You may have heard recently about the Transportation Safety Administration’s record for safety measures in airline transportation. The task with which the government agency is charged has become a bit of a joke, with public perception almost of a gang of thieves running a sanctioned-criminal enterprise. The groping and stealing are held back, with apathy and inertia on its side, mainly by the idea that those may be the costs of keeping safe.

The revelations more recently call even that weak assumption into question, where the TSA was found to have a 5% success rate (or, as it should properly be classified, 95% failure rate) in detecting dangerous contraband items, most particularly weapons and explosives. If we tolerate the government’s band of misfits making airline travel an extreme chore all in the name of forestalling the next 9-11, then being fooled or missing 95% of the time is the very definition of a joke. That would prove that there is very little correlation between preventing violent attacks on transportation and what the TSA “provides.”

That was as much admitted, repeatedly, by TSA officials who cannot come up with any specific (or even general) cases where their agency’s efforts were fruitful (for the public’s interests rather than specific, rotten TSA agents). Even the agent in charge of screening and all that wasn’t fired, he was shuffled off to another high level position somewhere else in Homeland Security. All of which leaves the TSA as another epitome of bureaucracy, more concerned with its own interests than the original mandate and furthering the empowerment of government reach to the iron-clad exclusion of all other designs and ideas.

Yet, all of that is tolerated; there is no noise to disassemble it and start over, let alone perhaps even allow private, market forces to build a better security apparatus far more responsible and effective in the public interest. Even making that suggestion would be futile as conditioning has been taking place ever since the TSA was first thought up – “only the government” is the loudest refrain in highly sensitive areas of national importance. It is a highly undemocratic thought, and it is ubiquitous.

The parallels to the economic case are easy to see and make. The Federal Reserve is as much the TSA, conducting an almost (legal questions remain on a whole host of “emergency” issues) criminal enterprise that, certainly in a great deal of public thought, has benefited very few at great cost to the rest. Ben Bernanke and his fellow economists have recognized that, but like the TSA depend exclusively on unprovable counterfactuals – the TSA says there has been no repeat of 9-11 and so even its incompetence may have played at least a small role in that, Bernanke says it could have been worse without him and his.

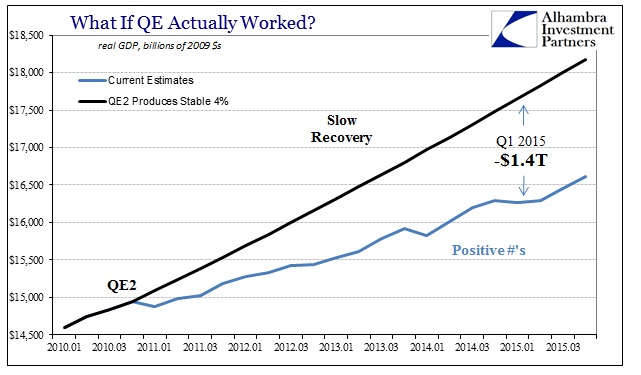

That seems to be the last vestige of the monetary program, as that is more than a little revisionism. Even QE1 was declared a positive economic agent as much as saving the financial system. But from QE2 onward, it was all aimed squarely at the recovery and returning to the prior economic trend; reread Bernanke’s November 2010 oped (re)introducing QE, only a year and a half removed from panic, for confirmation of its first priority. Saying now that QE “worked” only because there was no secondary breakout of disorder (there was, actually, in 2011 in eurodollars; and you can make the case for the middle of 2013 and again in the middle of 2014) is being intentionally disingenuous.

When QE was first tapered, back in December 2013, Ambrose Evans-Pritchard wrote in The Telegraph:

As the US Federal Reserve starts to drain dollar liquidity from the global system at long last, let us celebrate success. Quantitative easing has worked marvellously [SIC] well. Monetary policy has been vindicated.

The US, UK and Japan are all recovering, moving closer to “escape velocity”. The Swiss National Bank – that bastion of orthodoxy – has kept its economy on an even keel by quietly amassing a bond portfolio equal to 85pc of GDP.

That last paragraph is especially ripe, as less than two years later there is absolutely nothing left of it. US, UK and Japan are all recovering? You might make the case for the UK, as that country amounts to a non-euro version of Germany, but the US and somehow Japan? How do the Swiss look now as a bastion, or even as relative to euros?

