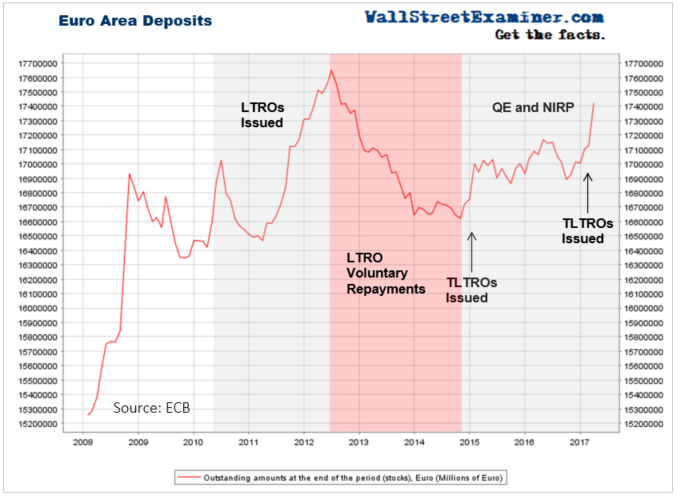

Deposits in Europe exploded upward in March, rising by a whopping €290 billion (1.7%). But don’t be tempted to annualize that. This surge coincides with a net issuance of €245 billion in the ECB’s occasional TLTRO program. Every time the ECB has done a slug of LTRO or TLTRO, this happens. Then most of it is reversed in a few months as the useless loans for which there is no demand, are quickly repaid.

The ECB’s outright bond purchases (or QE). So even as the LTROs are repaid, some of the deposits created when the ECB buys bonds outright will stick around. Since the ECB started QE and NIRP at the end of 2014, it has managed to goose deposits in Europe’s banks by a total of 4.8%, or an average of 1.9% per year. However, without the 2 TLTRO facilities, the growth rate would be close to zero. QE alone has had very little effect on the level of bank deposits.

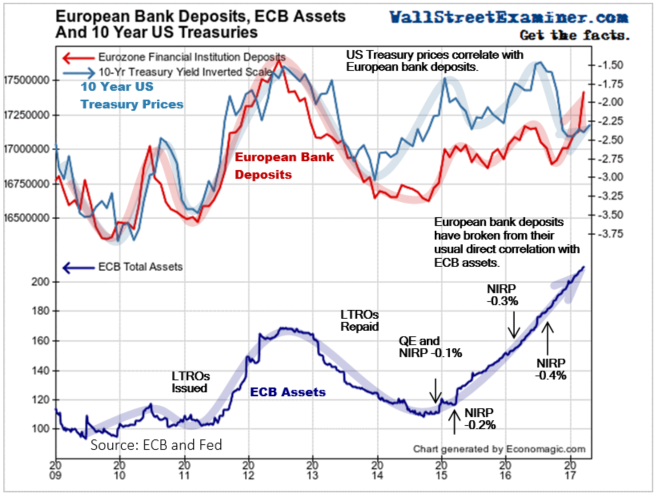

The total increase in deposits since the inception of NIRP/QE is now nearly €800 billion. It sounds impressive. But it’s pathetic, considering that the ECB has pumped €2.1 trillion into the banks over that time. Most of it has disappeared. Depositors have used much of it to buy assets in the US and elsewhere. Much of the rest has gone toward paying down debt, thereby getting rid of the cost of holding deposits or European sovereign paper with negative yields.

Surging deposits in Europe have in the past been a bullish sign for US markets. The correlation is strongest with Treasuries as Europeans with cash tend to buy US Treasuries. But some of the deposits created when the ECB prints money are also used to buy stocks.

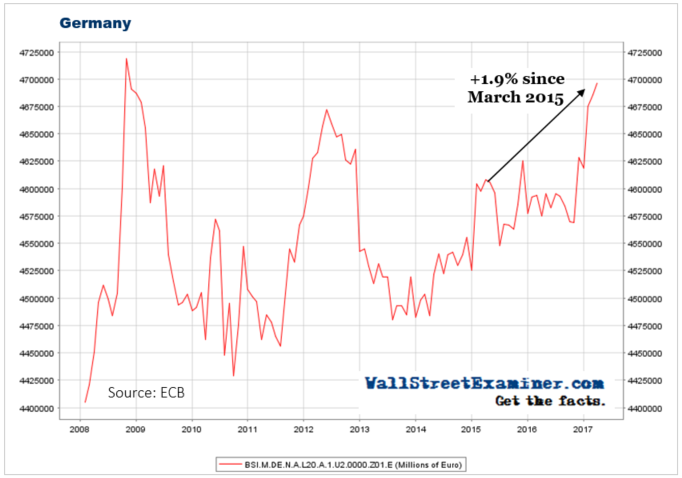

Germany

Deposits in Germany rose in March. They were up by €10.8 billion or 0.2%. Year to year they’re now up 2.6%. German bank deposits have seen a massive spike since… wait for it… Brexit! I suspect that that was the driver. It sent German deposits soaring to all-time highs, after years of weak growth.

