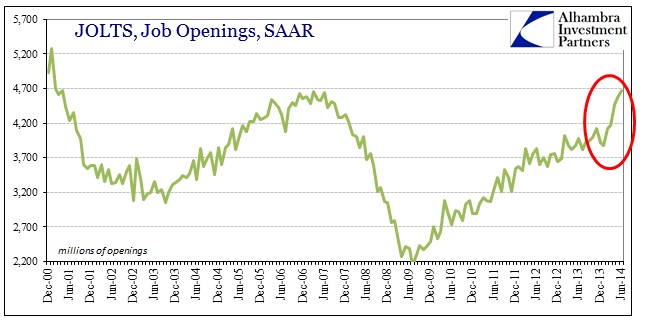

I think it pretty clear after examining the rest of the labor market that the pop in JOLTS estimation of job openings fits well within the idea of statistical problems. This is wholly unsurprising given that JOLTS is directly tied into the BLS’ Current Employment Situation report, meaning that part of the Establishment Survey forms the basis for the calculation of JOLTS levels. However, the recent figures on job openings are something else altogether, looking very much like an outlier of fantasy.

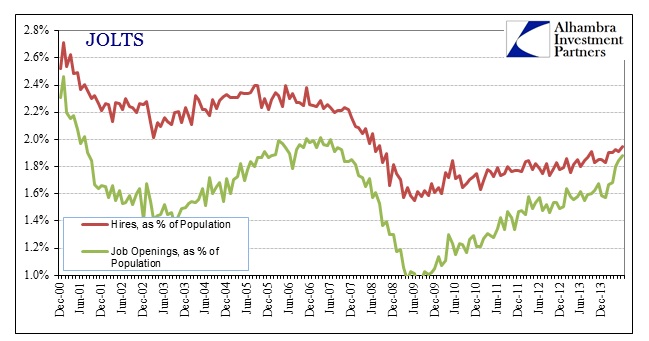

On the surface, that would seem to offer corroboration for the mainstream view of the economy and labor market, but job openings have always been more volatile and offered far less of a correlation to other labor market indications. Hires, for example, seem to be not just more stable but fit far more easily aside other and actually separate statistical series.

Where job openings have surged, purportedly, these other data points have remained lackluster, at best, recently. Further, they all remain significantly below their prior cycle peaks, thus offering corroborative support for each other. It is especially noteworthy how the BLS’ estimation of total hours (which is used in their productivity measure) is nearly identical to the level of full-time employment derived from the Household Survey. Further, though JOLTS is again more volatile overall, the trend in both of those is actually quite close to that of JOLTS hiring rate.

In other words, something odd and potentially anomalous has taken hold of the job openings series. If it was just one or two months it would probably “correct itself” over time, but it has persisted now not just in the past five months or so but really going back into 2013. The ratio of job openings to hires, for example, has been at a new peak since late 2012. That does not indicate growing strength in labor markets but rather a very diminished correlation with the rest of the estimates for payrolls (which I still think are themselves over-estimated).

Any breakdown of the correlation between job openings and hires (which is the more important of the two for obvious reasons) is potentially representative of statistical weakness more broadly. Some of that is just common sense, but there are other indications as well.

Comparing both to the overall size of the labor force shows that though there is an upward movement in JOLTS it is not the same as recovery, even lately.

But when viewed in proportion to the overall population expansion, the straight lines that emerge are very odd in the overall context. Like the Establishment Survey, such stability is a potential giveaway of statistical irregularity. Low volatility is a signal of the possibility of over-adjusting for the natural variation that should be far more evident in not just the month-to-month changes but even between discrete parts of any business cycle.

Even if there is no reason to suspect the veracity of JOLTS figures here, the breaking of the correlation within from job openings to hires is enough to be wary of over-interpretation. Further, in the context of population growth, none of it seems to be especially favorable to the idea of the economy as it actually is. Again, this is more of the dichotomy between simple positive numbers and actual economic gain or advance. And while a straight line would be a welcome result for a recovery, it would be highly unusual (especially from nearly five full years) and more likely come in a much steeper ascent.

In my opinion, this simply reinforces the idea that these accounts and estimates are not fully calibrated to the economic climate that actually exists in all its dramatic deficiencies. Maybe that is why GDP “had” to be revised so vividly as the figures are just incapable of using pre-crisis assumptions in this post-crisis world of disappointment.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com