The only thing that can be said about Janet Yellen’s simple-minded paint-by-the-numbers performance yesterday is that the Keynesian apotheosis is complete. American capitalism and all political life, too, is now ruled by a 12-member monetary politburo, which is essentially accountable to no one except its own misbegotten doctrine that prosperity flows from the end of a printing press.

To be sure, this non-sensical and historically disproven proposition gets all gussied up in neo-Keynesian Fed-speak about dual mandates, monetary support to aggregate demand, “slack” in labor markets and remaining shortfalls from potential GDP, among endless like and similar jargon. But it did not take long during yesterday’s presser to reveal that Yellen’s mind dwells completely in a circular puzzle palace.

For once she got a decent question or two, but answered by lapsing instantly into ritual incantation about the macro-cycle the Fed pretends to be superintending. Thus, when asked about the tepid rate of business investment in future productivity and growth, the answer was: Right, that’s why we need ZIRP for longer! That is, until we can inflate the GDP tire by monetary accommodation, expect CapEx to run flat.

Heavens to Betsy Janet! CapEx has been running flat for 14 years. The compound growth rate of real plant and equipment spending is less than 1% since 2000 and is still 5% below its 2007 interim peak. There is nothing remotely this dismal during any extended period in modern history.

Likewise, with the structural unemployment and labor force drop-out problem. This has been building for 14 years as documented by the fact that there are now 102 million persons in the working age population who do not have jobs compared to 75 million back in 2000 when the maestro was being hailed for his monetary policy genius.

And no, Janet, these 27 million did not move to a golf course community in Florida for a much deserved and pleasurable retirement. In fact, there are only 7 million more people on OASI retirement today than there were 14 years ago. So don’t dismiss the graph below as representing retirement as normal; its actually an indictment of the Fed’s manic money printing during the interim.

The monetary politburo has been pushing on an employment string for more than a decade, but this is not a cyclical problem. We have a debt-saturated failing economy that is not generating genuine growth, jobs or earned household incomes. Yet the Cool-Aid drinkers in the Eccles Building seem to think that a vast population (at least 30-40 million) that has moved onto food stamps and disability, or into mom and dad’s basement, or onto the student loan bonanza at on-line colleges, or on to the streets is just waiting for “lower for longer” to work it magic.

In fact, Yellen’s lame answer to the chart below was “Its conceivable there has been some permanent damage”. Indeed.

Never mind. Yellen has a hockey stick embodied in the Fed’s DSGE model that always predicts a return to the full employment GDP path 2-5 years down the road. And by the internal logic of this misbegotten model—which is only a vast set of discredited regression equations and data that embody the Neo-Keynesian world view—-all economic performance problems cure themselves after the Fed has gotten “aggregate demand” re-aligned with its theoretical full employment path. Its one-decision economic levitation writ large.

Except….except… it should be damn obvious after five years of what can only be described relative to all prior history as lunatic monetary expansion—that this mysterious Keynesian ether called “aggregate demand” is not realigning with the postulated full employment path of GDP embedded in the DSGE. That much is blatantly evident in yesterday’s markdown of its estimates for 2014 GDP to take account of the -2% hole in Q1 results.

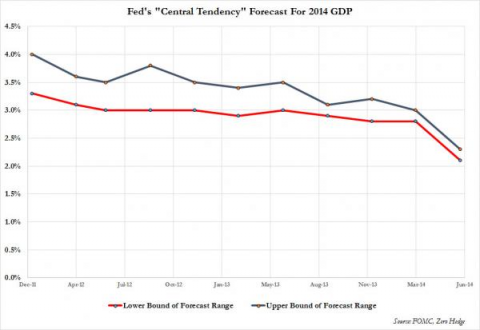

So as recently as early 2012, the Fed was confidently predicting “escape velocity” would be in full force by 2014, with GDP growth accelerating to 4% and thereby representing the catch-up phase of the macro-cycle. That “above trend” performance, in turn, would bring the nirvana of full employment a few more years down the road. Until then, “unusually accommodative “policy would be warranted.

Well, here we are in 2014 and there is no escape velocity in sight despite roughly $1.8 trillion of bond-buying in the interim, and the GDP forecast is drastically marked down to the 2.1-2.3% range. Was there any detailed explanation for this stunning repudiation of everything the Fed has predicted for meeting after meeting. Nope! Nothing but the passing of winter, which does come every year, even if this one was somewhat harsher than normal.

But if ZIRP and QE were working, the lost GDP due to snow and cold should be quickly recovered during the balance of 2014. Why did the Fed not upgrade its remainder of the year forecast to 6.0%/quarter to get back to its 4% annualized escape velocity? After all, virtually every one of the barriers that it blamed for the tepid recovery to date back in 2012 have now been overcome.

