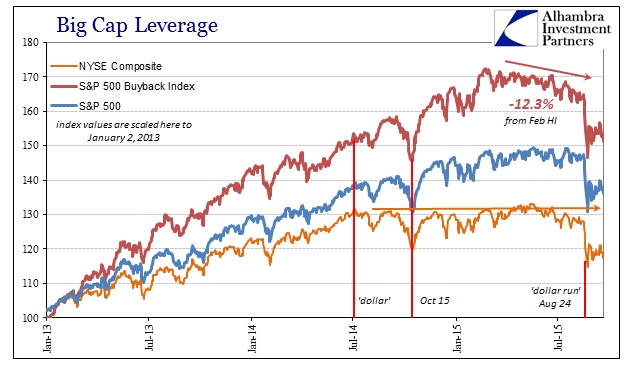

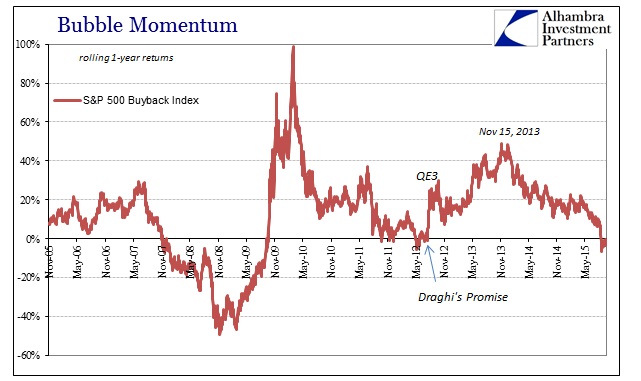

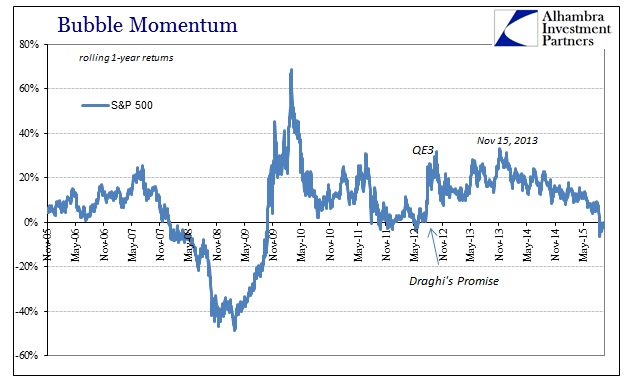

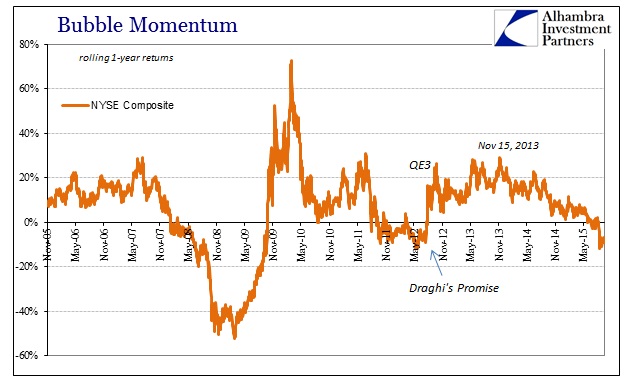

There is growing turmoil in buybacks that threatens the very fabric of the stock bubble. That was always the primary transmission of the foundation of its current manifestation, corporate debt, into asset prices; especially the huge run following QE3 and QE4. As represented by the S&P 500 Buyback Index, this liquidity propensity has found a durable reverse. After peaking all the way back in late February, the index is now more than 12% below that level after sustaining the August 24 liquidation.

The fact that this reversal is seven months in the making more than suggests a potential major shift. As the NYSE Composite, stocks were not long for continued momentum against the “dollar.” Buybacks seemed to have weathered the first piece of the first “dollar” wave, but as junk debt there was always conjoined a limit.

Some say expectations around the Federal Reserve have a lot to do with the buyback decline. Even though the central bank elected to keep its benchmark rate near zero Thursday, fears of higher rates are causing companies to rethink their capital return program, posits Boris Schlossberg of BK Asset Management.

“Even though rates have not gone up, we clearly are in a tightening position in terms of monetary policy, and I think they’re looking ahead and saying, ‘Do I really want to finance this thing with no-longer-cheap money that we used to have a couple months ago?’” Schlossberg said Tuesday in a ” Trading Nation ” segment.

