Gap announced another round of store closings, about 175 this time which is a significant chunk of its once-leading asset base. The company’s struggles aren’t new, having closed 200 stores only back in 2011. Since Gap was one of the first businesses to sign on for a higher wage base, you have to wonder how much of that was simple PR instead of actual business sense. Whatever the case, this is a US problem inside an economy that wasn’t supposed to be tracking so far backward.

The retailer said in a statement that it would shutter 175 of its 675 Gapstores in North America, of which about 140 will close in the current fiscal year that will end in January. The closings will leave the Gap label with about 500 specialty stores in the region, in addition to Gap’s 300 outlet stores, which are not being closed.

The bulk of the stores to be closed are in the United States. Gap will also close a limited number of European locations, the company said, though it did not give a specific store count. The retailer is slated to update investorson its turnaround plans on Tuesday.

The compression here is somewhat complicated, however, by not just one brand going awry, as in many ways the problem with Gap are shared throughout the US economy. What once made the mall experience the epitome of “American” consumerism now threatens to be the downfall of all those who embraced the idea of the 70%. That number or proportion is a myth on its face, but as a representation of where marginal economic growth was derived it was every bit as fitting; and remains so especially in the intentions of monetary policy directives.

Analysts are quick to point out how this is a positive business transformation, one in which online has taken market share by chunk. The excuses for Gap are already plugging that hole, as economic mellifluence is simply taken on faith, meaning that any sustained negativity must be idiosyncratic or as an offshoot of some other positive evolution.

The store closures are part of a larger trend by mall-based brands to reduce store locations, says Simeon Siegel, retail equity analyst at Nomura. Macy’s, J.C. Penney, Deb Shops, RadioShack, Sears and Wet Seal are all among brands that have or are planning to close stores.

“It’s more a continuation of what’s already been going on,” Siegel says. “Your biggest competitor used to be your neighbor in the mall. Right now your biggest competitor is the infinite number of random start-up websites. You just don’t need as many bricks and mortar locations.”

Every time that retailers report horrible same store numbers, the online competition is listed first in the analyst piece. This is not to say that the virtual transformation is small or insignificant, it clearly is revolutionary, but by sticking with that as an overarching reduction loses the primary meaning and point of emphasis. In other words, consumers are moving to nonstore retailing not out of convenience but almost exclusively via price. Shopping isn’t really dead as a trend, it is a victim of the highly and persistently deficient consumer position in the “recovery” age.

After dominating khaki and denim culture through the 1990s, Gap has stumbled in recent years, hurt by management blunders, a revolving door of executives and, by its own executives’ admission, uninspiring fashion. As with many midrange apparel retailers, both Gap and its sister brand, Banana Republic, have lost core shoppers, who were lured away by cheap chic styles offered by the likes of H&M.

I know absolutely nothing about “cheap chic” except for that first part. This trend against physical store locations began with the housing bust and then was magnified and amplified exponentially by the Great Recession. Consumers have simply never been made whole by the “recovery.” That has left price as the greatest consideration over and above almost everything else, a sharp enough contrast to the pre-recession era as to be unmistakable (where luxury brands once flourished).

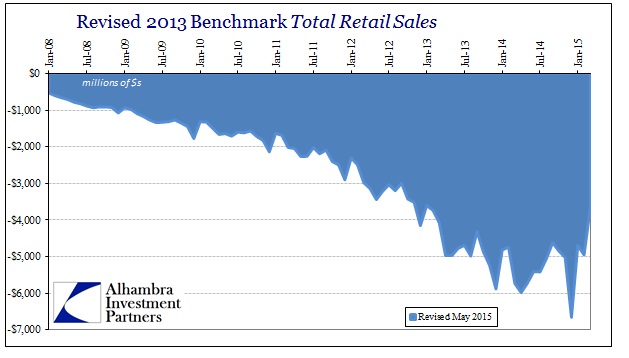

The Census Bureau conducts a bi-decadal exhaustive survey of the US economy, the last being 2012. The data from that survey is just being released and incorporated into the flow of economic statistics and accounts. I have already highlighted this “benchmark” reassessment on two occasions, the first with retail sales itself. In terms of the retail sales figures, the Census Bureau found out that they were still being over-optimistic on the overall retail sales trajectory, leading to a massive and downward benchmark revision to retails sales estimates for 2013 and forward.