Back then it blamed fiscal drag. But the Obama White House has noisily pointed out that in the interim we’ve had the largest reduction in the Federal deficit ever recorded—-even if it still has clocked in at nearly $500 billion so far this year. So on the fiscal drag front, we’re there. Check!

Then there was the household deleveraging matter. But we’re there, too. Aggregate household debt finally blipped up in the first quarter after years of decline. Even credit card debt recently got a boost. So, check, there too.

And what about global growth and the US export recovery? That one has to be an automatic, postulated…. check, check. Every major central bank in the world still has its shoulder to the wheel of extraordinary accommodation. The BOJ is literally printing itself silly and will soon have a balance sheet of nearly 50% of GDP; the ECB is diving into the monetary nether world of negative deposit rates and back-door money-printing on a vast scale; and the red capitalist overlords in China can’t keep their hands off the RMB print button, even as they fret about the monumental Ponzi rising up all about them. So, yes, check, global growth has to happen.

And never mind the graph below which documents the preposterous deflation of the Fed’s 2014 forecast. You heard Yellen’s words yesterday. No problem! Escape velocity has been rescheduled for 2015 and 2016. Check.

But here’s the point. If you are not wearing Keynesian blinders, it is self-evident that the $3.5 trillion expansion of the Fed’s balance sheet since September 2008 has all gone into the reflation of financial assets—a staggering gift to speculators and the small portion of households (10%) which own more than 80% of all financial assets. The reason for this diversion of the Fed’s vaunted “extraordinary accommodation” into windfall gifts to the 1% is that the historic “credit expansion channel” of monetary policy transmission is broken and done.

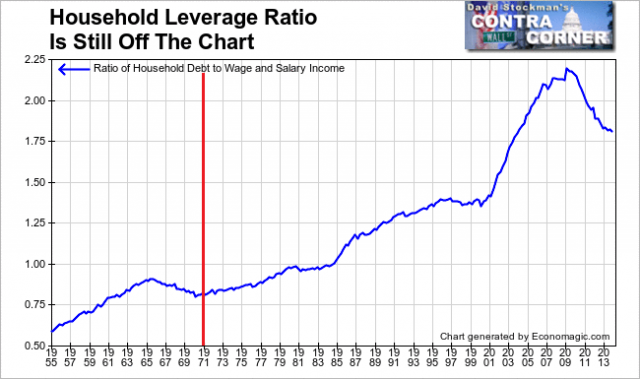

We are at “peak debt” folks. Household debt normally amounted to about 75% of wage and salary income back in the prosperous days before we launched into monetary central planning in 1971. But after a 40 year parabolic ratchet to a peak of 220% in 2007, the one time credit fueled boost to household consumption is done. Indeed, the household debt ratio is still at a precarious 180% of GDP, and that’s only on average and therefore only part of the story.

Take out the top 10% of households with their vastly, if temporarily, inflated financial asset troves, and the bottom 30% who live hand to mouth at Wal-Marts and can’t carry any debt except pay-day loans, and it is obvious that there has been no material deleveraging. The middle class core of main street households are still laboring under a crushing load of debt—so zero percent interest rates until the cows come home will not enable or induce them to borrow.

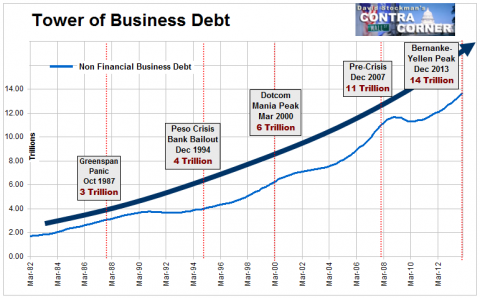

And on the business side of the peak debt story, the picture is now even worse. Non-financial business debt has grown from $11 trillion on the eve of the financial crisis to nearly $14 trillion at present. But this staggering gain of $3 trillion or 25% has not gone into incremental investment in plant and equipment—that is, the building blocks of future productivity and sustainable economic growth. Instead, and just like during the prior Greenspan housing bubble, it has gone into financial engineering and rank speculation.

That is the explanation for record stock buybacks and the resurgence of mindless M&A deals (globally we just had the first $1 trillion M&A quarter since Q3 2007). These deals are overwhelmingly nothing more than a vast expansion of cheap leverage being used to liquidate target company stock, and which are so lacking in business logic that they will surely be unwound to the tune of vast “one-time” write-offs in the years ahead.

What is at record 2007 peak levels is not loans to main street businesses—most of which do not need funding or are not credit worthy. Instead, the recently heralded growth in bank lending has gone into leveraged buyouts and dividend recaps.

Indeed, credit is flowing every which-way into the Wall Street casino including sub-prime auto junk funds, double-leveraged CLOs, massive junk bond issuance at the lowest rates and spreads ever and “cov lite” loan issuance at rates even higher than 2007. But according to Yellen, “our models” show no indications of bubbles or over-valuation.