More recently, writing for the NBER, Martin Feldstein was praising QE only four months ago on its economic success:

QE’s effect on demand in the US reflected the financial-market conditions that prevailed when the Federal Reserve began its large-scale asset purchases in 2008. At that time, the interest rate on ten-year Treasury bonds was close to 4%. The Fed’s aggressive program of bond-buying and its commitment to keep short-term interest rates low for a prolonged period drove the long-term rate down to about 1.5%.

The sharp fall in long-term rates induced investors to buy equities, driving up share prices. Low mortgage interest rates also spurred a recovery in house prices. In 2013, the broad Standard and Poor’s index of equity prices rose by 30%. The combination of higher equity and house prices raised households’ net worth in 2013 by $10 trillion, equivalent to about 60% of that year’s GDP.

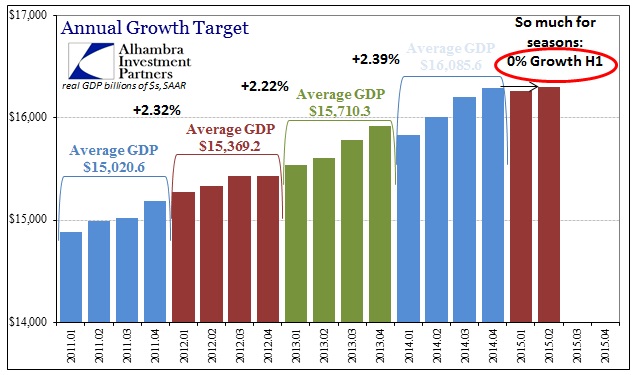

That, in turn, led to a rise in consumer spending, prompting businesses to increase production and hiring, which meant more incomes and therefore even more consumer spending. As a result, real (inflation-adjusted) GDP growth accelerated to 4% in the second half of 2013. After a weather-related pause in the first quarter of 2014, GDP continued to grow at an annual rate of more than 4%.

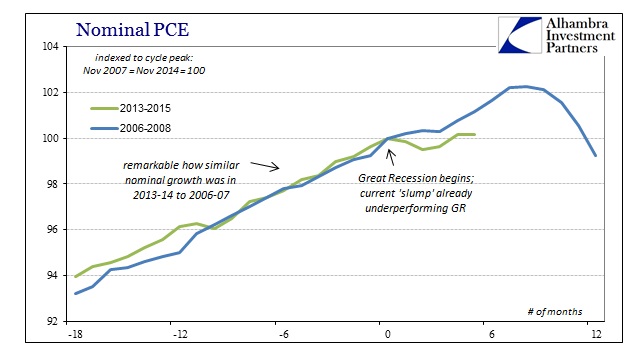

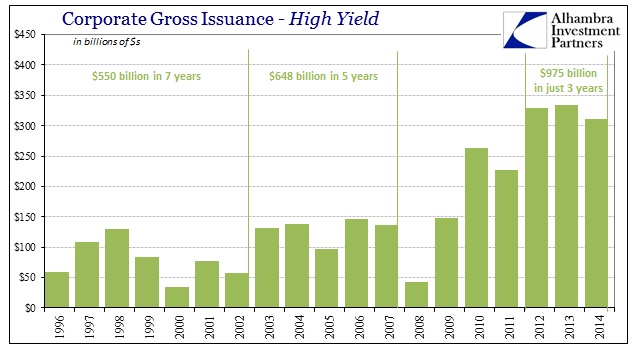

Whether or not QE drove bond yields so low is even debatable (especially when bond prices and yields more often than not moved contrary to all QE expectations, and not just since November 2013), but it almost doesn’t matter. Bond yields have fallen, corporate credit has exploded and financialism reigns supreme to the exclusion of all else. So what? Rise in consumer spending? Where?

GDP may have expanded at 4% or better in the middle of 2014, but there was nothing about it that suggested it was sustainable – a fact proven more than conclusively by recent events and forecasts. That 5% GDP is a distant memory now, with the economy of 2015 demonstrating that high growth (if it actually exists outside of statistics) is the anomaly, and that low and unstable growth is the norm under QE and ZIRP.

In short, this is reaching TSA-levels of futility. It’s not as if the Fed has been shy, either, though some like Paul Krugman always suggest there is another level of plunder yet to be explored. Bank reserves have swollen with something unlike anything ever seen, which is supposed to convey monetary power and authority; it does, just on a more limited basis than was ever believed.

