By Tyler Durden at ZeroHedge

Yesterday, when reporting on the latest development in China’s ongoing under-the-table stealth nationalization-cum-bailoutof insolvent enterprises courtesy of a proposed plan to convert bad debt into equity, we noted that while China has already managed to convert over $220 billion of Non-performing loans into equity, concerns – both ours and others’ – remained. As Liao Qiang, director of financial institutions at S&P Global Ratings in Beijing, said coercing banks to become stakeholders in companies that could not pay back loans will further weigh down profits this year. Instead of underpinning stability at banks, the efforts undermine it.

That said, while many have voiced their pessimism about China’s latest attempt to sweep trillions in NPLs under the rug, there had been no comprehensive analysis of just how big the impact on China’s banks, economy or financial system would be as a result of this latest Chinese strategy.

Until now.

In a must read note released by SocGen’s Wei Yao titled “Restructuring China Inc.” the French bank tackles just this topic (and many others). What it finds is disturbing and serves as a confirmation of all recent bearish assessments – most notably that of Kyle Bass – that China’s bad debt problem will end in tears.

Here is Yao’s summary:

China is still leveraging up rapidly, with its nonfinancial debt up to 250% of GDP [ZH: realistically 350%]. The corporate sector and capital market liberalisation that the authorities are pushing for has begun to destabilise the debt dynamics. The beginning of debt restructuring for SOEs, the biggest borrowers and underperformers, brings closer the prospect of bank restructuring – a scenario we think that has a probability of more than 50% over the medium term.As SOE restructuring progresses, it will also become more apparent that Chinese banks need to be rescued.

We estimate that the total losses in the banking sector could reach CNY8 trillion, equivalent to more than 60% of commercial banks’ capital, 50% of fiscal revenues and 12% of GDP. The actual tally may still be years away, but could be more sizeable if problems continue to grow.

China may still be able to dodge an economic crisis while restructuring its corporate and banking system, but the margin for error will be uncomfortably slim.

To repeat SocGen’s shocking conclusion, SocGen estimates that the total losses of banks could reach CNY8tn (or over $1.2 trillion), equivalent to more than 60% of their capital. It is also equivalent to 50% of fiscal revenues and 12% of China’s total GDP!

Before we get into the details, SocGen reminds us how China’s conducted its previous debt-for-equity round back in 1999, and what happened then:

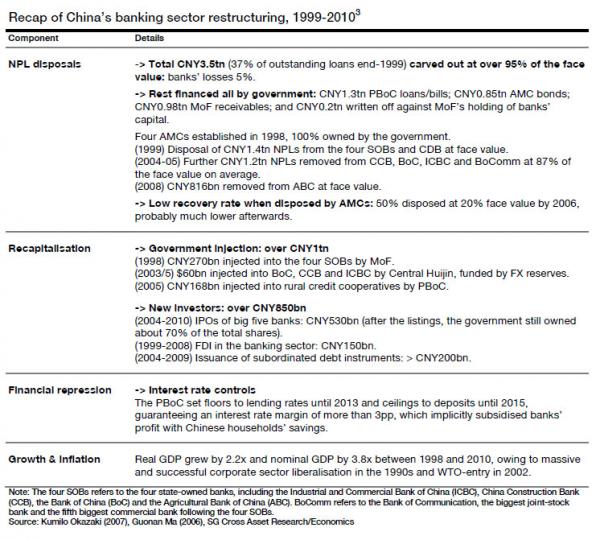

The previous round of bank restructuring started in 1999, after the liberalisation of the corporate sector was well on track. The programme was wrapped up after the Agricultural Bank of China was successfully listed in 2010.The explicit cost was close to CNY5.4tn (= total NPLs disposed + capital injection, table below), equivalent to 25% of average annual GDP during that period. The government – or essentially taxpayers – footed about 80% of the bill, while new investors – mostly FDI and IPO proceeds – financed more than 15%, and losses on banks accounted for less than 3%. For the government component, the MoF offered 40%, the PBoC 35% and AMCs (100% owned by the government) the remainder.

There was also a less obvious – though not any less real – cost inflicted on the private sector. Financial repression, in the form of interest rate controls, forced households to accept low deposit rates, while guaranteed interest rate margins (minimum 300bp throughout the 2000s). Although SOEs, thanks to implicit state guarantees, enjoyed lower borrowing rates from banks than what they should have be charged based on their performance, the interest rate margin made it easy enough for banks to make decent profits. As a result, banks had few incentives to service private corporates, which were pushed to shadow banks for exorbitantly expensive borrowing costs. In addition, banks were also offered tax exemptions and other forms of fiscal subsidies.

However, the impressive growth, owing to economic liberalisation and the strength of the global economy, was the biggest debt-shrinking tool. The bold SOE reform in the 1990s dissolved the lion’s share of SOEs, opening a vast space for the private sector to grow. The market liberalisation that commenced in 1978 eventually paved the way for China’s WTO entry in 2002, which gave the economy another big boost.

That was then, what about now?