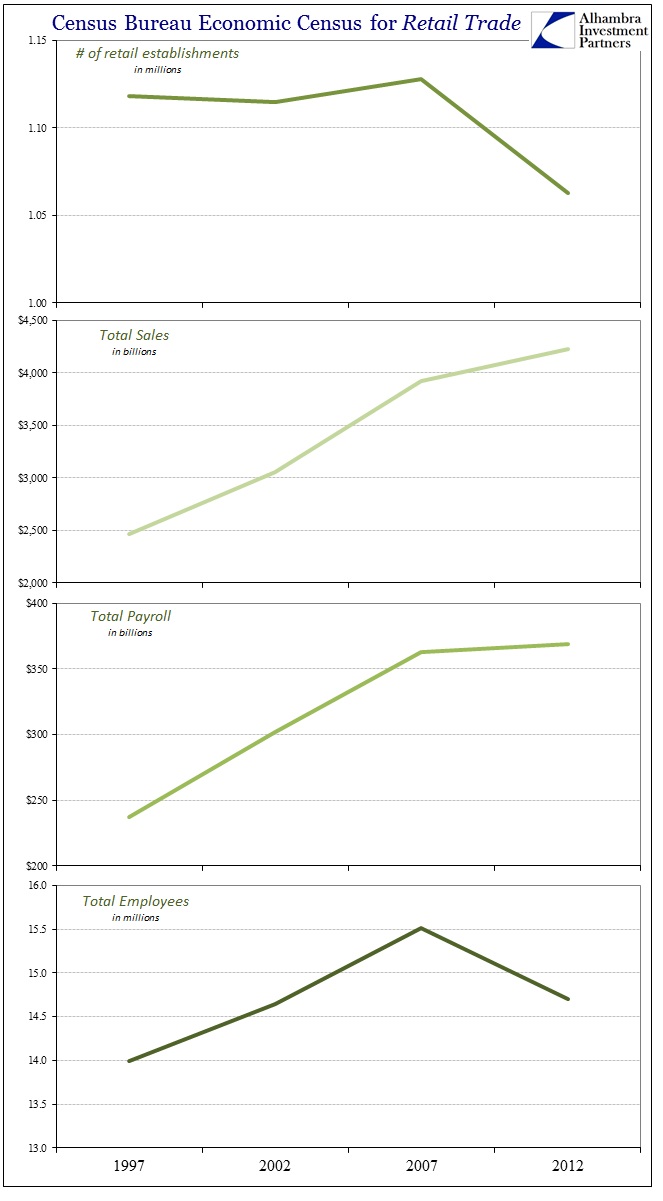

The actual survey results, upon which these baseline benchmarks are constructed, were quite shocking as to the economic “hole” opened by the Great Recession. Compared with prior 5-year survey periods, the last one was simply unprecedented.

The dot-com recession, by contrast, shows almost no imprint on the 2002 economic census despite being still quite in progress (in many respects) during the final year of that survey period. That was the point of spacing these by five-year intervals, believing that they would be far enough apart to incorporate full cycles into the structural view of the retail economy. Where expectations were for the same out of even the huge declines of the Great Recession itself, and certainly by 2012 three years after its end, the lack of regrowth even from a cyclical standpoint is stunning.

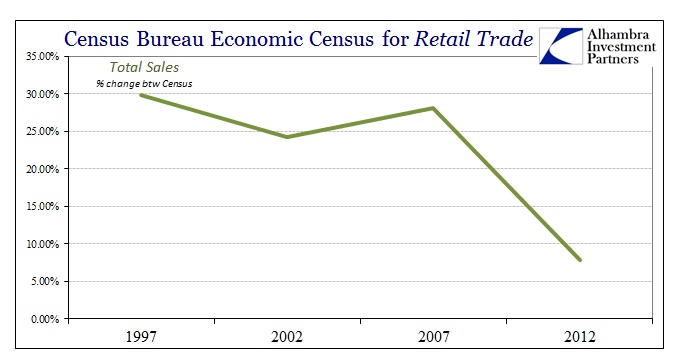

Total estimated retail sales in 2012 were only 7.8% above 2007, which is why the retail benchmarks had to be reset so much lower, where the dot-com numbers had depressed total sales gains to “just” 24.2% at the 2002 survey.

The problem of this insufficiency from the consumer side isn’t limited to just the consumer side. In terms of the economy, again, retail businesses built themselves up for the 70% consumer ethos, meaning that a huge amount of capital expenditure supporting further economic gains prior to 2007 was predicated on the 70% idea being permanent – regardless of any upcoming cycle(s).