Yes, with the Russell 2000 at 85X reported earnings there is no over-valuation. Likewise, S&P 500 reported LTM earnings in Q1 clocked in a $105 per share, meaning the broad market was trading at 18.7X as she spoke. Incidentally, that multiple of the kind of GAAP earnings that they put you in jail for lying about is higher than 86% of the monthly observations in in modern history, and actually higher than 95% if you take out the years of Greenspan’s lunatic dot-com bubble.

Worse still, those $105 of earnings have crept up by only 5% annually since later 2011— during a period in which the stock index has risen by nearly 60%. Yet the current $105 earnings number is also bloated with unsustainable interest subsidies on upwards of $3 trillion of S&P company debt owing to the Fed’s financial repression which is eventually to end; is festooned with tax rate gimmickry that is finally stimulating a Washington revulsion; and is flattered with earnings translation gains that are going to reverse as the ECB puts the kibosh on the Euro.

Yet in the face of all this, her is the Yellen money quote:

“I don’t see a broad based increase in leverage, rapid increase in credit growth or maturity transformation.”

OK, we are nearly at record levels of margin debt against GDP and the former is callable, meaning that it has an effective duration of zero. But no maturity transformation there. Likewise, the US treasury has massively pushed its outstandings to the front end of the curve, yet there is nothing unusual going on there, either. And what does Yellen suppose the massive explosion of ETFs and options trading during the Bernanke-Yellen bubble inflation is? Well, its all callable money with a half-life of zero when the crunch comes.

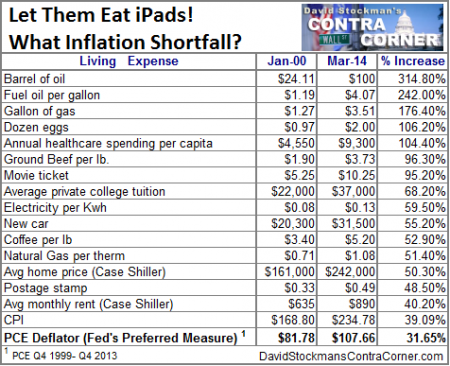

So no bubbles—just endless Keynesian babble. On the question of resurgent inflation asked by court jester Steve Leisman, for example, Yellen dismissed his observation that the CPI is already running above target by noting “the data we’re seeing is noisy”.

But that was only half the noise. Later Yellen noted that the Fed’s favorite non-price index, the PCE deflator, is still running well below target and that the Fed would not be satisfied until it hit 2% and stayed there. Well, let’s see. For the last 17 years the PCE deflator has run a full 0.5% behind the CPI, which medicated as it is, does measuring some of the gain in living costs. So apparently, the long run CPI target is 2.5%, and even that’s not the whole story.

As the table below shows, the cost of things that people really buy has run well ahead of the CPI for the last 14 years. The monetary politburo apparently means, therefore, that it will keep printing and accommodating— even if the actual cost of living on main street is rising by 4-5% annually. Or to put it in the sage context of Paul Volcker’s comment about the arbitrary 2% inflation target in the first place, the Fed’s implicit inflation target implies that a worker’s savings will be cut by 70% over the course of a 30-year working lifetime. But then why should people save, anyway. The Fed has now signaled for most of this century that it intends to punish any citizen who does not spend all he gets and all she can borrow, too.

But then we get to the rotten heart of the matter, and the everlasting blame that should be assigned to the two Bush presidencies—-12 years of alleged “conservative” economic governance that actually implanted the Keynesian curse now upon us. Namely, the “dot plot”, and folks its just that. Namely, its an emerging bit of pure intellectual gibberish with respect to the so-called “neutral federal funds” rate that if adhered to would keep Wall Street speculators in zero-cost trading stakes for time immemorial.

For several years now there was a constant refrain from the Eccles Building that as soon as its dual mandate targets were securely in sight or hand, that the funds rate would be lifted back to its alleged neutral level of 4%–representing the math of 2% inflation plus the 2% real rate that was decreed 20 years ago. The author of that thoroughly destructive rule was a crypto-Keynesian economist by the name of John Taylor, who had managed to implant himself in high economic positions at the Treasury and CEA during the George H.W. Bush Administration.

Needless to say, the so-called Taylor Rule is anti-capitalist to its core because it denies the free market the essential task of price discovery on the single most important price there is—namely, the price of carry in the money markets and therefore the price of leveraged speculation. After three bubbles in two decades that should be obvious enough.

But no matter. The Taylor Rule is the foundation of our current regime of Keynesian central banking. As Jim Grant has so succinctly explained it, it establishes the rule of price administration by the state in place of price discovery by the market. Yet once that line of demarcation was crossed early in the Greenspan era it was Katie-bar-the door. With government policy apparatchiks in charge of pricing money, debt and indirectly all risk assets which are inherently valued based in cap rates and yield curves established by the central bank, there would always be a vast potential for mission creep and re-definition of the Rule.