I have little doubt that the causation effect claimed above is slightly misplaced, as “monetary tightening” isn’t the Fed so much as the eurodollar standard; that is just one mainstream method of trying to reconcile what is now seen with the financial plumbing remained misunderstood and largely hidden. As with the junk bond bubble, there is undoubtedly a correlation between re-assessing stock repurchases and the bald reductions of issuance in corporate credit. That hasn’t changed throughout this year, instead having gained further in this second “dollar” wave. Yet again, we see the “dollar” intrude in unwelcome fashion (to the bubbles).

The problem once momentum fades is that investor attention turns toward valuations that were repeatedly ignored before. As long as everything is moving upward and any fundamental downside is completely contained (in perception) as “transitory” then valuations are easily set aside as one form of rationalization. The effect of reversing momentum is for a more honest measurement; particularly by force of change in economic sentiment which is almost always concurrent.

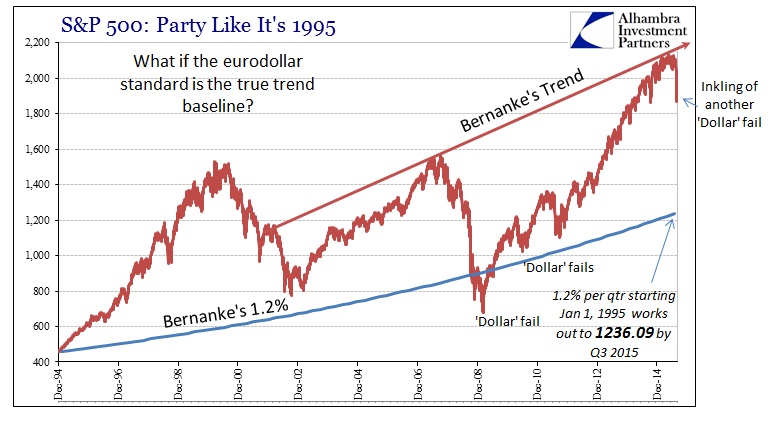

To that end, valuations remain as they have been for the past several years. Stock prices are out of alignment with any historical trend (except the one weakly conjured by Bernanke to attempt self-justification, which instead actually furthered the score against him). Worse, some forms of valuation are subject the same kind of statistical subjectivity that has plagued main accounts like GDP and the Establishment Survey (trend-cycle).

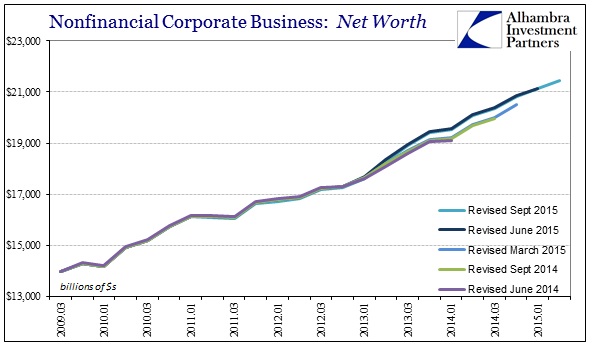

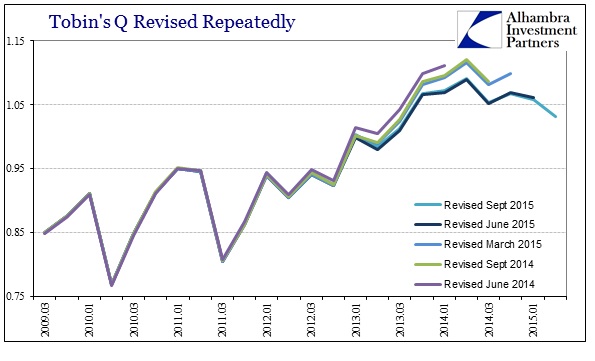

In the Tobin’s Q measure of valuation for the stock bubble, the basis (denominator) is Nonfinancial Corporate Net Worth. Revisions in this segment of the Financial Accounts of the United States (formerly Flow of Funds) have followed the pattern of revisions in GDP; upward until the last benchmark which reduced 2012 and 2013 figures while preserving the levels for 2014 and 2015. That had the effect, on GDP, of reducing growth rates in the first period while thus increasing them in the second. Corporate net worth is somewhat derived from that economic view, and its revised results are somewhat reflective of that.

