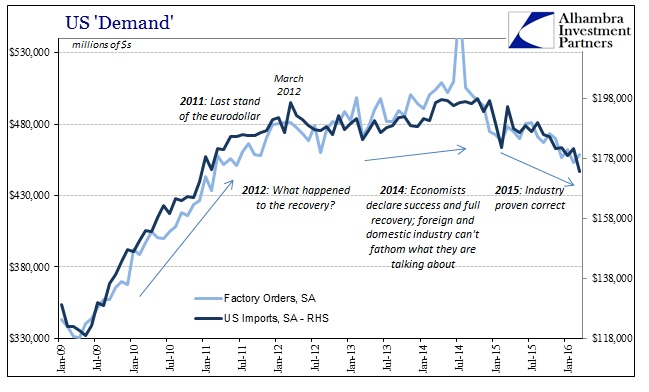

Second, this unbelievable slowdown is found in any number of other indications in almost exactly the same dimensions of time and change. As noted this morning, it extends to US trade especially on the import side. In what could only frustrate the FOMC and Janet Yellen, that actually makes more sense given that foreign exports to the US and domestic factory production are competing for primarily the same market – US consumers (but not just consumers). To find that both US imports and US factory orders don’t just bear passing resemblance but are nearly identical can only mean that “global weakness” again originates here.

The view of the US economy from the global industrial economy could not be more uniformly resolute – the recovery ended in early 2012, as the eurodollar system used up its last chance at restoration in 2011. From that point until later 2014, growth slowed to barely a crawl; yet during that time, economists and policymakers were only increasingly convinced (convincing themselves through nonsense like stock prices; stocks are up because the economy is good, and we know the economy is good because stocks are up) of the opposite. By 2015, global industry, both foreign and domestic, was proven right as what seemed like slow but steady growth instead turned to now slow and steady contraction.

One reason for the change is something like the economic/financial equivalent of gravity and aeronautics. In other words, slow and steady is not a stable condition for an economy, it is rather a critical state in search of a phase shift to something actually stable. Like an airplane flying too slow, the economy was in danger of stalling yet policymakers had become only determined to look past these obvious deficiencies because they thought the unemployment rate and Establishment Survey were meaningful predictions about the future (picking up speed and then overheating).

So the true policy error and really the error in judgment lay in not reconciling the large and palpable inconsistencies of 2014. Economists looked upon the labor statistics as definitive proof (because that is what they wanted to see) when at the very least they should have opened a serious inquiry into the divergence. With now the high cost of hindsight, the employment numbers appear only more and more erroneous, obviously a poor foundation for setting global economic expectations.

Economists and policymakers knew well that income was the primary problem long before 2014. The difference was that in 2014 GDP in the middle turned up just enough (5% pre-revisions) along with the sudden (and questionable) appearance of the “best jobs market in decades” for them to see what they wanted to see out of “stimulus”; that despite all evidence (uninterrupted slowdown) elsewhere, it had to be working. They took a highly dubious anomaly in data and turned it around into projecting their own biases about QE so that GDP would to them suggest income was about to turn higher when in fact it was the continued lack of income that showed GDP (and the labor stats) was the illusion all along. Causation never reversed.

As I wrote then, it has always been income. The figures on imports and factory orders further confirm it was just never there and had, in fact, only gotten worse all these years (time is the biggest cost). Spending follows income just as night follows day. It is an appropriate metaphor given that seems the economic course set out as the recovery passed its sunset way back in 2012. Only an orthodox economist would confuse the sunset for sunrise.