Ambrose Evans-Pritchard spells it out in his eighteen-month old ode to QE:

The Fed’s $3.2 trillion bond spree since 2009 has certainly been imperfect. It has fuelled asset bubbles, not by mistake, but by design. Fed chairman Ben Bernanke puts much faith in the wealth effect, the trickle down theory that understandably disgusts Pope Francis in his latest apostolic exhortation.

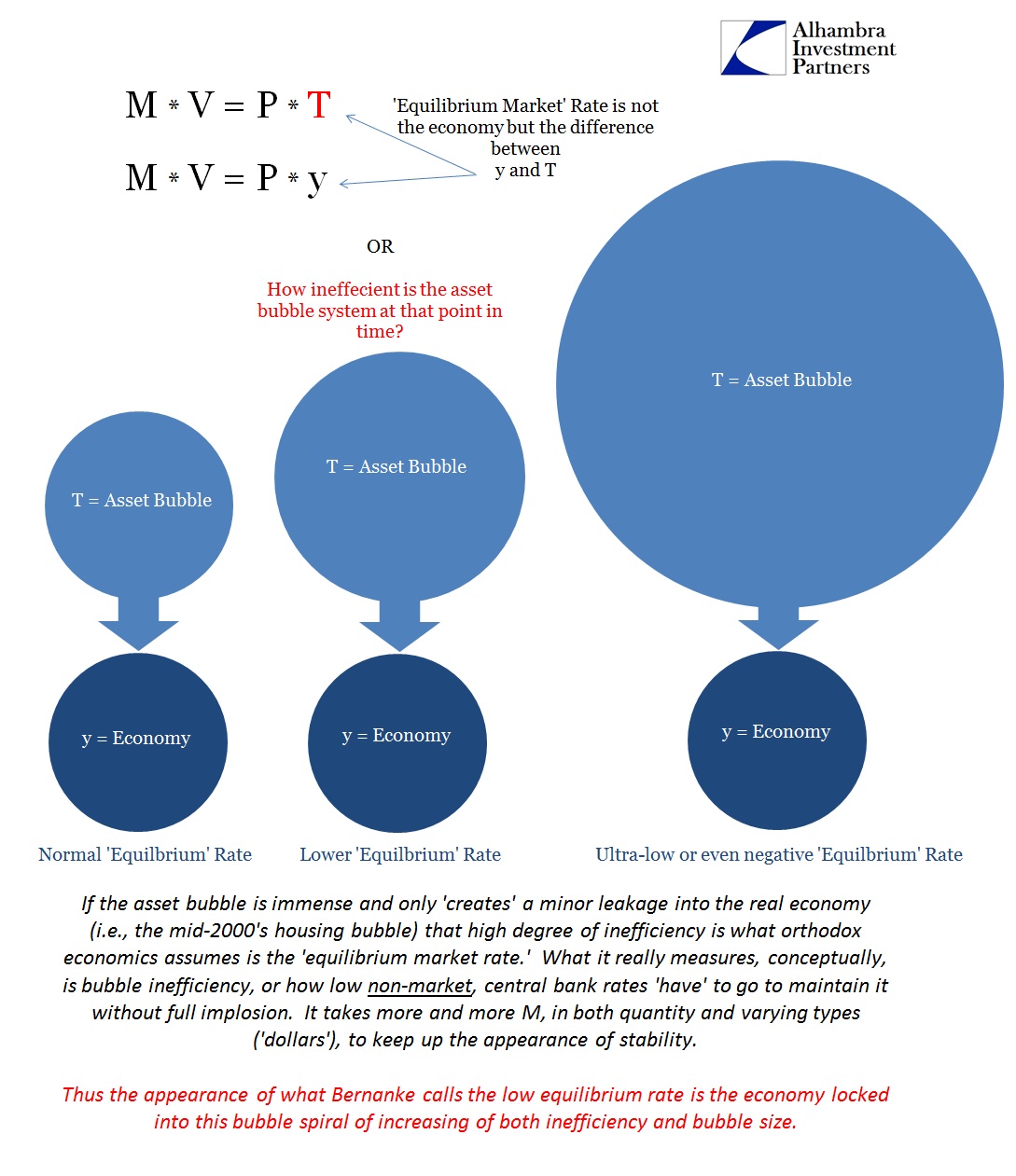

This is where the operative theories of Bernanke and Janet Yellen at least intersect, in that asset bubbles and great financial imbalances are the order of the day, for circumstances that they now believe are beyond their control and lie deep within the recesses of “the economy.” It is already deeply contradictory in its formulation, that the Fed holds and wields great and terrible financial power but in its primary mandate it is something like powerless. Thus, we get the bubbles without the economy that is supposed to tread with them.