But alas, the chart scale makes this rebound look bigger than it is. The annual growth rate is now still just 2% after this “massive rebound” of 2.8% from the October 2016 low. The total rise since March 2015 is just 1.9%. That’s a growth rate of less than 1% per year.

We have seen these spikes before in Germany. They never stick. The German banks are still sick. Even this weak growth would not have been possible without massive ECB monthly cash infusions.

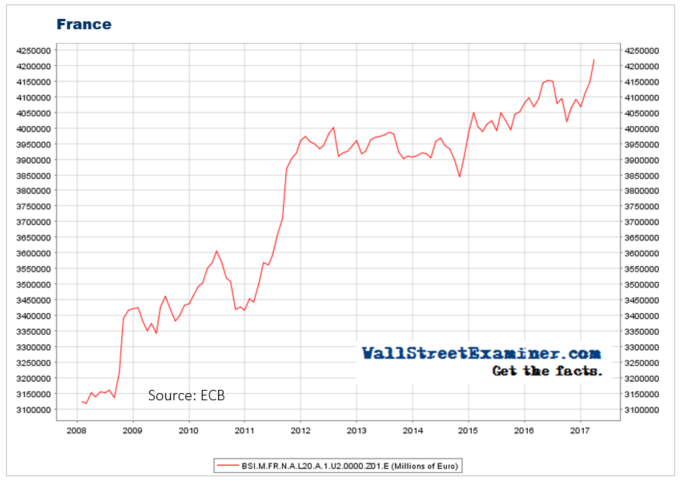

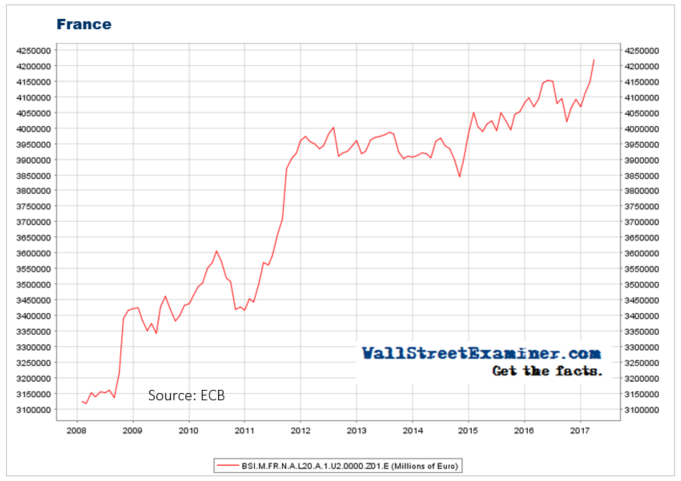

France

French bank deposits also rose in March, but unlike Germany, French deposits are forging new highs. French deposits rose by a massive €70 billion or 1.7%, driving the annual growth rate to 3%. The ECB’s TLTRO appears to have been the driver of the increase in both Germany and France. The stop start path of deposits in both countries is a sign of central bank interventions, not intrinsic economic growth.

Household Deposits

Household deposits downticked in Germany in March. This was a clear sign that the March increase in deposits was institutional, driven by the ECB’s extremist policy manoeuver of TLTRO. Household deposits fell by 0.1% but are up 5% year over year. Households typically do not have the ability to move their money out of the country. German households are increasing their holdings of cash despite the lousy, or even negative returns.

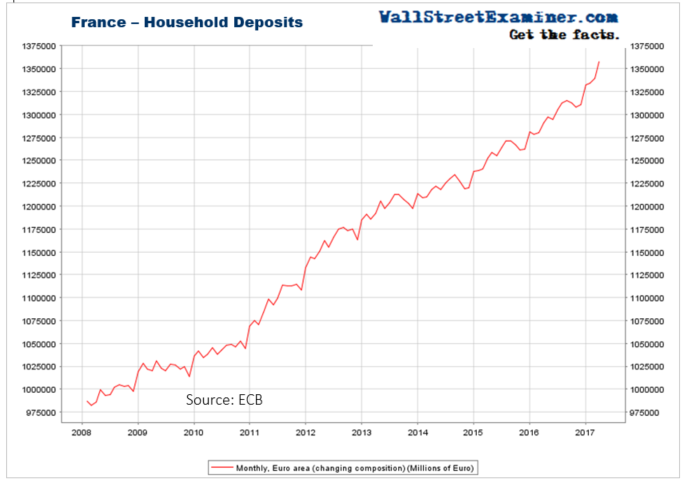

We see the same dynamic, but even more pronounced in France. Household deposit growth in French banks is actually accelerating! They rose 1.3% in March, driving the annual growth rate to 5.1%.

It looks like a panic to hold cash. French households are rapidly increasing their cash as they prepare for the collapse and depression they sense ahead. Unfortunately, the bubble in cash is a warning sign that something bad could be coming for those cash holdings.

Here again, households have fewer options than big business and institutions about where to keep their cash. Household deposits in French banks are growing faster than total deposits. That means that commercial and financial depositors are fleeing.

