Now that the FOMC has been sufficiently conscious to see the economy as something other than the long-awaited arrival Recovery Summer, it might pay to revisit the basis for this downward trajectory. It is simply not enough of a step forward to admit there is a problem, you have to do as Eric Rosengren candidly counseled and commit to finding the “something else going on.”

ConAgra’s announcement this morning was fortuitous in that sense, though certainly not for the growing dysfunctory portion of the economy. You cannot have the case where a large segment (and there is legitimate debate about proportionality here) of the working population, setting aside those that are not working for whatever reasons, sees no real gain in wages. Inflation is a deeper concept than the second derivative inference of changes in a basket of goods. Spending is a function of willingness and ability; willingness might be closely tied to wages but ability is affected by both wages and prices.

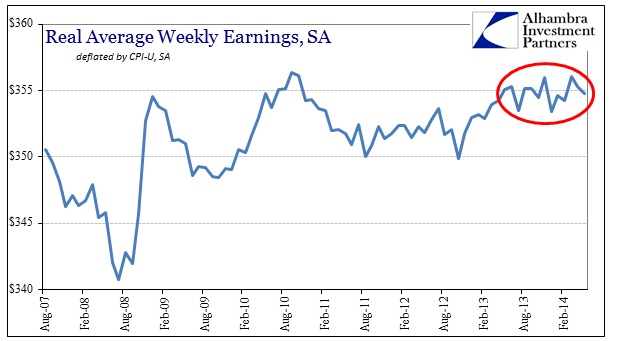

The most recent figures on real average weekly earnings (nominal earnings estimates deflated by the CPI-U) show that in recent months there has been little by way of advancement. In other words, workers still receive raises in pay rates (though no increase in hours worked) but that they are only keeping pace with the official estimate of inflation.

That is quite a depressing result given the conspicuous lack of official inflation in the past year. That would mean, on a nominal basis, wage rates have barely found any increase beyond the minimal level to keep pace with the falling second derivative of the CPI-U. That sounds like the opposite of a robust bounce in payroll conditions, and nothing at all like a situation where “slack” in the labor market has been mostly alleviated.

In terms of consumer spending, it does add to the growing evidence as to why the economy has actually grown weaker since the middle of 2012.

Using the typical CPI-U deflator, it appears as if real wages increased by more than a little in the early months of 2013. So where wages have been stagnant since about May 2013, at least it appeared there was some relief in the months prior. But in actuality, that jump is a figment of statistical calculation, showing only the reduction in the CPI rate rather than any gain in wages. If you hold the CPI constant at 2% throughout (not that such is a representative rate of how consumers are experiencing inflation, only for the sake of consistency in observation), it is clear that wages have been stagnant going back to 2011 (the red line in the chart immediately above).

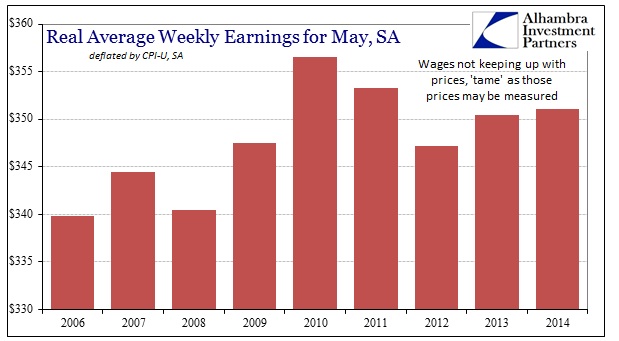

That certainly would seem to comport well with the picture of the economy given by ConAgra, McDonalds, WalMart, etc., where an obvious slowdown in 2012 has never been resolved, instead winding slowly lower. In other words, wages weren’t changing toward acceleration, all that changed was the CPI. The only counterargument against that interpretation is that if there was indeed a reduction in price pressures it would have benefited consumers through purchasing power. That may be true of certain circumstances, but inflation is not just a static comparison of one time period.

Prices may have indeed moved more slowly into 2013, but if they never fully regained lost purchasing power from previous periods (2010-11, 2007-08) of disproportion in favor of inflation, then the economy still stands on an eroding foundation. To equalize means not just a slower price advance, rather it requires actual price declines, robustly rising wages, or some combination of the two. All we saw in 2013 was a lower official inflation measure that made a mockery of QE expectations.

Viewing the cycle in total, what becomes clear is that wages are not keeping up with prices. The real weekly wage rate in May 2014 is 0.6% below May 2011, and 1.5% below May 2010. That is not a recovery regardless of the behavior of prices in 2013. It shows how much ground has been lost by those that have actually attained employment. Throw that together with the immense number of those unable to follow into the jobs economy and you start to see why there is “something else going on.”

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com