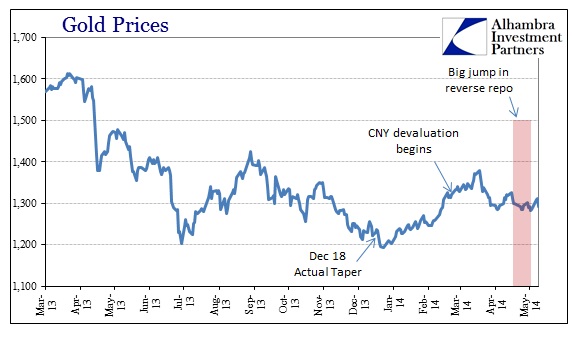

Apparently the stasis that has infected credit markets has been visited upon gold prices. Going back to late March, gold has straddled the $1,300 level without straying too far on either side. As with other credit market prices, such stability is conspicuously different from what would be considered “normal” market behavior.

Is it possible the two opposing forces affecting gold trading have reached a steady equilibrium? That would be tough for me to accept since I don’t think equilibriums actually exist; at least not naturally.

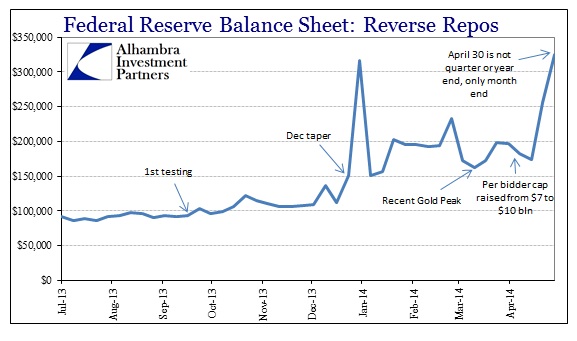

I still believe, this trading range notwithstanding, that the bid for gold is safety. Against that is apparently balanced financial and money market factors, mostly US$ collateral issues. To that end, reverse repo usage at the Fed was up quite a bit into the end of April.

That includes not just the most recent “testing” of TOMO operations in the space, but all Fed reverse repo programs. It’s odd that April 30 would trigger a calendar response as those are more persistent at quarter and year ends. The most innocuous explanation is the decline in on-the-run t-bill auctioning by the treasury. That, however, wouldn’t explain the specific timing here.

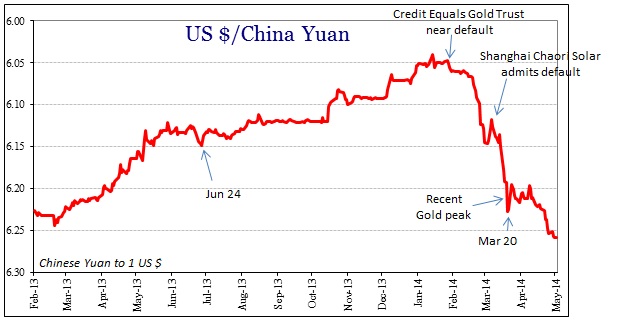

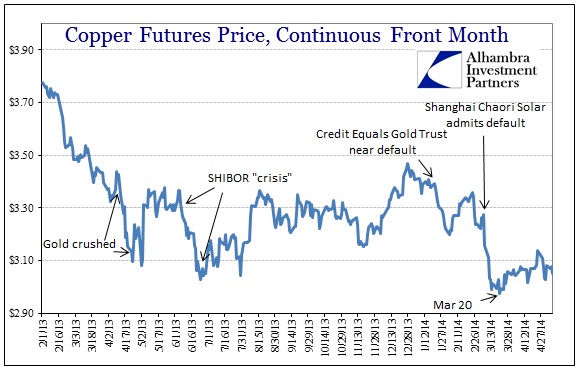

The other justification has run toward China’s need for dollars. The yuan too has entered a bit of a stasis period – still not out of the woods but not getting obviously worse. That observation can also be used of copper prices.

There is also the potential for spillover out of Europe as the LTRO’s wear down on euro liquidity. The volatile rise in Eonia more than suggests that liquidity is much less apparent now than back in November at the last ECB rate change. That is more or less confirmed by the ECB’s inability, particularly in the past couple of months, to sterilize its SMP operations.

That is what we are really talking about here, namely the world of collateral as central banks buy their own optimism. In both euros and dollars, “reserves” on balance with respective central banks are uncollateralized only in the most literal sense. From the banks’ collective perspective, these deposit programs (I’m including the IOER) function very much like collateralized arrangements since they are with the central banks themselves. If they are to be transitioned off this risk-free substitute, the choice is not to go from the Fed or ECB to Eonia or federal funds (let alone LIBOR), but rather into some kind of repo arrangement. That is the “market” substitute here.

That means any effort to withdraw bank tendencies toward the deposit account or IOER is essentially the same as removing collateral from the system. Less $ in IOER (assuming we ever get there) will stretch the collateral chain. The Fed is, obviously, hoping that the reverse repo will be enough of an offset to maintain order. My bias against them is that they are always behind the curve on transitions (which is not necessarily a fault; that is true of everyone to different degrees, but central banks never seem to fully recognize the limits of their own abilities) and see no reason why this should be different.

At any rate, I think this dovetails with my assessments recently of the varying picture of the future. There are going to be less central bank operations in the world ahead (still distortions), but rather than occurring during a real and robust recovery it will take place “as is.” There is no historic growth to make this transition easier (though there would be if monetarism would stop interfering and distorting) and that places greater emphasis on collateral streams. That is why banks, I believe, are gearing up their collateral transformation systems (rent out inventory in the bank book – take in junk and give back UST – for a fee). I think it will be a growth business if we get that far.

It is unsettling to see markets like gold behave like this. But, again, I think it like credit and inflation as a reflection on great uncertainty ahead as the paradigm of the past six years finally shifts. Some are already (laughably) calling this the Great Moderation 2.0; they better hope it’s not 1937 redux.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com