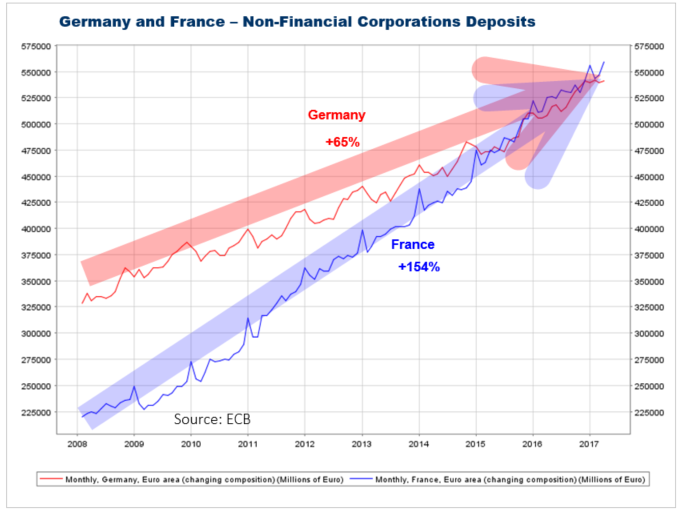

Commercial Deposits

Non financial corporate deposits rose in both France and Germany in March. France continues to outpace Germany in growth of business deposits. Big companies have their choice of where to deposit their cash. Last month they again chose France over Germany. That has been the trend for the past 7 years.

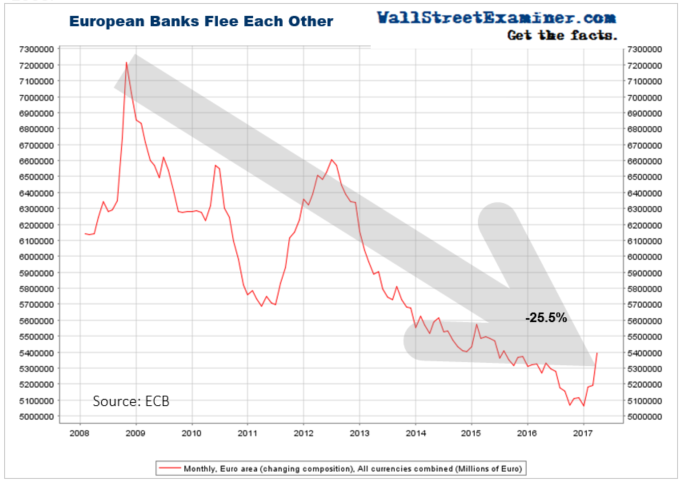

Interbank Deposits

The downtrend in total interbank deposits—deposits of Europe’s banks in other European banks—was interrupted in March. We see the ECBs fingerprints all over this. Interbank deposits rose by €204 billion. Not coincidentally was the bulk of the €245 billion TLTRO.

The banks took down the TLTRO and lent the money to each other. They earned the bonus interest from the ECB for taking the money and lending it, and now they will quickly repay the loans. So my bet would be that this bounce is temporary and the trend will soon revert to form. Even with this bounce, interbank deposits remain down by €1.8 trillion, or 25.5%, since 2008.

Where To Now

The €245 billion TLTRO from the ECB has stopped the bleeding for now. But it’s a temporary illusion of improvement. The banks have played games with the money. They have extracted their subsidy from the ECB, and now, since they have no further use for the cash, they’ll pay back the ECB or pay down other debt. They will use their deposits of cash to do that. That will expunge the deposits, and keep the European banking system under pressure.

Meanwhile, some of the cash will continue to flow to the US. It’s excess cash in Europe. European dealers and financial institutions look for opportunities to place that cash elsewhere, to get it out of the European banking system. Negative rates punish them when they keep the money at home.

They are also rightly concerned about the safety of keeping cash in their domestic banks. They see the US, particularly Treasuries, as less risky. So they send the money here. Those waves of cash continue to create an artificial prop for US bonds and equities.

That won’t last forever. Eventually the ECB will end QE and NIRP. The trial balloons have been floated. The ECB pretends to stand behind its policies, but its protestations ring hollow.

I can’t predict with any certainty when the ECB will begin to cut back. But the noises have started, and that usually means that change is no more than a year to 18 months away.

Until the ECB actually begins to cut back on the printing, it’s still too soon to go heavily short US equities. You can hold your longs, raising your stops along with and just below the trendlines that are consistent with your holding period. The shorter your holding period, the steeper the trendline and tighter your stops should be. Likewise, use long term trendlines and looser stops for long term holdings.

I would not initiate any longs, other than for very short term trades. In the same vein, I would only consider short sales for short term trades.

This report is derived from Lee Adler’s Wall Street Examiner Pro Trader Monthly report on the status of the European banking system.

Lee first reported in 2002 that Fed actions were driving US stock prices. The US Treasury has also played a role in directly moving markets. Lee has tracked and reported on those relationships for his subscribers for the last 15 years, helping to identify major turning points in the markets in their earliest stages. Try Lee’s groundbreaking reports on the Fed and the Monetary forces that drive market trends for 3 months risk free, with a full money back guarantee. Be in the know. Subscribe now, risk free!