In one previous section, we noted that 12% of listed SOEs’ debt is at risk. Our equity strategists deemed 10% as a baseline estimate for the NPL ratio at listed banks, based on an analysis of financial data of all the listed companies’ – both SOEs and private. Looking at the bigger picture, we have reasons to believe that the share of non-performing assets in the entire banking system or non-performing debt within the entire corporate sector should be higher – at 15% or more. (Again, note that we previously estimated the nonperforming debt ratio of SOEs at 18%.)Big banks, which account for less than 50% of the banking sector, are better run and more prudent than small banks; and listed companies, which account for 10% of total corporate sector debt, should be more efficient than non-listed ones. Furthermore, since banks have engaged in off-balance-sheet lending for years and in many forms, some of the credit risk there may well remain with them because of reputational risk.

Applying a 15% non-performing ratio on banks’ total claims on nonfinancial corporates and total debt of nonfinancial corporates gives us CNY12tn and CNY18.5tn, respectively. In order to capture banks’ contingent risk currently hidden in the shadow banking system, we take the mid-point of CNY15tn – $2.3tn, 22% of 2015 GDP and 7.5% of banks’ total assets – as the basis for the likely aggregate non-performing assets that the banking sector may suffer.

According to the Doing Business Survey, the average recovery rate in China is about 35% at present. However, once NPL recognition picks up the pace, this rate could be compressed. Assuming the recovery rate drops to 30%, the potential losses on the CNY15tn nonperforming assets would be CNY10.5tn. Regardless, the first line of defence should be banks’ loan-loss reserves, which stood at CNY2.3tn at end-2015. That leaves about CNY8tn in losses (equivalent to over 60% of commercial banks’ total capital, and close to 50% of annual fiscal revenues and 12% of GDP).

In short, according to SocGen an unprecedented 12% of China’s GDP at risk of loss (and perhaps well more than this based on the bank’s conservative NPL assumptions). So how will China fund these losses? This is where it gets tricky, and why devaluation is looking like an inevitable outcome.

As SocGen writes next, when it says to “beware of devaluation risk”, one possible source of funding is backed by government bonds, which is effectively a form of QE, and which, as a result of China’s impossible trinity would have an impact on capital flows and the yuan that would be “rather negative.”

Last time, AMCs issued CNY846bn of bonds to pay for NPL purchases, which was more than three times the amount of CGBs issued by the MoF for that restructuring. We think CGBs should play a much bigger role in the next round. A bank restructuring with explicit sovereign support is the most transparent form, which can help clarify the state’s boundaries going forward and avoid revisiting the question about implicit government guarantees.There is also one technical consideration on the bond market. Last time, the MoF did not issue government bonds for most of the bailout funds it provided, but rather used a much less transparent structure of “MoF receivables” vis-à-vis each bank. At present, CGBs account for only 15% of GDP, which is not deep enough for the long-term development of China’s domestic bond market.

In either case (fundraising by the MoF or quasi-government agencies), increased bond supply could overwhelm the market. The PBoC might have to expand its balance sheet to either purchase CGBs directly (i.e. quantitative easing) or provide liquidity for big financial institutions to absorb the bond supply, so as to keep domestic interest rates from rising too much. However, given the impossible trinity – unless the authorities decide to seal off the capital account – the impact on capital flows and the yuan would then be rather negative.

This was not an issue last time due to strong economic growth, a rapidly expanding current account surplus and, most important of all, a completely closed capital account. However, none of these could be feasibly repeated to the same degree.

Let us go back to the CNY8tn estimate for capital losses. The government would need to raise CNY2-6tn if it wanted to fund 25-75% of the recapitalisation on top of the losses already incurred on its equity holding. If all in the form of CGB issuance, then the new CGB supply would be equivalent to 3-9% of GDP, 12-35% of fiscal revenues and 20-60% of outstanding CGBs. In addition to bank recapitalisation, the government would have to provide fiscal support to address unemployment pain and other social effects. The total fiscal bill would probably be considerably more than 10% of GDP.

After such expansion, CGBs would still account for only 18-25% of GDP, while the total government debt would rise anywhere between 50% and 75%, depending on how much more LGFV debt would be converted into LGBs.Our rate strategist thinks that it would be rather difficult for the bond market to cope with the high end of the estimates of additional CGB supply without help from the PBoC.

Another option is for the PBOC to use its vast (if declining) reserve holdings to directly inject funds into the banking system. This approach is less likely.

The CNY8tn in losses is equivalent to $1.2tn at today’s exchange rate. The same ratio as last time means $480bn FXRs of the $3.2tn stock for recapitalising banks – not implausible technically. If another FXR injection were to take place, banks might be under greater pressure to convert and put at least part of the new capital to use as soon as possible. Any conversion would exert appreciation pressure on the Chinese currency versus the dollar (i.e. deflationary). Even if banks were to use derivatives to raise local currency without conversion (for example, repo contracts), these activities would still impact the currency market.Then, the PBoC would need to make another difficult decision – whether or not to buy these dollars back for a second time. Technically, the PBoC could choose to do so, and that would mean heavy intervention in the FX market, reversing all the reforms aimed at currency flexibility and – possibly – capital account liberalisation.