Indeed, Professor Taylor, who was himself a life-long policy apparatchik and had hung around the White House, Treasury and think tanks, was the very archetype of the power-hungry bureaucrats who subsequently took his Rule and ran with it. Apparently, the good professor was trying to solve Milton Friedman’s quantity rule, which had become an laughing-stock during the 1980s, with his own selfie called the Taylor Rule.

But the Taylor Rule is much worse and far more statist than Friedman’s. It’s just flat-out price administration, and it’s content was not all the scientific razz-matazz it was cracked up to be. The proceeding decades of history which he claimed to have based his Rule on were not a timeless clock of business cycles that could be weighed, averaged and regressed upon a mean. Instead, Taylor’s test period was a historically unique and aberrant trip into a regime of bad money that incepted in the mid-1960s and was interrupted only briefly by the Volcker interregnum—a period in which an inflation fevered economy was largely cured, but under conditions in which the Taylor Rule would have been a menacing excuse for accommodation.

In short, after the travesty of the Great Inflation during the 1970s and the free ride given to nearly $2 trillion of deficits during the Reagan-Bush period we desperately needed to get back to sound money based on an external anchor like gold—-a standard which would discipline the monetary politburo, not enable it to run the printing press at will. As is now becoming evident as the Taylor Rule prepares to be gutted by the current inhabitants of the Eccles Building, the good professor is second only to Alan Greenspan in the gallery of villains who paved the way toward the present Keynesian apotheosis—which is to say, destruction of free market capitalism as we have known it.

For what is now going down is a accelerating crawl toward a re-tailored funds neutrality rule at 2%. It is already being promoted as the new abnormal by Wall Street gamblers, and especially the larcenous front-runners who operate PIMCO. The reasoning is that with 2% inflation given by policy writ, the “real” neutral rate should remain at zero indefinitely, and here’s the reason why: Namely, that the US economy is too weak to hold-up the vastly inflated trillions of debt and equity that have been priced under a regime of zero-cost carry. Stated differently, we dare not risk a recession owing to interest rate normalization—least PIMCO and most of its hedge fund bretherns will be instantly put out of business as the Wall Street house of cards craters.

Already, the dot-plot is heading toward 2%, and the theory is that it would stay there will beyond the 2017-2018 milestone where DSGE model says we will reach the Fed’s targets. Could anyone have imagined zero or negative real interest rates for a decade running even as late of 1990 when some folk memory of sound traditions still existed?

In fact, they were quashed once and for all by the Bush White Houses. Another huge villain in the piece is Michael Boskin, the Bush 1.0 CEA head who lead the commission that attempted to define inflation out of existence, and thereby remove the last folk restraint on the Fed’s resort to the printing press. All of the mechanisms which drastically dilute the CPI—hedonic adjustments, geometric means, frequent least-cost product substitution are all on his plate–even if Boskin’s real purpose was to cheat old people out of their full COLA adjustment.

But obviously what has happened, instead, is that the American people have been jipped out of sound money and the value of their savings. Good going, Michael.

And then we get to the depredations of Bush 2.0, but only one needs a reminder. Bernanke’s published work, as thin and derivative as it is, was there in plain sight when he was drafted for the Fed by Karl Rove and the Bush 2.0 gang of political hacks.

They could not read his comments about the Fed’s printing press? They could not detect the obvious Keynesian bias of the demand-side model that suffused his writings. For all their Reagan worship, they did not know that the Bernanke view of the world was something that the Gipper actually understood, and thoroughly detested. They did not recall that even Ronald Reagan understood that an activist Fed would eventually lead to the evisceration of free market capitalism?

The worst thing is that this out-and-out Keynesian in their midst got two more promotions–to the CEA in 2005 and to head the Fed in 2006. And the last one was fatal. It placed this phony scholar of the 1930s—-the professor who had won his PhD from Stanley Fischer by essentially xeroxing Milton Friedman’s drastically erroneous claim that the Fed’s failure to go on a bond buying spree during 1930-1932 was the cause of the Great Depression—in the catbirds seat when the second Greenspan Bubble came crashing down in September 2008.

Yet there was never any Great Depression 2.0 in sight, as I have documented thoroughly in my book, The Great Deformation: The Corruption of Capitalism In America.

As we now embark upon the apotheosis of Keynesianism it can be well and truly said that the conservative party in America brought this baleful condition to its present estate. First, with Nixon’s abominations at Camp David in August 1971; and then with the horrid economic legacy of the Bushes who brought the Keynesian destroyers to the killing rooms of the Eccles Building.{adinserter 1}