I think too often capex and productive investment is limited in conventional thinking to factories and actual production. During the 1990’s and 2000’s especially, capex as a major economic force was marginally more expressive in retail form than production. In other words, as retailers built new locations to service the 70% American consumer it provided a good, if ultimately artificial, grounding for some of the economy’s baseline gains. It was, in many respects, the Keynesian fulfillment of spending for the sake of spending, especially as it was established upon more and more debt.

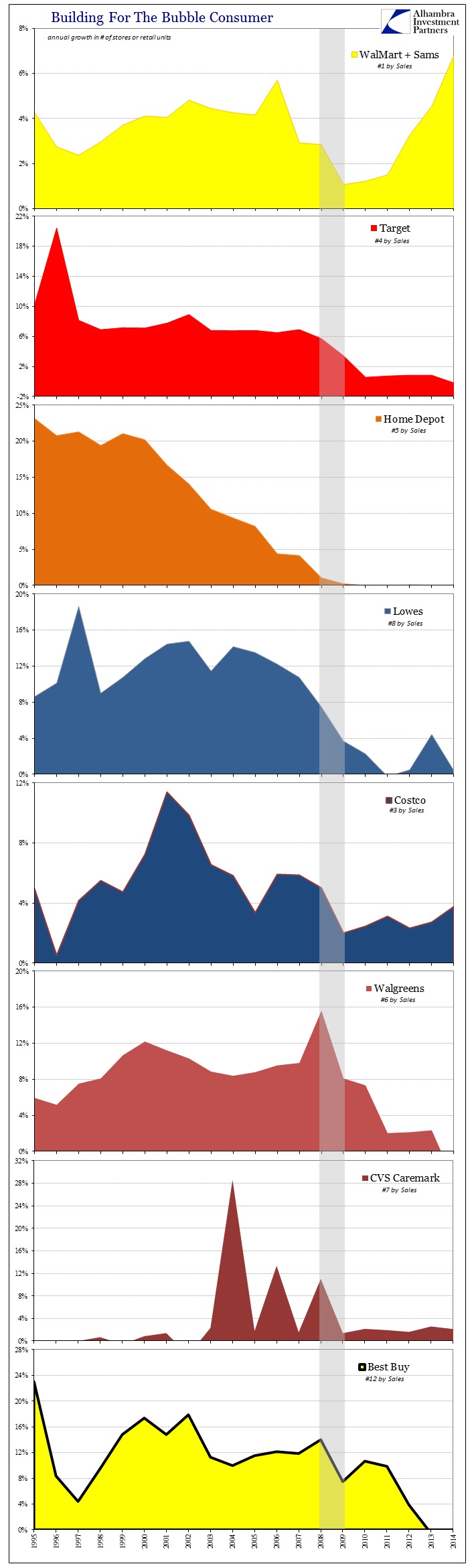

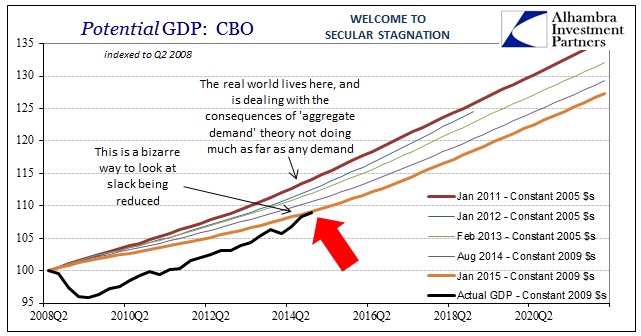

Without having any rebound at all after 2007, the retail industry is finding itself far overbuilt for the times even if online retailing did not exist at all. In that crucial respect, the economy suffers from consumerism in decline but compounding that by the “absence” of further retail capex; revealing the downside to generic “aggregate demand” or spending due to artificial intrusiveness. This problem (in the respect of rebuilding the consumer economy of the prior bubble periods, without qualification as to whether that is actually desirable) is widespread, as you can see plainly below.

NOTE: I did not include purely grocers above, such as the #2 US retailer Kroger, and I took the raw count of retail locations as a proxy for retail capacity and productive investment rather than square footage; neither are perfect comparisons but the point is, I think, amply made from this view alone, especially as new locations for the “big box” pieces typically are not stand-alone locations, clustered with other smaller retailer expansions.

I think it is simply astounding that Target, for example, a company with only 554 locations in 1994, grew to 1,740 by 2009; and now has only added 50 more in five years. That is an enormous reduction in capital expenditures through not just construction and construction jobs, but ongoing labor and retail capacity. Home Depot went from 328 store locations in 1994 to 1,971 by 2008, having added, on net, all of six locations as of 2014. Best Buy, perhaps the most directed by consumer habits and depressed purchasing power, grew from 204 units in 1994 to 1,317 by 2010, only slowed somewhat by the Great Recession, and 1,503 by 2012. Now, the company has cut back to 1,448.