In summary China has two options how to address its upcoming CNY8(+) trillion in bank losses:

- Using government bonds to recapitalise banks would lead to either higher domestic interest rates or higher currency devaluation risk, if the PBoC helps absorb the bond supply.

- Using FX reserves would result in high appreciation pressure on the currency after the injection in the short term, but the PBoC’s ability to prevent renminbi depreciation in the future would be weakened.

And here is why, as per SocGen’s conclusion, Kyle Bass will be ultimately right and why China will almost certainly be forced to devalue its currency:

The solution to the currency issue might be a mix of two: basically, banks selling the PBoC’s dollars (obtained from FXR injection) to dampen the depreciation pressure on the renminbi caused by the expansion of the PBoC’s balance sheet, which is a result of the PBoC’s acquisition of CGBs issued for bank recapitalisation. However, it is impossible to make the mix just right so that there is no or little impact on the currency – this would require an unrealistically high degree of PBoC control over banks and/or an incredible amount of foresight.The bottom line is that the government bail-out programme could be designed in a way to greatly limit its impacts on currency and capital account stability. Such designs seem to exist in theory, but would be very difficult to realise in the real world. We think that greater currency flexibility would probably be another major consequence that the authorities need to accept alongside bank restructuring.

At this point, since the math does not lie only Chinese statistics do, the only question is how will China engage the wholesale restructuring of its banking system: fast or slow.

A fast restructuring of corporates and banks risks an economic hard landing, since that could entail massive corporate defaults and big losses in terms of economic output, even in the case of a quick recapitalisation. A hard landing threatens social stability, and for this obvious reason, Chinese policymakers have opted for a slow and gradual process.

As a result, a fast restructuring, while ultimately preferable as it will allow China to peel the bandaid off, suffer acute pain for short period of time, then resume growth, is unlikely. This only leaves a slow restructuring as the option:

Being slow and gradual means that policymakers will most likely continue to adjust the pace of defaults and restructuring by offering (targeted) credit stimulus from time to time and, if needed, topping up financial support for failing SOEs and/or banks. This approach would also force relatively stronger banks to pay for incremental NPL disposals with their profits, which is essentially asking banks’ existing shareholders to bear some of the further cost of debt restructuring.

This is precisely what China’s recently introduced debt-for-equity restructuring program is facilitating.

The government seems to think that it can restructure the worst part of the corporate sector – zombie SOEs – bit by bit and use the freed-up resources to support good corporates and the new economy. The strength seen there, alongside help from modest fiscal expansion, could offset most of the negative impacts of the debt restructuring – including unemployment pains.However, this is an overly optimistic view. There are two major risks with this gradual approach, in our view: a lost decade and policy uncertainty.

The restructuring might be too slow – even slower than the formation of new NPLs. In this case, we would never see deleveraging, and the restructuring bill would only grow – which has been the case in previous years.

This is bad as it implies China builds up bad debt faster than it eliminates it, which with $35 trillion in bank “assets” is to be expected: recall that Chinese banks are now adding roughly $3 trillion in assets every year, a staggering pace.

Here, SocGen once again channels Kyle Bass:

It is difficult, if not impossible, for us to picture a debt restructuring scenario that does not impact industrial output. The service sector might make such an outcome possible for the whole economy, but a high degree of policy precision and coordination is required nonetheless.

But the biggest problem for China is not whether it picks the fast or slow restructuring pathway, but how it decides to pick anything in the first place.

The government appears to still be in the process of working out how to restructure. This is the root of the uneasiness – the excruciating time spent waiting before the government takes action. In the face of negative market events, the state’s gradualism may be interpreted by everyone else as policy uncertainty.A case in point – although most people (if asked on a good day) still believe that the Chinese government will eventually come to the rescue, this view was widely questioned and did not help avoid bond market jitters when SOE defaults occurred during the past month. Not to mention the fact that this view has not been very helpful in dispelling the doubts of investors about the asset qualities of listed banks.

SocGen’s conclusion is virtually identical to that of Kyle Bass, if not even more dire, although for the sake of the bank’s access to China, it clearly needs to tone down its assessment, to wit:

Given the immense challenges and risks inherent in the debt restructuring, it is unrealistic to expect a perfectly smooth process. Even if Chinese policymakers can come up with a sensible strategy and start implementing it tomorrow, the chance of policy errors – small or large – during the process would still be quite high. This is why we assign a 30% probability to a hard landing scenario over the medium term.

And, as Kyle Bass would note, even a 30% hard landing probability is enough to lead to a 15% or greater devaluation in the Yuan. The question is not if – the math confirms it – the question is when.

Finally, we would add that with China currently nursing a realistic 350% in debt/GDP according to Rabobank, the probability of a hard landing with no incremental debt capacity left unlike the last time China restructured its banks, is just shy of 100%.