The S&P500 jerked higher yesterday afternoon when the Fed minutes revealed no new information on the dreaded day when interest rates begin to rise. In other words, the stock market is one sick puppy—utterly addicted to the Fed’s baleful regime of ZIRP.

And it is a regime. We are now in month 68 of essentially zero interest rates in the money markets. There is nothing like it in post-war history.

The argument for the dangerous absurdity of providing zero cost funding to carry-traders and speculators is that the US economy was smacked by a 100-year flood type event during the 2008 financial crisis and, therefore,”extraordinary monetary accommodation” is required to heal the damage. But that is a bogus rationalization.

The financial crisis was caused by the Fed, and then became an excuse for extending and intensifying an interest rate pegging regime that has been in place for 27 years—essentially since the Greenspan Fed panicked after the Black Monday stock market meltdown in October 1987. Indeed, Bernanke didn’t gum about the “zero-bound” inadvertently; it was, in fact, the end game of the Greenspan Fed’s core premise: Namely, that the business cycle can be flattened (if not eliminated) and macro-economic performance improved by pegging prices in the money markets; and that there will be no untoward effects from supplanting market price signals and allocations with a regime of administered money.

In truth, the Fed’s quarter century march to yesterday’s pathetic rerun of yet another episode of “lower for longer” has produced virtually the opposite of the Greenspan Fed’s premise. That is, macro-economic performance has worsened, while the negative side-effects—serial financial bubbles and massive extension of debt and leverage in all sectors of the US economy—have been monumental.

As to the macro-economic effects, you can’t find any discussion of them in the Fed’s minutes because they are essentially a short-term economic weather report. But the ticks in the U-3 unemployment rate or blips in the monthly rate of gross capital spending tell almost nothing about the trend performance and health of the national economy. Janet Yellen was perhaps unintentionally correct in her “noise” comment, but simply neglected to note that this characterization applies not just to last month’s CPI, but to the entirely of the “incoming data” which the Fed obsesses about.

At the end of the day, there are two core indicators of the trend in macroeconomic performance and health that are never noted by the monetary central planners in the Eccles Building: Namely, the rate of net capital investment growth— because that establishes the foundation for future productivity and real wealth gains; and full-time bread-winner jobs— because that measures the gains in main street living standards. In particular, part-time jobs in bars and restaurants generating annualized pay rates of less than $20k are cyclical noise, not indications of sustainable economic growth.

After a temporary but unsustainable spurt in CapEx during the Greenspan tech bubble, net investment after allowance for capital consumption in the current reporting period has been dismal for 17-years. And the relevant figure is net investment, not the Keynesian measure of gross capital spending embodied in the GDP equation and endlessly jabbered about on bubblevision. The truth is, during the last 15 years, the highs in real domestic net investment have been getting lower and the lows have also been posting lower. Indeed, after 68 months of ZIRP real net business investment is 20% lower than it was at the turn of the century.

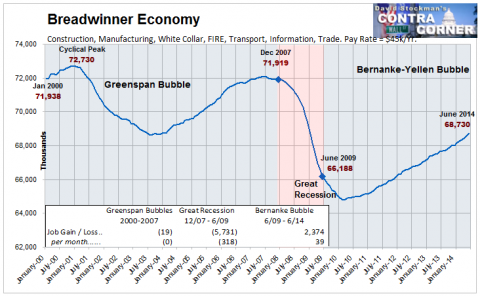

Likewise, notwithstanding last Friday’s swell jobs report headlines, the level of full-time, family supporting “breadwinner” jobs in the US economy is still 4.4 % below the 2007 peak; and the ballyhooed June number was actually 4 million below the level attained way back in early 2001. The irony of this dismal condition of jobs in construction, manufacturing, the white collar professions, distribution and transportation, FIRE, business management and core government employment is that more “jobs” has been the ultimate and incessant justification for interest rate pegging and ZIRP.

So there is just no way to argue that the Fed’s long march to ZIRP has enhanced the foundational performance of the macro-economy. And that means, in turn, that the Fed is up to something altogether different. In effect, it is involved in a giant and futile game of tilting at short-run cyclical windmills on the implicit theory that the American economy is a fragile flower that will tumble into recession the minute the Fed loosens its grip on the money market dials.

This is patent nonsense. The mild recession cycle of 2001-2002 and the deep but brief plunge of 2008-2009 represented the liquidation of bloated inventories, jobs and marginal output that had built-up during the Fed enabled dotcom and housing/credit bubbles, respectively. During the so-called “recovery” period of 4-5 years after each of these cycles, it was not interest rate pegging and its ultimate manifestation in ZIRP that did the trick.

In fact, the above graphs make absolutely clear that low interest rates did not stimulate capital spending or real job creation. What pick-up in activity that did occur under these foundational headings represented the ordinary workings of the capitalist economy. Not withstanding the cyclical windmill tilting in the Eccles Building, and the massive diversion of capital resources and financial activity to the Wall Street casino that is the inexorable result of free money to the carry-trade gamblers, the natural forces of capitalist regeneration did propel the US economy sluggishly forward during the so-called recoveries.

In short, the 27 year regime of interest rate pegging has done nothing to flatten the business cycle, but, instead, has actually intensified it by fueling malinvestment-riven financial bubbles that inevitably need to be liquidated. On an all-in basis, therefore, administered prices in the money markets have increased cyclical instability and detracted from trend performance of the fundamentals.

As defective as it is, even the real GDP measure doesn’t lie. During the last 14 years, real GDP growth has averaged only 1.8 percent annually or barely half of the trend during the prior 50-years.

At the same time, interest rate-pegging and ZIRP have destroyed the most important price in all of capitalism—namely, the cost of short-term money used to fund speculation in the financial markets—whether through old-fashioned margin credit or other leverage or through more sophisticated forms of options and structured finance trades.

In any event, honest price discovery throughout the whole range of financial assets has been destroyed because Fed enabled and subsidized speculation has caused cap rates to be artificially repressed and asset prices to be vastly inflated by one-way trading in the Wall Street casino.

So maybe its time for a new version of the old regime at the Fed. That is, for the Eccles Building to eschew interest rate-pegging and ZIRP entirely, and thereby allow financial markets to once again engage in honest price discovery and two-way trading; and to allow the natural business cycle to meander along its own capitalist path as determined not by the 12 members of the monetary politburo, but the 317 million consumers, producers, investors, entrepreneurs and even speculators who comprise the real main street economy.