By Michael Lingenheld at Forbes

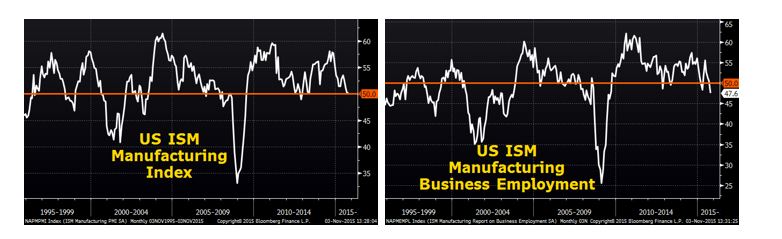

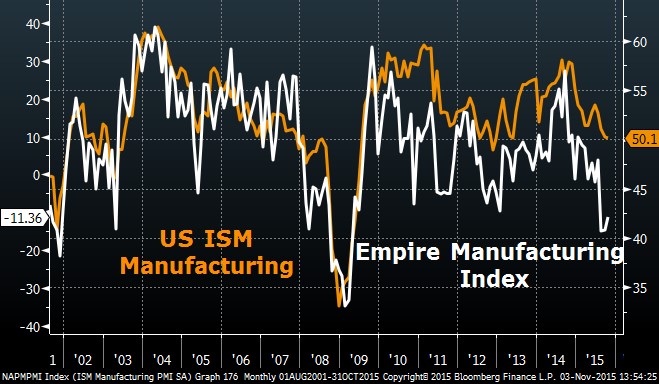

You wouldn’t know it from looking at stocks, but the US manufacturing sector came darn close to contracting in October. Readings above 50 indicate expansion in the ISM gauge of manufacturing activity, and the October reading of 50.1 was the lowest in 29 months. Overall manufacturing activity has expanded for 34 straight months, but the pace of growth in the main ISM gauge has deteriorated for four consecutive months.

There is reason for optimism. Factories saw new orders come in at a faster pace and production was strong. But, other than that, the ISM details were far from impressive. Not surprisingly, the prices paid index came in below 40 for the third consecutive month, reflecting the deflationary headwinds flowing through the economy. More importantly, the employment details showed a sharp contraction, down to 47.6 versus 50.5 in September. The market is more concerned about non-farm payroll figures, but this sure seems to be a leading indicator, especially when you consider the weakness from September’s NFP report.

It’s the same story in Germany, where mechanical engineering orders slumped 13% Y/Y in September, hit by an 18% drop in foreign demand. In a sign that the weakness in September wasn’t just a blip, foreign orders from outside the eurozone were down 7% in the nine months through September from the same period a year earlier, hit by a slowdown in developing economies that account for around 42% of Germany’s plant and machinery exports.

Source: US Manufacturers Can’t Shake the Slowdown in China – Forbes