For the Yellen Doctrine, as I posed it yesterday, that is a major problem since the breakdown between bubbles and the bubble economy that is very evident right now means that those intentional bubbles are exposed to their very narrow foundations – and right now all that is holding them up is whatever is left of credibility in future promises for growth and the rather unexamined, at least in the main, appeal of liquidity as it relates to forsaking “tail risks.”

All of which starts to add up to, “what was the point in the first place?” The Fed, or any central bank, is not dedicated to recovery from any means; that much is plain now in all those “successes” listed by Evans-Pritchard. Rather, what central banks aim is a very constricted definition of economy, one that is wholly driven by debt, and thus is under its jurisdiction with it on top. What the Fed intends to save is not the economy for you and me, but rather the means by which it will maintain control over the economy – financialism, Wall Street and debt above everything else. In that respect, which in 2015 should be all that matters, the Fed is no different than any other bureaucracy, TSA included.

We tolerate the asset bubbles because they are proclaimed as economic security, even as there is little intuition about how that might actually be; it is, actually, quite counter-intuitive yet it is now the dominant theoretical basis for current policy operation. Economists live in a maze of mathematics which is proclaimed as science, so who with just common sense will challenge? That is the grandest tool for maintaining this debt-socialism, as neither political party will so much as dare defy, directly, orthodox economics’ hold on matters to which it clearly has no true expertise or even hope of success. Politicians are scared of the math because they have never really looked at it; if they did they would find the voodoo rather easy to comprehend.

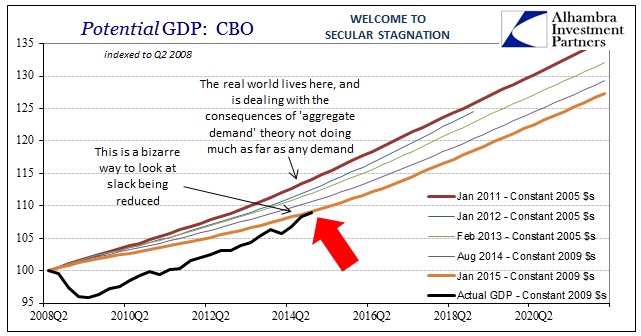

That is the point of a bureaucracy, to stake out itself as the sole arbiter of expertise to head off any challenge before it is ever conceived. In that respect, there is actually no need to be actually successful because you are the one who declares what defines success in the first place; QE will create a beautiful recovery like all previous; no, QE will just create a recovery; no, QE will help the economy limp forward; no, the economy is to blame so QE kept it from being worse. Deflation in monetary policy really has nothing to do with consumer prices and everything to do with the reduction in standards to which monetary “expertise” judges itself.

That is why a potential recession in 2015 would be devastating, not just to the Yellen Doctrine but to all that was celebrated about monetarism and not that long ago. A recession now would be total destruction of the orthodox paradigm, though we should never discount the wiliness bureaucracies possess in finding yet another excuse.

This is a rather timeless issue, one that has never really been resolved under the serial bubble paradigm that covers pretty much the whole of the eurodollar standard’s global ascendance. No one has ever answered for it apart from ludicrous suggestions of causes that don’t hold with actual observation (global savings glut, interest rate conundrum; now secular stagnation). That is the true genius of monetary policy and monetarism, under the theoretical assumption of monetary neutrality, as it, in the math, divorces central banks from the messes they make, positioning themselves as only saviors.

Monetarism is never what it seems, which is highly germane to whatever is coming next. Most commentary dismisses it as pensive fancy, but there are dark clouds gathering drawing the seeds of accountability closer. If we end up in a terrible economic position yet again, was this system worth saving the first time? It doesn’t even work how it is supposed to, but as long as the status quo is maintained, and asset bubbles tantalizing those with the shortest attention, the standards and benchmarks for success can be reduced, lowered and altered wholesale. This all raises the intriguing possibility that perhaps the status quo simply cannot be maintained at all, as soft central planning may have reached the inevitable wall. If that is true, do we “let” Bernanke’s successor, Janet Yellen, “save it” yet again?