Outside of WalMart, every one of the major retailers shown above has curtailed actual productive expansion; i.e., capex. Further, the fact that WalMart is the only firm embarking on an increasing baseline further proves the consumer problems since WalMart’s entire business is predicated on consumer pricing power in the first place – if there is one firm that might benefit from a terrible overall consumer environment from which to gather market share from all competitors, WalMart is it. That is especially true since the company can’t maintain much forward momentum from existing stores, which also tells the story of exhausted consumers, leaving the company with little choice but an expansion through market share strategy.

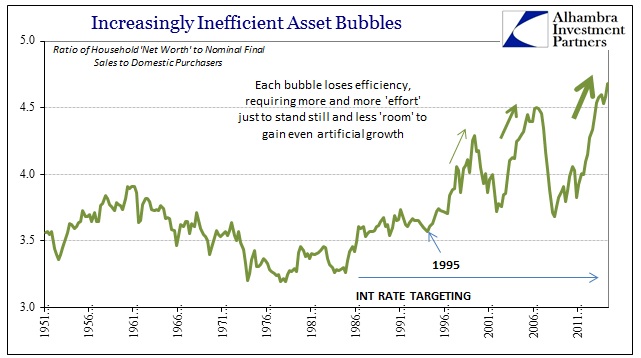

In terms of economy-wide capex, it is obvious that this recovery has been no such thing, and here we find some of the reasons for that. The retail industry far overbuilt in the prior, housing bubble cycle because it was assumed that consumer spending was an article of faith; Americans would always be that way. Worse, so much of global expansion during the period (China) was predicated on the same assumption of Americans. It was all tremendous waste based on the idea of monetary neutrality. The myth of that reliance is revealed:

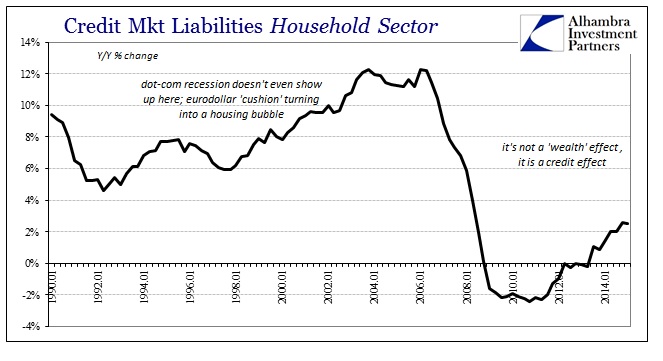

Monetary policy takes it as an article of faith that consumers are to be what they had been the past two or three decader, quite pliable through from a standpoint of financial central planning. Thus, all policy prescriptions revolve around the idea of getting consumers back to that prior baseline, even if it had been all a debt-driven illusion, unsound in any fundamental terms. All four QE’s and ZIRP are supposed to drive consumers to spend, and do so on borrowed sources, but it is clear that they will not and/or cannot, at least not widespread enough to justify a return trajectory to past economic experience. So the economy suffers both from that loss of circulation through debt, but also, perhaps more importantly, as the virtuous circle of spending into capex also breaks down significantly.

So in the period after the Great Recession, we see another reason as to why companies do not engage in productive capex in addition to (and agreement with) the tendency toward stock repurchases and purely financial “investment.” It isn’t just stock repurchasing that has taken so much out of potential productive gains, monetary policy has found other ways of destroying actual economic capacity. If it “needs” massive debt expansion to continue, then it was never real economic growth but rather the pure violation of neutrality, and a bastardization of economic trends.

It was the bubble economy through debt that created the myth that the 70% consumer was a permanent part of the economic architecture, so much that it instilled a false construction and investment boom in whose absence the current economy cannot gain any actual traction. It certainly does not help that central banks everywhere are still trying to return to that artificial baseline, as if conjuring consumer spending through more debt is the answer to that imbalance in the first place.

In other words, the reduction in retail capacity is yet another facet of the inefficiency of asset bubbles as an economic “tool” and the very real downside to “aggregate demand” as a foundation for soft central planning. It is bad enough in weakened consumers, but worse in terms of prior waste in capex-driven resources and now the absence of further gains. This is the greatest violation of demand theory, as instead of retail capacity the economy had gained organic and natural growth in other areas we would instead be “harvesting” those productive and sustainable trends now when needed most; rather than having so much resources, past and present, tied up in stupid and artificial consumerism.