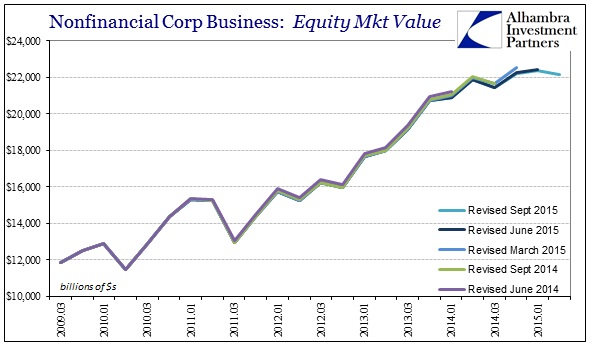

The numerator for Tobin’s Q is corporate equities (the classification now changed with this Q2 update from equity liabilities to market value of corporate equities) which somehow are continually revised downward. The net result is a vision of Tobin’s Q that is less outlier (but still historically high).

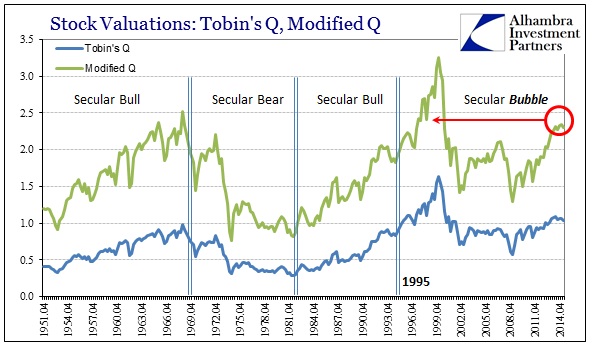

Even with these revisions and the decline in valuation intensity, the current calculated Tobin’s Q for Q2 2015 remains at the 90th percentile. The level for my modified Q ratio (which subtracts the market value of real estate from net worth, so as to not “justify” one bubble with another) remains above the 92nd percentile.

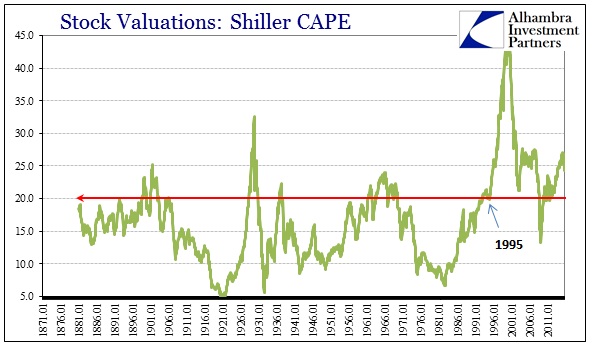

Robert Shiller’s CAPE’s current reading, also down from 2014, of 24.3 is also just about the 90th percentile but in a data series that goes back almost a century and a half. And if we exclude the obvious bubble period after 1995, 24.3 would have been in the 99th percentile for the period 1871-1995 (which shows you just how much the past two decades have skewed and screwed valuations).

That truly becomes a serious consideration where the eurodollar, the mother and proginator of all these bubbles, is no longer the assumed basis. In other words, if “investors” have been expecting “dollar” liquidity and eurodollar financial resources as a root for maintaining valuations and that turns out as a false assumption (like 2008) what becomes the true underlying value for stocks? Certainly not something close to the 90th percentile.

Without direct momentum, valuation and fundamentals begin to govern which is why, I believe, QE3 pushed the market as much as it did; it promised to provide both with a direct attachment to the corporate bubble to project that perfection. The lack of momentum in 2015 is the stock “market” waking up to the falsification of those assumptions as QE aided the debt-based flow but little else (and that spans the globe). Again, extreme valuations are trouble at any time, even when they are “justified” by economic expectations. That is the Yellen Doctrine whereby a bubble isn’t a problem when it leads to or even just leads recovery and booming growth.

That theory is, of course, as absurd as it sounds. The problem right now is that even if you buy into it, as so many did literally as well as rationalizing, the booming growth is still, at some point, necessary. That may be why the FOMC is so insistent upon “strong” no matter how much that is demonstrably assaulted. We are clearly at that point where it does not want to remain; if the growth doesn’t show up soon, then by this very count stocks are in a bubble and worse, already on the downslope. It is the raw force of the “dollar” in all forms, to rebuke Yellen by compelling sanity of asset bubbles, stripped of further financial inequality, making investors come to terms with reality rather than continued fantasy.